Enlarge image

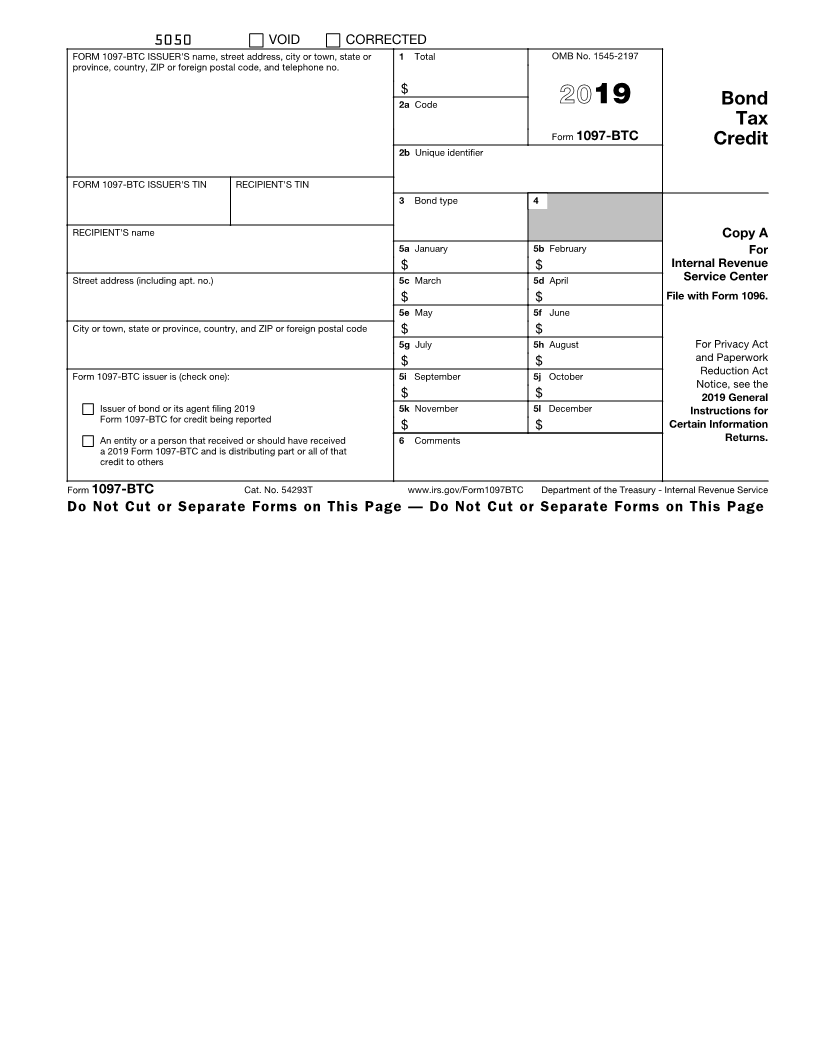

5050 VOID CORRECTED

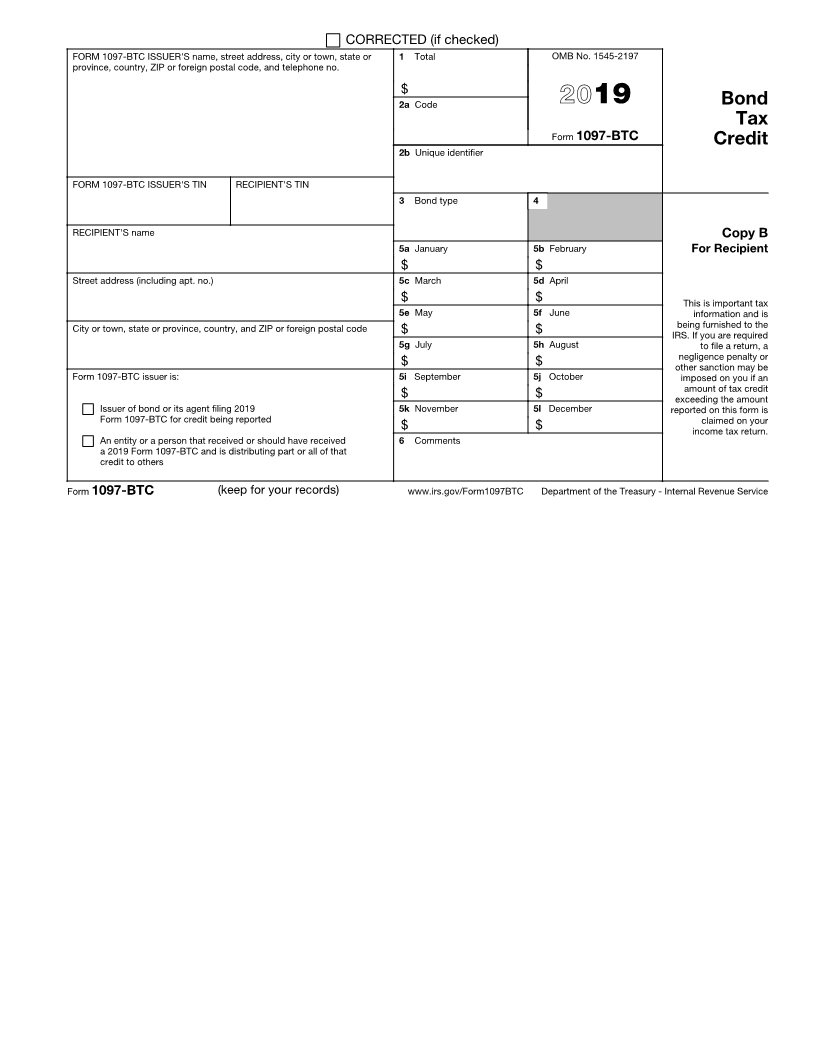

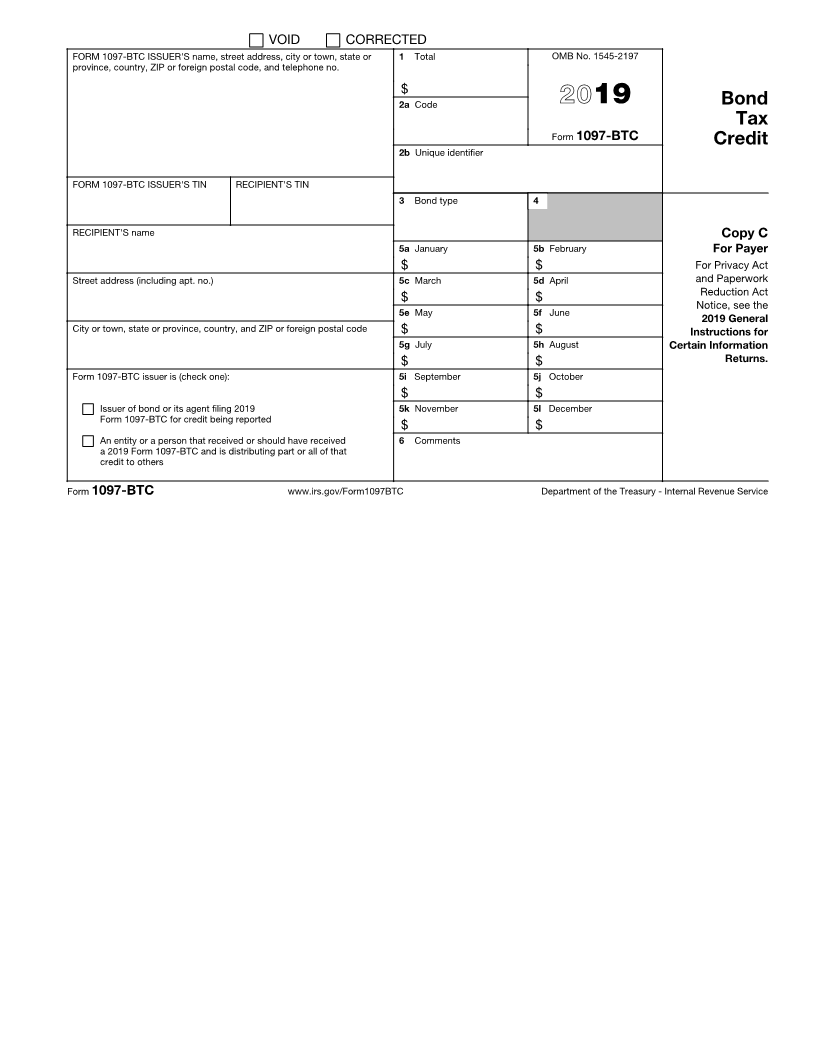

FORM 1097-BTC ISSUER'S name, street address, city or town, state or 1 Total OMB No. 1545-2197

province, country, ZIP or foreign postal code, and telephone no.

$

2a Code 2019 Bond

Tax

Form 1097-BTC Credit

2b Unique identifier

FORM 1097-BTC ISSUER'S TIN RECIPIENT'S TIN

3 Bond type 4

RECIPIENT'S name Copy A

5a January 5b February For

$ $ Internal Revenue

Street address (including apt. no.) 5c March 5d April Service Center

$ $ File with Form 1096.

5e May 5f June

City or town, state or province, country, and ZIP or foreign postal code $ $

5g July 5h August For Privacy Act

$ $ and Paperwork

Form 1097-BTC issuer is (check one): 5i September 5j October Reduction Act

Notice, see the

$ $ 2019 General

Issuer of bond or its agent filing 2019 5k November 5l December Instructions for

Form 1097-BTC for credit being reported Certain Information

$ $

An entity or a person that received or should have received 6 Comments Returns.

a 2019 Form 1097-BTC and is distributing part or all of that

credit to others

Form 1097-BTC Cat. No. 54293T www.irs.gov/Form1097BTC Department of the Treasury - Internal Revenue Service

Do Not Cut or Separate Forms on This Page — Do Not Cut or Separate Forms on This Page