Enlarge image

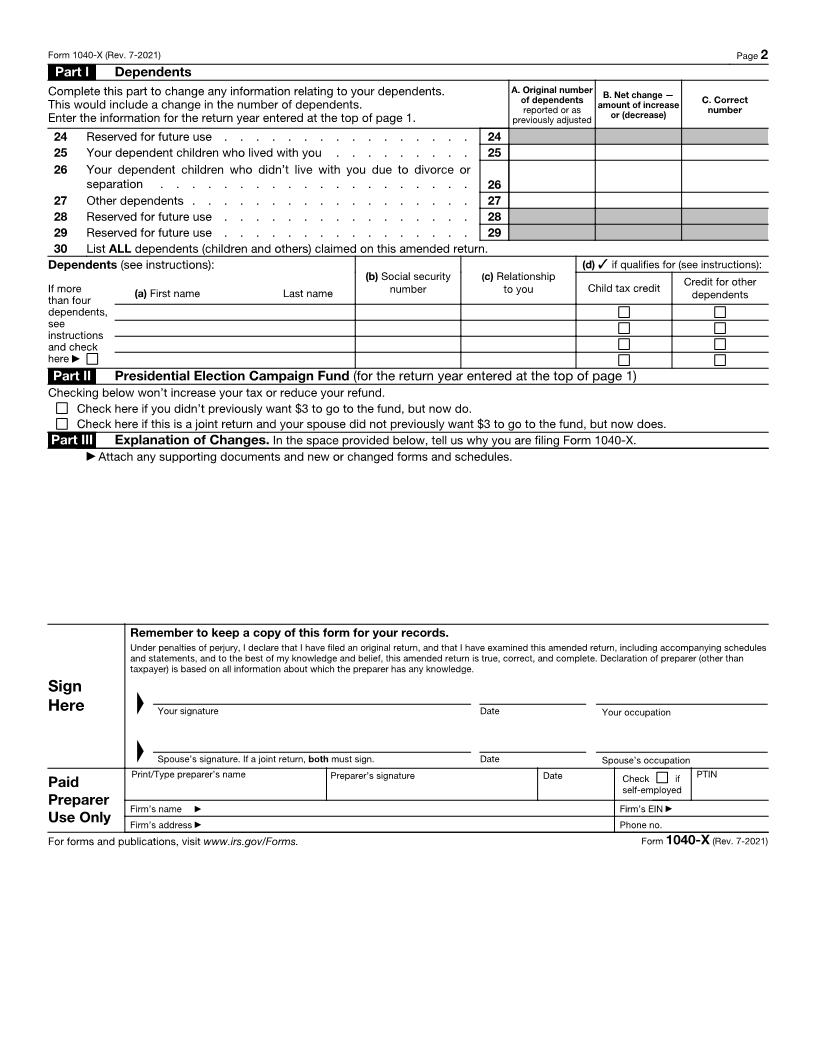

Department of the Treasury—Internal Revenue Service

1040-X

Form Amended U.S. Individual Income Tax Return OMB No. 1545-0074

▶ Use this revision to amend 2019 or later tax returns.

(Rev. July 2021) ▶ Go to www.irs.gov/Form1040X for instructions and the latest information.

This return is for calendar year (enter year) or fiscal year (enter month and year ended)

Your first name and middle initial Last name Your social security number

If joint return, spouse’s first name and middle initial Last name Spouse’s social security number

Current home address (number and street). If you have a P.O. box, see instructions. Apt. no. Your phone number

City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below. See instructions.

Foreign country name Foreign province/state/county Foreign postal code

Amended return filing status. You must check one box even if you are not changing your filing status. Caution: In general, you can’t

change your filing status from married filing jointly to married filing separately after the return due date.

Single Married filing jointly Married filing separately (MFS) Head of household (HOH) Qualifying widow(er) (QW)

If you checked the MFS box, enter the name of your spouse. If you checked the HOH or QW box, enter the child’s name if the qualifying

person is a child but not your dependent ▶

Enter on lines 1 through 23, columns A through C, the amounts for the return A. Original amount B. Net change—

year entered above. reported or as amount of increase C. Correct

previously adjusted or (decrease)— amount

Use Part III on page 2 to explain any changes. (see instructions) explain in Part III

Income and Deductions

1 Adjusted gross income . If a net operating loss (NOL) carryback is

included, check here . . . . . . . . . . . . . . . ▶ 1

2 Itemized deductions or standard deduction . . . . . . . . . 2

3 Subtract line 2 from line 1 . . . . . . . . . . . . . . . 3

4a Reserved for future use . . . . . . . . . . . . . . . . 4a

b Qualified business income deduction . . . . . . . . . . . . 4b

5 Taxable income. Subtract line 4b from line 3. If the result is zero or less,

enter -0- . . . . . . . . . . . . . . . . . . . . . 5

Tax Liability

6 Tax. Enter method(s) used to figure tax (see instructions):

6

7 Nonrefundable credits. If a general business credit carryback is

included, check here . . . . . . . . . . . . . . . ▶ 7

8 Subtract line 7 from line 6. If the result is zero or less, enter -0- . . . 8

9 Reserved for future use . . . . . . . . . . . . . . . . 9

10 Other taxes . . . . . . . . . . . . . . . . . . . . 10

11 Total tax. Add lines 8 and 10 . . . . . . . . . . . . . . 11

Payments

12 Federal income tax withheld and excess social security and tier 1 RRTA

tax withheld. (If changing, see instructions.) . . . . . . . . . 12

13 Estimated tax payments, including amount applied from prior year’s return 13

14 Earned income credit (EIC) . . . . . . . . . . . . . . . 14

15 Refundable credits from: Schedule 8812 Form(s) 2439 4136

8863 8885 8962 or other (specify): 15

16 Total amount paid with request for extension of time to file, tax paid with original return, and additional

tax paid after return was filed . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Total payments. Add lines 12 through 15, column C, and line 16 . . . . . . . . . . . . . 17

Refund or Amount You Owe

18 Overpayment, if any, as shown on original return or as previously adjusted by the IRS . . . . . 18

19 Subtract line 18 from line 17. (If less than zero, see instructions.) . . . . . . . . . . . . 19

20 Amount you owe. If line 11, column C, is more than line 19, enter the difference . . . . . . . 20

21 If line 11, column C, is less than line 19, enter the difference. This is the amount overpaid on this return 21

22 Amount of line 21 you want refunded to you . . . . . . . . . . . . . . . . . . . 22

23 Amount of line 21 you want applied to your (enter year): estimated tax 23

Complete and sign this form on page 2.

For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11360L Form 1040-X (Rev. 7-2021)