Enlarge image

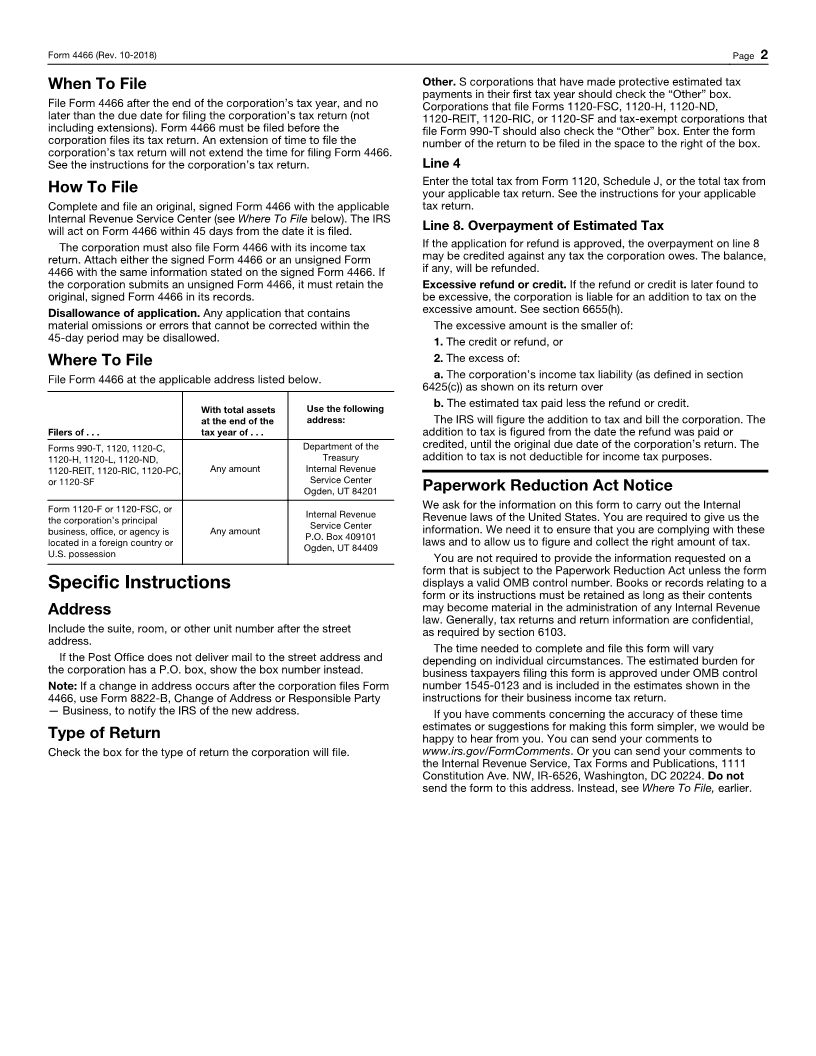

Corporation Application for Quick Refund of

Form 4466

(Rev. October 2018) Overpayment of Estimated Tax OMB No. 1545-0123

▶

Department of the Treasury Go to www.irs.gov/Form4466 for instructions and the latest information.

Internal Revenue Service For calendar year 20 or tax year beginning , 20 , and ending , 20

Name Employer identification number

Number, street, and room or suite no. (If a P.O. box, see instructions.) Telephone number (optional)

City or town, state, and ZIP code

Check type of return to be filed (see instructions):

Form 1120 Form 1120-C Form 1120-F Form 1120-L Form 1120-PC Other ▶

1 Estimated income tax paid during the tax year . . . . . . . . . . . . . . . . 1

2 Overpayment of income tax from prior year credited to this year’s estimated tax . . . . . 2

3 Total. Add lines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Enter total tax from the appropriate line of your tax return. See

instructions . . . . . . . . . . . . . . . . . . 4

5 a Personal holding company tax, if any,

included on line 4 . . . . . . . 5a

b Estimated refundable tax credit for

federal tax on fuels . . . . . . . 5b

6 Total. Add lines 5a and 5b . . . . . . . . . . . . . 6

7 Expected income tax liability for the tax year. Subtract line 6 from line 4 . . . . . . . . 7

8 Overpayment of estimated tax. Subtract line 7 from line 3. If this amount is at least 10% ofline

7 and at least $500, the corporation is eligible for a quick refund. Otherwise, do not filethis form.

See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . 8

Record of Estimated Tax Deposits

Date of deposit Amount Date of deposit Amount

Under penalties of perjury, I declare that I have examined this application, including any accompanying schedules and statements, and to the best of my

knowledge and belief, it is true, correct, and complete.

Sign

Here ▲ ▲

Signature Date Title

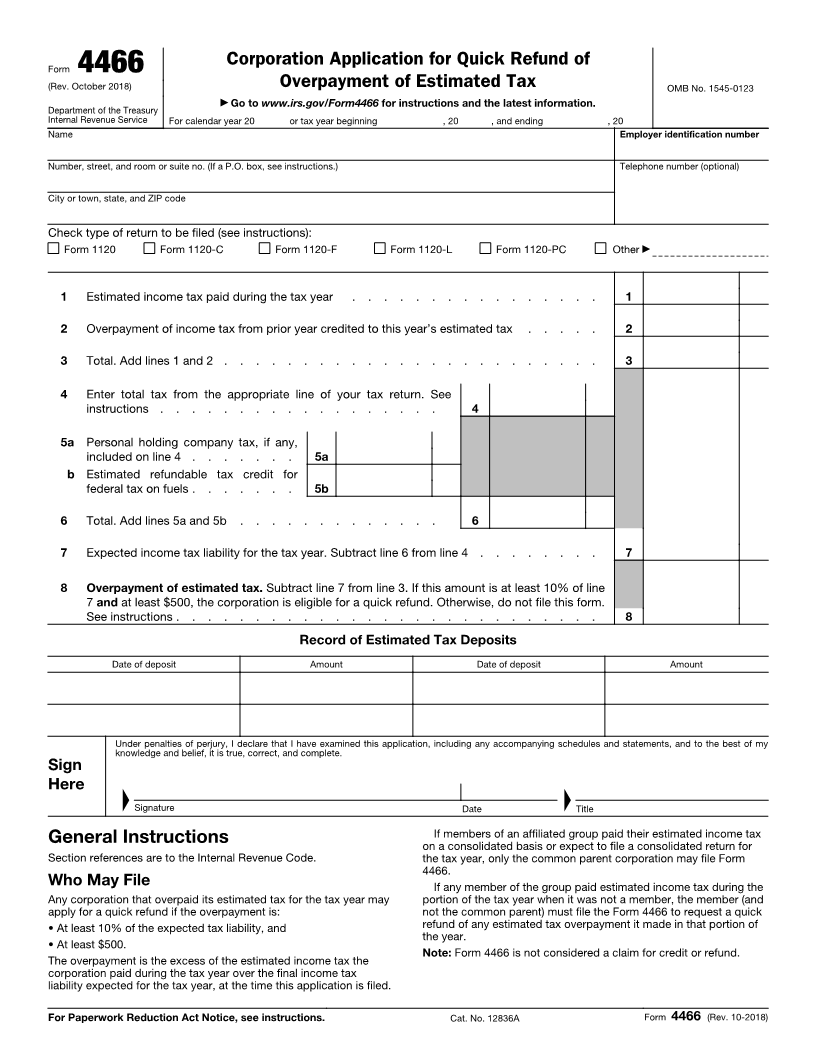

If members of an affiliated group paid their estimated income tax

General Instructions on a consolidated basis or expect to file a consolidated return for

Section references are to the Internal Revenue Code. the tax year, only the common parent corporation may file Form

4466.

Who May File If any member of the group paid estimated income tax during the

Any corporation that overpaid its estimated tax for the tax year may portion of the tax year when it was not a member, the member (and

apply for a quick refund if the overpayment is: not the common parent) must file the Form 4466 to request a quick

• At least 10% of the expected tax liability, and refund of any estimated tax overpayment it made in that portion of

the year.

• At least $500.

Note: Form 4466 is not considered a claim for credit orrefund.

The overpayment is the excess of the estimated income tax the

corporation paid during the tax year over the final income tax

liability expected for the tax year, at the time this application is filed.

For Paperwork Reduction Act Notice, see instructions. Cat. No. 12836A Form 4466 (Rev. 10-2018)