Enlarge image

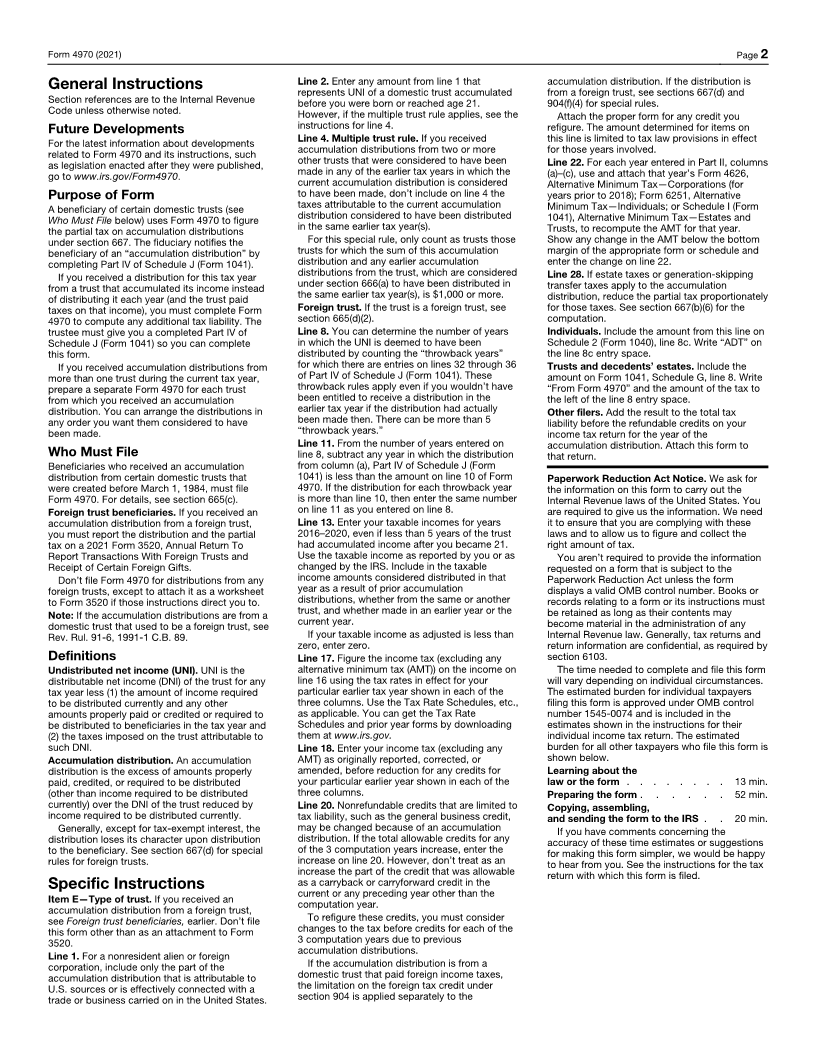

OMB No. 1545-0192

Tax on Accumulation Distribution of Trusts

Form 4970

▶

Department of the Treasury Attach to beneficiary’s tax return. 2021

Attachment

Internal Revenue Service ▶ Go to www.irs.gov/Form4970 for the latest information. Sequence No. 178

A Name(s) as shown on return B Social security number

C Name and address of trust D Employer identification number

E Type of trust (see instructions) F Beneficiary’s date of birth G Enter the number of trusts from which you received

Domestic Foreign accumulation distributions in this tax year . . . . ▶

Part I Average Income and Determination of Computation Years

1 Amount of current distribution that is considered distributed in earlier tax years (from Schedule J

(Form 1041), line 37, column (a)) . . . . . . . . . . . . . . . . . . . . . . . 1

2 Distributions of income accumulated before you were born or reached age 21 . . . . . . . . 2

3 Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Taxes imposed on the trust on amounts from line 3 (from Schedule J (Form 1041), line 37, column (b)) . 4

5 Total (add lines 3 and 4) . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Tax-exempt interest included on line 5 (from Schedule J (Form 1041), line 37, column (c)) . . . . 6

7 Taxable part of line 5 (subtract line 6 from line 5) . . . . . . . . . . . . . . . . . . 7

8 Number of trust’s earlier tax years in which amounts on line 7 are considered distributed . . . . 8

9 Average annual amount considered distributed (divide line 3 by line 8) . . . 9

10 Multiply line 9 by 25% (0.25) . . . . . . . . . . . . . . . . 10

11 Number of earlier tax years to be taken into account (see instructions) . . . . . . . . . . . 11

12 Average amount for recomputing tax (divide line 7 by line 11). Enter here and in each column on line 15 12

13 Enter your taxable income before (a) 2020 (b) 2019 (c) 2018 (d) 2017 (e) 2016

this distribution for the 5 immediately

preceding tax years.

Part II Tax Attributable to the Accumulation Distribution

(a) (b) (c)

14 Enter the amounts from line 13, eliminating the highest and lowest

taxable income years . . . . . . . . . . . . . . . 14

15 Enter amount from line 12 in each column . . . . . . . . . 15

16 Recomputed taxable income (add lines 14 and 15) . . . . . . 16

17 Income tax on amounts on line 16 . . . . . . . . . . . 17

18 Income tax before credits on line 14 income . . . . . . . . 18

19 Additional tax before credits (subtract line 18 from line 17) . . . 19

20 Tax credit adjustment . . . . . . . . . . . . . . . 20

21 Subtract line 20 from line 19 . . . . . . . . . . . . . 21

22 Alternative minimum tax adjustments . . . . . . . . . . 22

23 Combine lines 21 and 22 . . . . . . . . . . . . . . 23

24 Add columns (a), (b), and (c), line 23 . . . . . . . . . . . . . . . . . . . . . . . 24

25 Divide the line 24 amount by 3.0 . . . . . . . . . . . . . . . . . . . . . . . . 25

26 Multiply the amount on line 25 by the number of years on line 11 . . . . . . . . . . . . . 26

27 Enter the amount from line 4 . . . . . . . . . . . . . . . . . . . . . . . . . 27

28 Partial tax attributable to the accumulation distribution (subtract line 27 from line 26) (If zero or

less, enter -0-) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

For Paperwork Reduction Act Notice, see the instructions. Cat. No. 13180V Form 4970 (2021)