Enlarge image

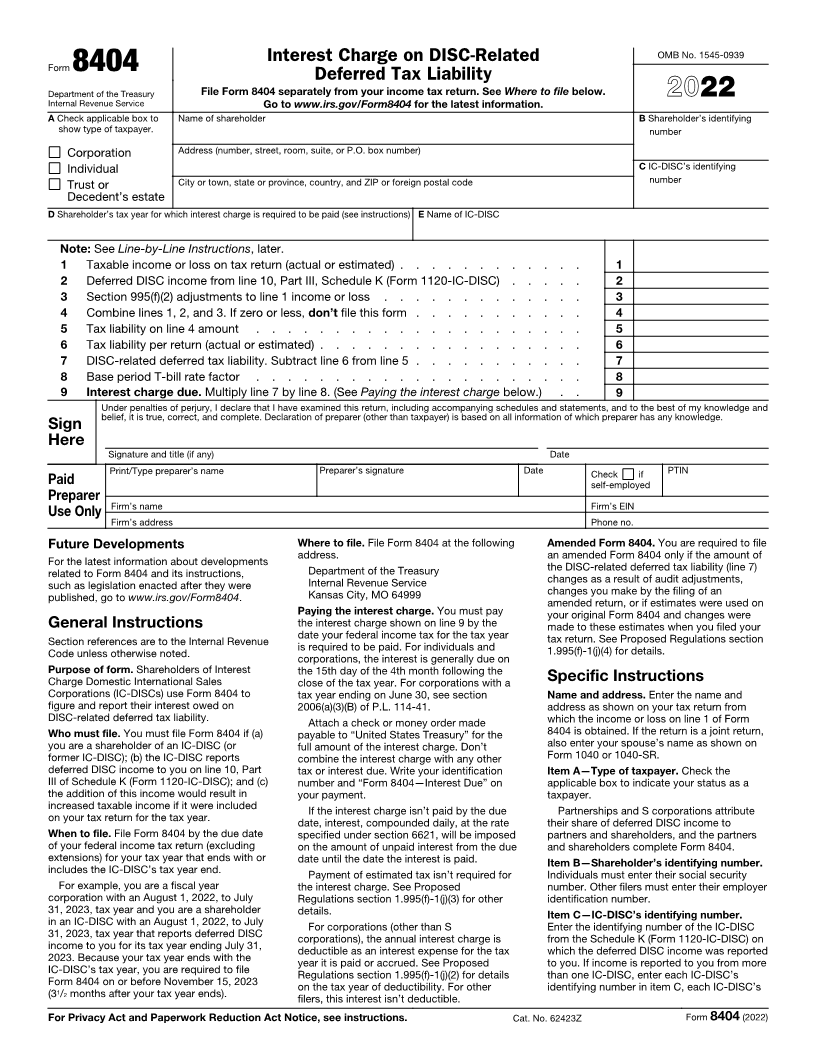

Interest Charge on DISC-Related OMB No. 1545-0939

Form 8404 Deferred Tax Liability

Department of the Treasury File Form 8404 separately from your income tax return. See Where to file below. 22

Internal Revenue Service Go to www.irs.gov/Form8404 for the latest information. 20

A Check applicable box to Name of shareholder B Shareholder’s identifying

show type of taxpayer. number

Corporation Address (number, street, room, suite, or P.O. box number)

Individual C IC-DISC’s identifying

Trust or City or town, state or province, country, and ZIP or foreign postal code number

Decedent’s estate

D Shareholder’s tax year for which interest charge is required to be paid (see instructions) E Name of IC-DISC

Note: See Line-by-Line Instructions , later.

1 Taxable income or loss on tax return (actual or estimated) . . . . . . . . . . . . 1

2 Deferred DISC income from line 10, Part III, Schedule K (Form 1120-IC-DISC) . . . . . 2

3 Section 995(f)(2) adjustments to line 1 income or loss . . . . . . . . . . . . . 3

4 Combine lines 1, 2, and 3. If zero or less, don’t file this form . . . . . . . . . . . 4

5 Tax liability on line 4 amount . . . . . . . . . . . . . . . . . . . . . 5

6 Tax liability per return (actual or estimated) . . . . . . . . . . . . . . . . . 6

7 DISC-related deferred tax liability. Subtract line 6 from line 5 . . . . . . . . . . . 7

8 Base period T-bill rate factor . . . . . . . . . . . . . . . . . . . . . 8

9 Interest charge due. Multiply line 7 by line 8. (See Paying the interest charge below.) . . 9

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and

belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign

Here

Signature and title (if any) Date

Print/Type preparer’s name Preparer’s signature Date Check if PTIN

Paid self-employed

Preparer

Firm’s name Firm’s EIN

Use Only

Firm’s address Phone no.

Future Developments Where to file. File Form 8404 at the following Amended Form 8404. You are required to file

address. an amended Form 8404 only if the amount of

For the latest information about developments

related to Form 8404 and its instructions, Department of the Treasury the DISC-related deferred tax liability (line 7)

such as legislation enacted after they were Internal Revenue Service changes as a result of audit adjustments,

published, go to www.irs.gov/Form8404. Kansas City, MO 64999 changes you make by the filing of an

amended return, or if estimates were used on

Paying the interest charge. You must pay your original Form 8404 and changes were

General Instructions the interest charge shown on line 9 by the made to these estimates when you filed your

date your federal income tax for the tax year

Section references are to the Internal Revenue tax return. See Proposed Regulations section

is required to be paid. For individuals and 1.995(f)-1(j)(4) for details.

Code unless otherwise noted. corporations, the interest is generally due on

Purpose of form. Shareholders of Interest the 15th day of the 4th month following the

Charge Domestic International Sales close of the tax year. For corporations with a Specific Instructions

Corporations (IC-DISCs) use Form 8404 to tax year ending on June 30, see section Name and address. Enter the name and

figure and report their interest owed on 2006(a)(3)(B) of P.L. 114-41. address as shown on your tax return from

DISC-related deferred tax liability. Attach a check or money order made which the income or loss on line 1 of Form

Who must file.You must file Form 8404 if (a) payable to “United States Treasury” for the 8404 is obtained. If the return is a joint return,

you are a shareholder of an IC-DISC (or full amount of the interest charge. Don’t also enter your spouse’s name as shown on

former IC-DISC); (b) the IC-DISC reports combine the interest charge with any other Form 1040 or 1040-SR.

deferred DISC income to you on line 10, Part tax or interest due. Write your identification Item A—Type of taxpayer. Check the

III of Schedule K (Form 1120-IC-DISC); and (c) number and “Form 8404—Interest Due” on applicable box to indicate your status as a

the addition of this income would result in your payment. taxpayer.

increased taxable income if it were included If the interest charge isn’t paid by the due Partnerships and S corporations attribute

on your tax return for the tax year. date, interest, compounded daily, at the rate their share of deferred DISC income to

When to file. File Form 8404 by the due date specified under section 6621, will be imposed partners and shareholders, and the partners

of your federal income tax return (excluding on the amount of unpaid interest from the due and shareholders complete Form 8404.

extensions) for your tax year that ends with or date until the date the interest is paid. Item B—Shareholder’s identifying number.

includes the IC-DISC’s tax year end. Payment of estimated tax isn’t required for Individuals must enter their social security

For example, you are a fiscal year the interest charge. See Proposed number. Other filers must enter their employer

corporation with an August 1, 2022, to July Regulations section 1.995(f)-1(j)(3) for other identification number.

31, 2023, tax year and you are a shareholder details. Item C—IC-DISC’s identifying number.

in an IC-DISC with an August 1, 2022, to July For corporations (other than S Enter the identifying number of the IC-DISC

31, 2023, tax year that reports deferred DISC corporations), the annual interest charge is from the Schedule K (Form 1120-IC-DISC) on

income to you for its tax year ending July 31, deductible as an interest expense for the tax which the deferred DISC income was reported

2023. Because your tax year ends with the year it is paid or accrued. See Proposed to you. If income is reported to you from more

IC-DISC’s tax year, you are required to file Regulations section 1.995(f)-1(j)(2) for details than one IC-DISC, enter each IC-DISC’s

Form 8404 on or before November 15, 2023 on the tax year of deductibility. For other identifying number in item C, each IC-DISC’s

(31/ 2months after your tax year ends). filers, this interest isn’t deductible.

For Privacy Act and Paperwork Reduction Act Notice, see instructions. Cat. No. 62423Z Form 8404 (2022)