Enlarge image

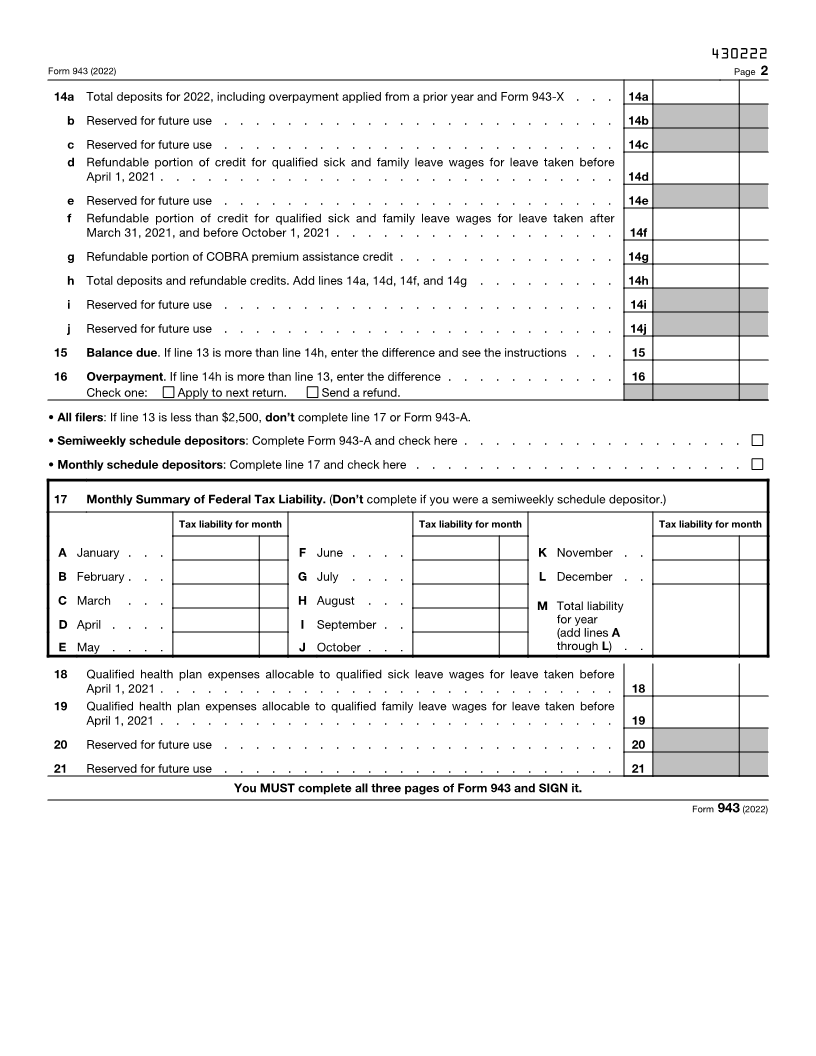

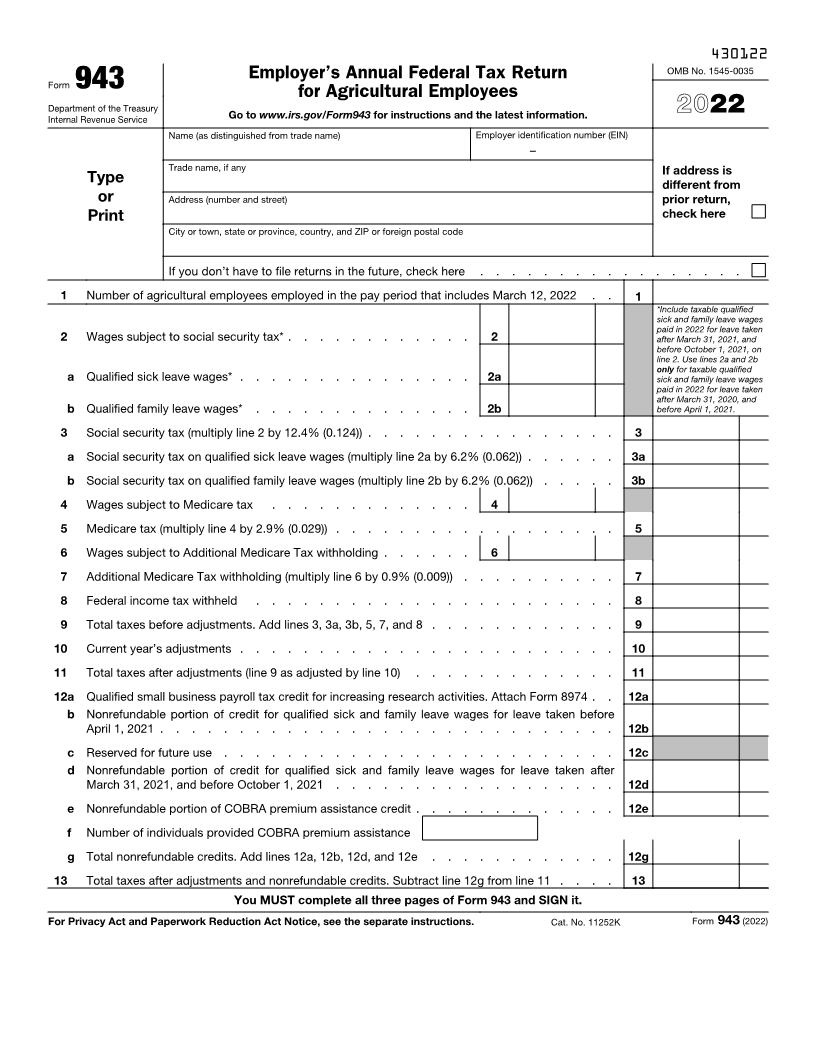

430122

OMB No. 1545-0035

Employer’s Annual Federal Tax Return

Form 943 for Agricultural Employees

Department of the Treasury 2022

Internal Revenue Service Go to www.irs.gov/Form943 for instructions and the latest information.

Name (as distinguished from trade name) Employer identification number (EIN)

–

Trade name, if any If address is

Type different from

or Address (number and street) prior return,

Print check here

City or town, state or province, country, and ZIP or foreign postal code

If you don’t have to file returns in the future, check here . . . . . . . . . . . . . . . . .

1 Number of agricultural employees employed in the pay period that includes March 12, 2022 . . 1

*Include taxable qualified

sick and family leave wages

paid in 2022 for leave taken

2 Wages subject to social security tax* . . . . . . . . . . . . 2 after March 31, 2021, and

before October 1, 2021, on

line 2. Use lines 2a and 2b

only for taxable qualified

a Qualified sick leave wages* . . . . . . . . . . . . . . . 2a sick and family leave wages

paid in 2022 for leave taken

after March 31, 2020, and

b Qualified family leave wages* . . . . . . . . . . . . . . 2b before April 1, 2021.

3 Social security tax (multiply line 2 by 12.4% (0.124)) . . . . . . . . . . . . . . . . 3

a Social security tax on qualified sick leave wages (multiply line 2a by 6.2% (0.062)) . . . . . . 3a

b Social security tax on qualified family leave wages (multiply line 2b by 6.2% (0.062)) . . . . . 3b

4 Wages subject to Medicare tax . . . . . . . . . . . . . 4

5 Medicare tax (multiply line 4 by 2.9% (0.029)) . . . . . . . . . . . . . . . . . . 5

6 Wages subject to Additional Medicare Tax withholding . . . . . . 6

7 Additional Medicare Tax withholding (multiply line 6 by 0.9% (0.009)) . . . . . . . . . . 7

8 Federal income tax withheld . . . . . . . . . . . . . . . . . . . . . . . 8

9 Total taxes before adjustments. Add lines 3, 3a, 3b, 5, 7, and 8 . . . . . . . . . . . . 9

10 Current year’s adjustments . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Total taxes after adjustments (line 9 as adjusted by line 10) . . . . . . . . . . . . . 11

12a Qualified small business payroll tax credit for increasing research activities. Attach Form 8974 . . 12a

b Nonrefundable portion of credit for qualified sick and family leave wages for leave taken before

April 1, 2021 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12b

c Reserved for future use . . . . . . . . . . . . . . . . . . . . . . . . . 12c

d Nonrefundable portion of credit for qualified sick and family leave wages for leave taken after

March 31, 2021, and before October 1, 2021 . . . . . . . . . . . . . . . . . . 12d

e Nonrefundable portion of COBRA premium assistance credit . . . . . . . . . . . . . 12e

f Number of individuals provided COBRA premium assistance

g Total nonrefundable credits. Add lines 12a, 12b, 12d, and 12e . . . . . . . . . . . . 12g

13 Total taxes after adjustments and nonrefundable credits. Subtract line 12g from line 11 . . . . 13

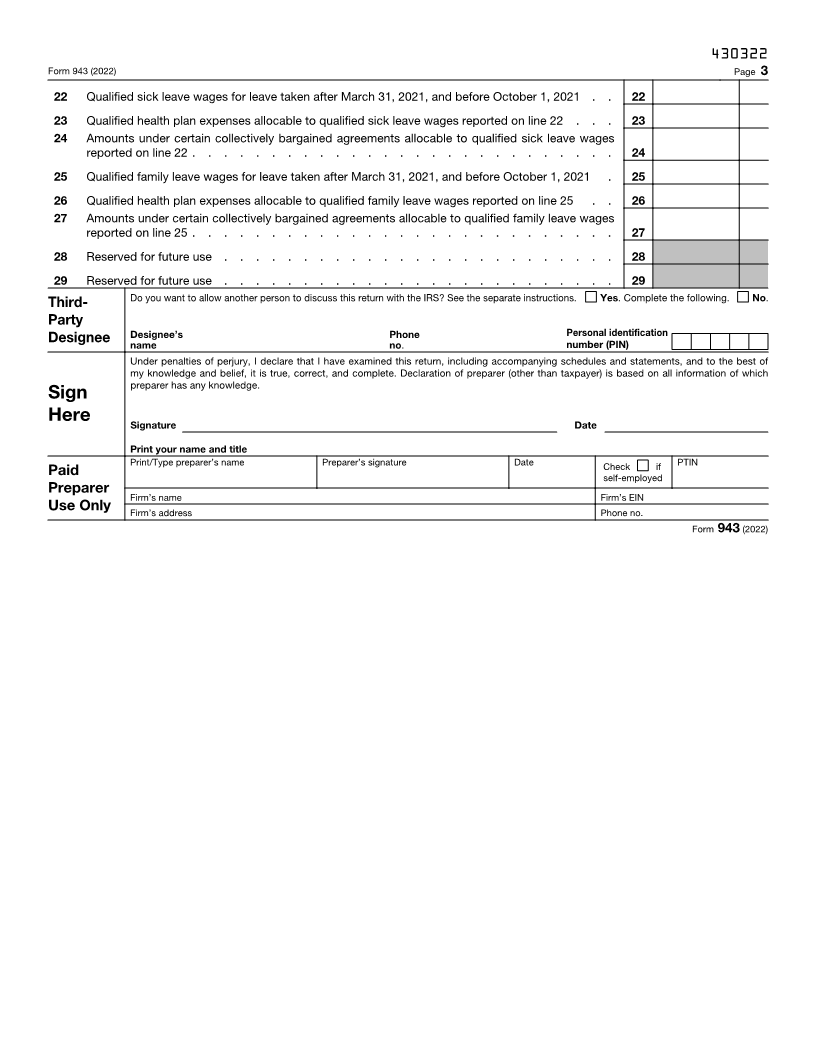

You MUST complete all three pages of Form 943 and SIGN it.

For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 11252K Form 943 (2022)