Enlarge image

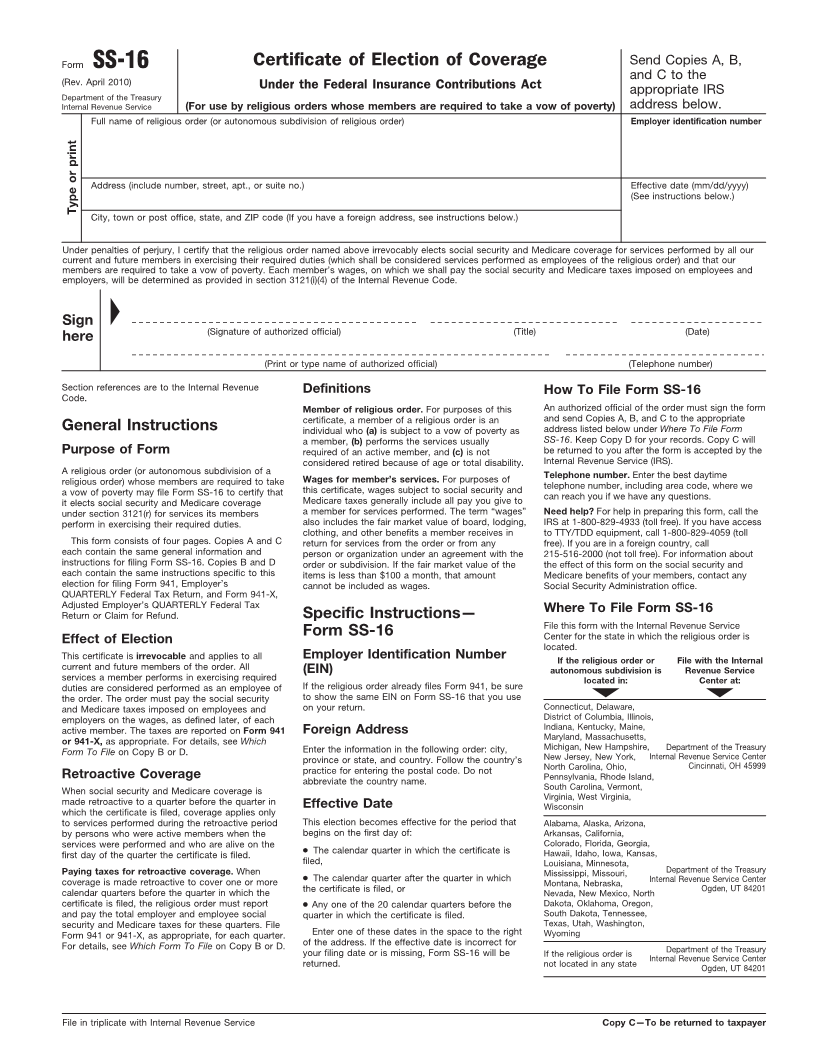

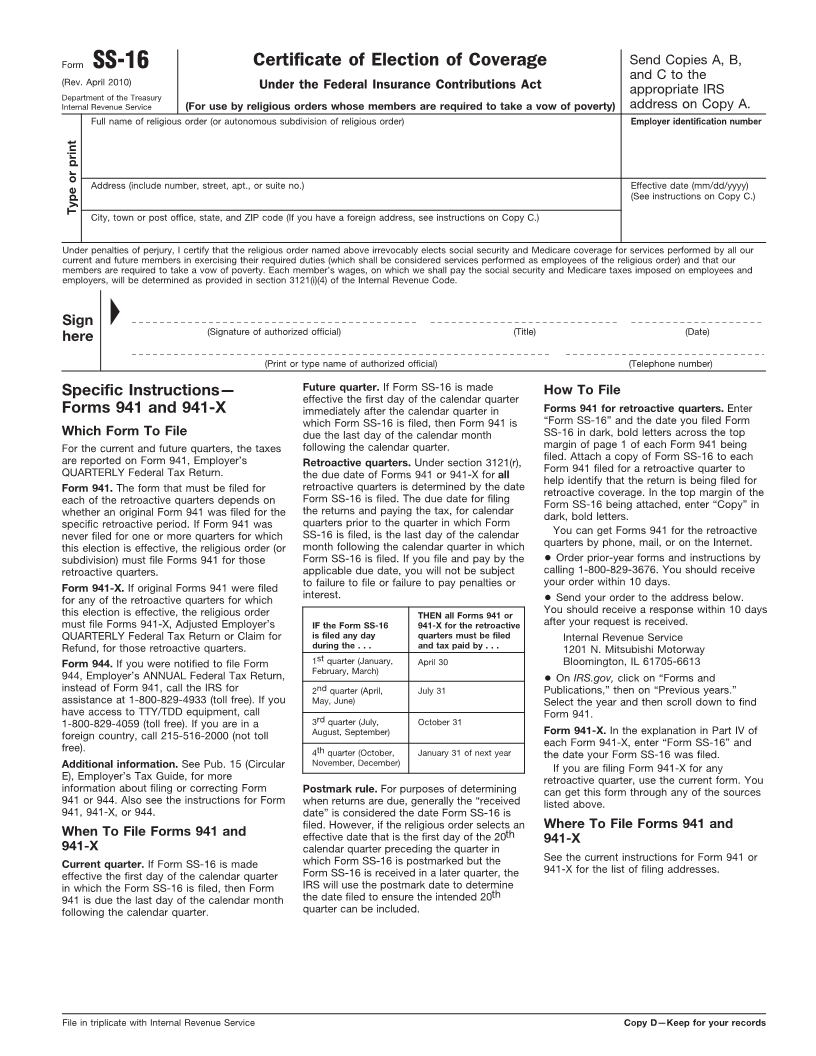

Form SS-16 Certificate of Election of Coverage Send Copies A, B,

and C to the

(Rev. April 2010) Under the Federal Insurance Contributions Act

Department of the Treasury appropriate IRS

Internal Revenue Service (For use by religious orders whose members are required to take a vow of poverty) address below.

Full name of religious order (or autonomous subdivision of religious order) Employer identification number

Address (include number, street, apt., or suite no.) Effective date (mm/dd/yyyy)

(See instructions below.)

Type or print

City, town or post office, state, and ZIP code (If you have a foreign address, see instructions below.)

Under penalties of perjury, I certify that the religious order named above irrevocably elects social security and Medicare coverage for services performed by all our

current and future members in exercising their required duties (which shall be considered services performed as employees of the religious order) and that our

members are required to take a vow of poverty. Each member’s wages, on which we shall pay the social security and Medicare taxes imposed on employees and

employers, will be determined as provided in section 3121(i)(4) of the Internal Revenue Code.

Sign ©

(Date)

here (Signature of authorized official) (Title)

(Print or type name of authorized official) (Telephone number)

Section references are to the Internal Revenue Definitions How To File Form SS-16

Code.

Member of religious order. For purposes of this An authorized official of the order must sign the form

certificate, a member of a religious order is an and send Copies A, B, and C to the appropriate

General Instructions individual who (a) is subject to a vow of poverty as address listed below under Where To File Form

a member, (b) performs the services usually SS-16. Keep Copy D for your records. Copy C will

Purpose of Form required of an active member, and (c) is not be returned to you after the form is accepted by the

considered retired because of age or total disability. Internal Revenue Service (IRS).

A religious order (or autonomous subdivision of a

religious order) whose members are required to take Wages for member’s services. For purposes of Telephone number. Enter the best daytime

a vow of poverty may file Form SS-16 to certify that this certificate, wages subject to social security and telephone number, including area code, where we

it elects social security and Medicare coverage Medicare taxes generally include all pay you give to can reach you if we have any questions.

under section 3121(r) for services its members a member for services performed. The term “wages” Need help? For help in preparing this form, call the

perform in exercising their required duties. also includes the fair market value of board, lodging, IRS at 1-800-829-4933 (toll free). If you have access

This form consists of four pages. Copies A and C clothing, and other benefits a member receives in to TTY/TDD equipment, call 1-800-829-4059 (toll

return for services from the order or from any free). If you are in a foreign country, call

each contain the same general information and person or organization under an agreement with the 215-516-2000 (not toll free). For information about

instructions for filing Form SS-16. Copies B and D order or subdivision. If the fair market value of the the effect of this form on the social security and

each contain the same instructions specific to this items is less than $100 a month, that amount Medicare benefits of your members, contact any

election for filing Form 941, Employer’s cannot be included as wages. Social Security Administration office.

QUARTERLY Federal Tax Return, and Form 941-X,

Adjusted Employer’s QUARTERLY Federal Tax

Return or Claim for Refund. Specific Instructions— Where To File Form SS-16

File this form with the Internal Revenue Service

Effect of Election Form SS-16 Center for the state in which the religious order is

located.

This certificate is irrevocable and applies to all Employer Identification Number If the religious order or File with the Internal

current and future members of the order. All (EIN) autonomous subdivision is Revenue Service

services a member performs in exercising required located in: Center at:

duties are considered performed as an employee of If the religious order already files Form 941, be sure Ä Ä

the order. The order must pay the social security to show the same EIN on Form SS-16 that you use

and Medicare taxes imposed on employees and on your return. Connecticut, Delaware,

employers on the wages, as defined later, of each District of Columbia, Illinois,

active member. The taxes are reported on Form 941 Foreign Address Indiana, Kentucky, Maine,

or 941-X, as appropriate. For details, see Which Enter the information in the following order: city, Maryland, Massachusetts, Department of the Treasury

Form To File on Copy B or D. province or state, and country. Follow the country’s Michigan, New Hampshire, Internal Revenue Service Center

North Carolina, Ohio, Cincinnati, OH 45999

New Jersey, New York,

Retroactive Coverage practice for entering the postal code. Do not Pennsylvania, Rhode Island,

abbreviate the country name.

When social security and Medicare coverage is South Carolina, Vermont,

Virginia, West Virginia,

made retroactive to a quarter before the quarter in Effective Date Wisconsin

which the certificate is filed, coverage applies only

to services performed during the retroactive period This election becomes effective for the period that Alabama, Alaska, Arizona,

by persons who were active members when the begins on the first day of: Arkansas, California,

services were performed and who are alive on the Colorado, Florida, Georgia,

first day of the quarter the certificate is filed. ● The calendar quarter in which the certificate is Hawaii, Idaho, Iowa, Kansas,

filed, Louisiana, Minnesota, Department of the Treasury

Paying taxes for retroactive coverage.

When The calendar quarter after the quarter in which Mississippi, Missouri, Internal Revenue Service Center

coverage is made retroactive to cover one or more ● Montana, Nebraska, Ogden, UT 84201

calendar quarters before the quarter in which the the certificate is filed, or Nevada, New Mexico, North

certificate is filed, the religious order must report ● Any one of the 20 calendar quarters before the Dakota, Oklahoma, Oregon,

and pay the total employer and employee social quarter in which the certificate is filed. South Dakota, Tennessee,

security and Medicare taxes for these quarters. File Texas, Utah, Washington,

Form 941 or 941-X, as appropriate, for each quarter. Enter one of these dates in the space to the right Wyoming

For details, see Which Form To File on Copy B or D. of the address. If the effective date is incorrect for

your filing date or is missing, Form SS-16 will be If the religious order is Department of the Treasury

returned. not located in any state Internal Revenue Service Center

Ogden, UT 84201

File in triplicate with Internal Revenue Service Cat. No. 16202C Copy A—To be retained by Internal Revenue Service