Enlarge image

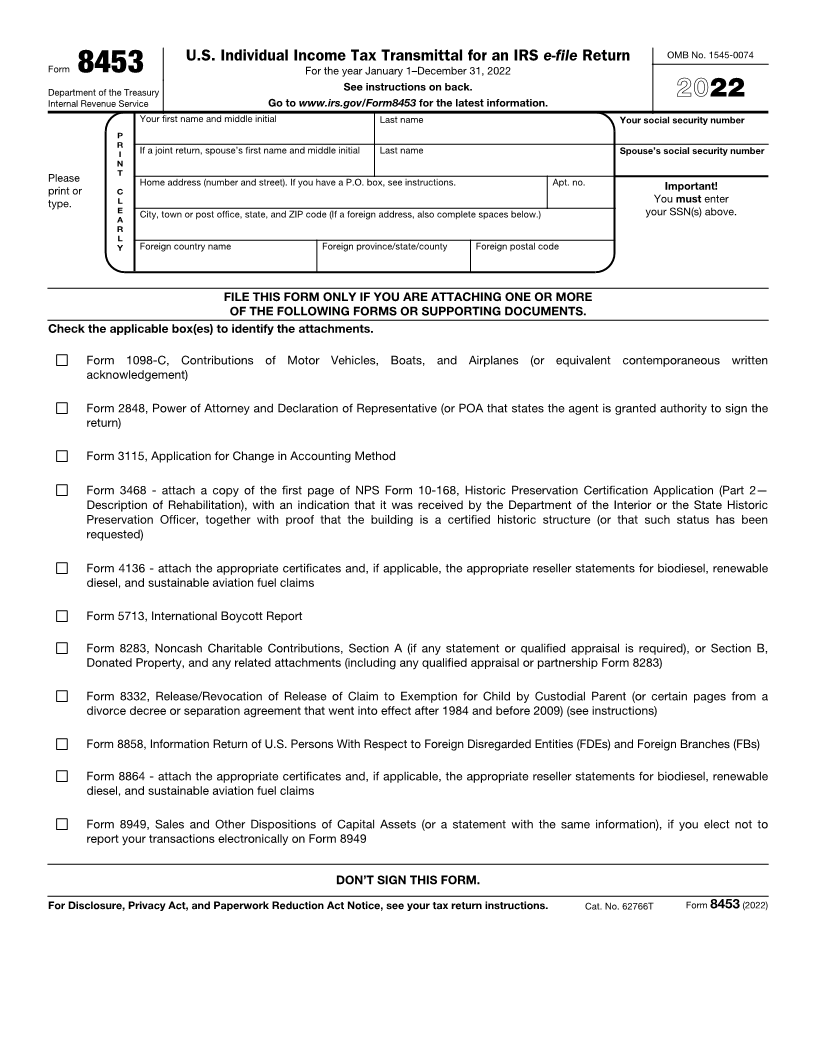

U.S. Individual Income Tax Transmittal for an IRS e-file Return OMB No. 1545-0074

Form 8453 For the year January 1–December 31, 2022

Department of the Treasury See instructions on back. 2022

Internal Revenue Service Go to www.irs.gov/Form8453 for the latest information.

Your first name and middle initial Last name Your social security number

P

R If a joint return, spouse’s first name and middle initial Last name Spouse’s social security number

I

N

Please T

print or C Home address (number and street). If you have a P.O. box, see instructions. Apt. no. Important!

type. L You must enter

E City, town or post office, state, and ZIP code (If a foreign address, also complete spaces below.) your SSN(s) above.

A

R

L

Y Foreign country name Foreign province/state/county Foreign postal code

FILE THIS FORM ONLY IF YOU ARE ATTACHING ONE OR MORE

OF THE FOLLOWING FORMS OR SUPPORTING DOCUMENTS.

Check the applicable box(es) to identify the attachments.

Form 1098-C, Contributions of Motor Vehicles, Boats, and Airplanes (or equivalent contemporaneous written

acknowledgement)

Form 2848, Power of Attorney and Declaration of Representative (or POA that states the agent is granted authority to sign the

return)

Form 3115, Application for Change in Accounting Method

Form 3468 - attach a copy of the first page of NPS Form 10-168, Historic Preservation Certification Application (Part 2—

Description of Rehabilitation), with an indication that it was received by the Department of the Interior or the State Historic

Preservation Officer, together with proof that the building is a certified historic structure (or that such status has been

requested)

Form 4136 - attach the appropriate certificates and, if applicable, the appropriate reseller statements for biodiesel, renewable

diesel, and sustainable aviation fuel claims

Form 5713, International Boycott Report

Form 8283, Noncash Charitable Contributions, Section A (if any statement or qualified appraisal is required), or Section B,

Donated Property, and any related attachments (including any qualified appraisal or partnership Form 8283)

Form 8332, Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent (or certain pages from a

divorce decree or separation agreement that went into effect after 1984 and before 2009) (see instructions)

Form 8858, Information Return of U.S. Persons With Respect to Foreign Disregarded Entities (FDEs) and Foreign Branches (FBs)

Form 8864 - attach the appropriate certificates and, if applicable, the appropriate reseller statements for biodiesel, renewable

diesel, and sustainable aviation fuel claims

Form 8949, Sales and Other Dispositions of Capital Assets (or a statement with the same information), if you elect not to

report your transactions electronically on Form 8949

DON’T SIGN THIS FORM.

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 62766T Form 8453 (2022)