Enlarge image

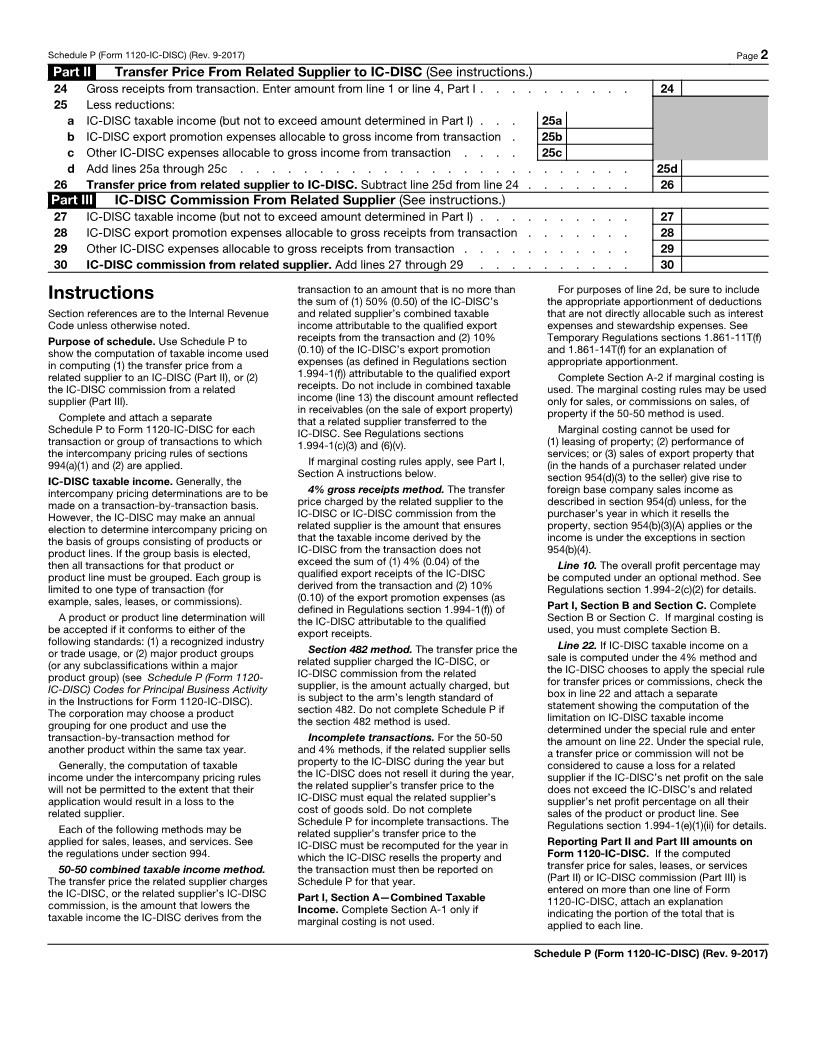

SCHEDULE P Intercompany Transfer Price or Commission

(Form 1120-IC-DISC) Attach a separate schedule for each transaction or group of transactions to

(Rev. September 2017) which the intercompany pricing rules under section 994(a)(1) and (2) are applied.

OMB No. 1545-0123

© Go to www.irs.gov/Form1120ICDISC for the latest information.

Department of the Treasury For the calendar year 20 , or fiscal year beginning , 20 , and ending , 20

Internal Revenue Service For amount reported on line , Schedule , Form 1120-IC-DISC

Name as shown on Form 1120-IC-DISC Employer identification number

Identify product or product line reported on this schedule. Also, enter the Principal Business Activity code This schedule is for a (check one):

number, if used. See instructions.

Single transaction . . . . . .

Group of transactions . . . . .

Part I IC-DISC Taxable Income

SECTION A—Combined Taxable Income

Section A-1—If marginal costing is not used

1 Gross receipts from transaction between IC-DISC (or related supplier) and third party . . . . . 1

2 Less costs and expenses allocable to gross receipts from transaction:

a Cost of goods sold from property if sold, or depreciation from property if leased 2a

b Related supplier’s expenses allocable to gross receipts from transaction . . . 2b

c IC-DISC export promotion expenses allocable to gross receipts from transaction 2c

d Other IC-DISC expenses allocable to gross receipts from transaction . . . . 2d

e Add lines 2a through 2d . . . . . . . . . . . . . . . . . . . . . . . . . . 2e

3 Combined taxable income. Subtract line 2e from line 1. If a loss, enter -0- . . . . . . . . . 3

Section A-2—If marginal costing is used

4 Gross receipts from resale by IC-DISC (or sale by related supplier) to third party . . . . . . . 4

5 Costs and expenses allocable to gross receipts from sale:

a Cost of direct material from property sold . . . . . . . . . . . . . 5a

b Cost of direct labor from property sold . . . . . . . . . . . . . . 5b

c IC-DISC export promotion expenses allocable to gross receipts from sales that

are claimed as promotional . . . . . . . . . . . . . . . . . . 5c

d Add lines 5a through 5c . . . . . . . . . . . . . . . . . . . . . . . . . . 5d

6 Combined taxable income or (loss) before application of overall profit percentage limitation. Subtract

line 5d from line 4. If a loss, skip lines 7 through 11 and enter -0- on line 12 . . . . . . . . . 6

7 Gross receipts of related supplier and IC-DISC (or controlled group) from all foreign and domestic sales

of the product or product line . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Costs and expenses of related supplier and IC-DISC (or controlled group) allocable to gross income

from such sales:

a Cost of goods sold from property sold . . . . . . . . . . . . . . 8a

b Expenses allocable to gross receipts from such sales . . . . . . . . . 8b

c Add lines 8a and 8b . . . . . . . . . . . . . . . . . . . . . . . . . . . 8c

9 Subtract line 8c from line 7. If a loss, skip lines 10 and 11 and enter -0- on line 12 . . . . . . . 9

10 Overall profit percentage. Divide line 9 by line 7. Check if controlled group optional method

is used . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ▶ 10 %

11 Overall profit percentage limitation. Multiply line 4 by line 10 . . . . . . . . . . . . . . 11

12 Combined taxable income. Enter the smaller of line 6 or line 11 . . . . . . . . . . . . 12

SECTION B—50-50 Combined Taxable Income Method (Must be used if marginal costing is used. See instructions.)

13 Combined taxable income. Enter amount from line 3 or line 12 . . . . . . . . . . . . . 13

14 Multiply line 13 by 50% (0.50) . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Enter 10% (0.10) of IC-DISC export promotion expenses allocable to gross income from transactions

that are claimed as export promotion . . . . . . . . . . . . . . . . . . . . . . 15

16 Add lines 14 and 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 IC-DISC taxable income. Enter the smaller of line 13 or line 16 . . . . . . . . . . . . . 17

SECTION C—4% Gross Receipts Method (Cannot be used if marginal costing is used.)

18 Gross receipts from transaction. Enter amount from line 1 . . . . . . . . . . . . . . . 18

19 Multiply line 18 by 4% (0.04) . . . . . . . . . . . . . . . . . . . . . . . . 19

20 Multiply line 2c by 10% (0.10) . . . . . . . . . . . . . . . . . . . . . . . . 20

21 Add lines 19 and 20 . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

22 Combined taxable income. Enter amount from line 3 or amount computed under special rule. If special

rule is applied, check here . See instructions . . . . . . . . . . . . . . . . . . 22

23 IC-DISC taxable income. Enter the smaller of line 21 or line 22 . . . . . . . . . . . . . 23

For Paperwork Reduction Act Notice, see the Instructions for Form 1120-IC-DISC. Cat. No. 11478S Schedule P (Form 1120-IC-DISC) (Rev. 9-2017)