Enlarge image

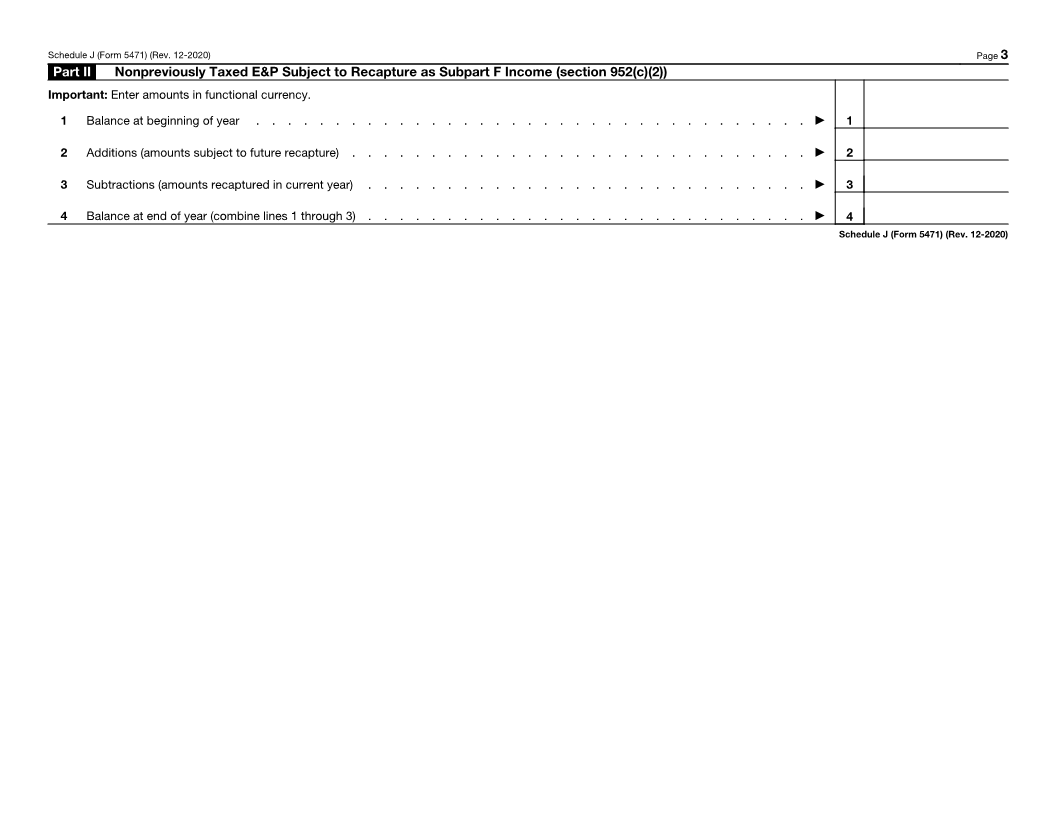

SCHEDULE J

(Form 5471) Accumulated Earnings & Profits (E&P) of Controlled Foreign Corporation

(Rev. December 2020) ▶ Attach to Form 5471. OMB No. 1545-0123

Department of the Treasury ▶ Go to www.irs.gov/Form5471 for instructions and the latest information.

Internal Revenue Service

Name of person filing Form 5471 Identifying number

Name of foreign corporation EIN (if any) Reference ID number (see instructions)

a Separate Category (Enter code—see instructions.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ▶

b If code 901j is entered on line a, enter the country code for the sanctioned country (see instructions) . . . . . . . . . . . . . . ▶

Part I Accumulated E&P of Controlled Foreign Corporation

Check the box if person filing return does not have all U.S. shareholders’ information to complete an amount in column (e) (see instructions).

(a) (b) (c) (d) (e) Previously Taxed E&P (see instructions)

Important: Enter amounts in functional currency. Post-2017 E&P Not Post-1986 Pre-1987 E&P Not Hovering Deficit and

Previously Taxed Undistributed Earnings Previously Taxed Deduction for (i) Reclassified section (ii) Reclassified section

(post-2017 section (post-1986 and pre-2018 (pre-1987 section Suspended Taxes 965(a) PTEP 965(b) PTEP

959(c)(3) balance) section 959(c)(3) balance) 959(c)(3) balance)

1a Balance at beginning of year (as reported on prior

year Schedule J) . . . . . . . . . . .

b Beginning balance adjustments (attach statement)

c Adjusted beginning balance (combine lines 1a and 1b)

2a Reduction for taxes unsuspended under anti-splitter rules

b Disallowed deduction for taxes suspended under

anti-splitter rules . . . . . . . . . . .

3 Current year E&P (or deficit in E&P) (enter amount

from applicable line 5c of Schedule H) . . . .

4 E&P attributable to distributions of previously taxed

E&P from lower-tier foreign corporation . . .

5a E&P carried over in nonrecognition transaction .

b Reclassify deficit in E&P as hovering deficit after

nonrecognition transaction . . . . . . .

6 Other adjustments (attach statement) . . . .

7 Total current and accumulated E&P (combine lines

1c through 6) . . . . . . . . . . . .

8 Amounts reclassified to section 959(c)(2) E&P from

section 959(c)(3) E&P . . . . . . . . .

9 Actual distributions . . . . . . . . . .

10 Amounts reclassified to section 959(c)(1) E&P from

section 959(c)(2) E&P . . . . . . . . .

11 Amounts included as earnings invested in U.S. property

and reclassified to section 959(c)(1) E&P (see instructions)

12 Other adjustments (attach statement) . . . .

13 Hovering deficit offset of undistributed post-

transaction E&P (see instructions) . . . . .

14 Balance at beginning of next year (combine lines 7 through 13)

For Paperwork Reduction Act Notice, see the Instructions for Form 5471. Cat. No. 21111K Schedule J (Form 5471) (Rev. 12-2020)