Enlarge image

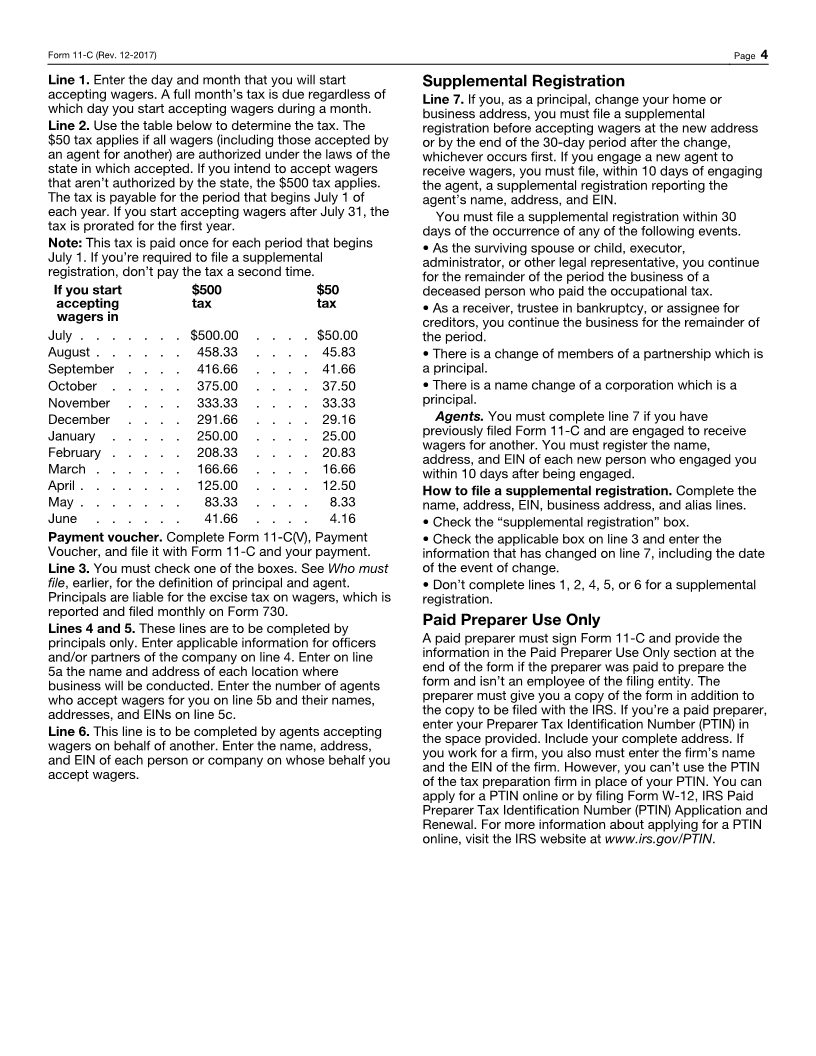

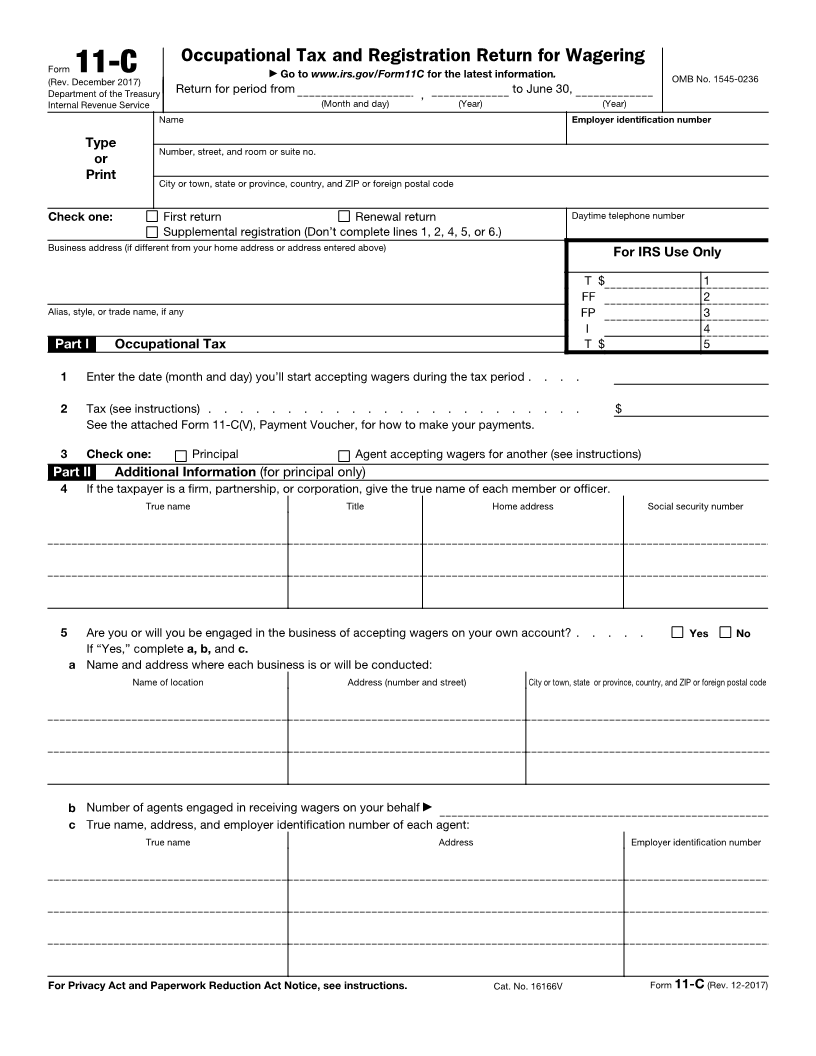

Occupational Tax and Registration Return for Wagering

Form 11-C ▶ Go to www.irs.gov/Form11C for the latest information . OMB No. 1545-0236

(Rev. December 2017)

Department of the Treasury Return for period from , to June 30,

Internal Revenue Service (Month and day) (Year) (Year)

Name Employer identification number

Type

Number, street, and room or suite no.

or

Print

City or town, state or province, country, and ZIP or foreign postal code

Check one: First return Renewal return Daytime telephone number

Supplemental registration (Don’t complete lines 1, 2, 4, 5, or 6.)

Business address (if different from your home address or address entered above) For IRS Use Only

T $ 1

FF 2

Alias, style, or trade name, if any FP 3

I 4

Part I Occupational Tax T $ 5

1 Enter the date (month and day) you’ll start accepting wagers during the tax period . . . .

2 Tax (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . $

See the attached Form 11-C(V), Payment Voucher, for how to make your payments.

3 Check one: Principal Agent accepting wagers for another (see instructions)

Part II Additional Information (for principal only)

4 If the taxpayer is a firm, partnership, or corporation, give the true name of each member or officer.

True name Title Home address Social security number

5 Are you or will you be engaged in the business of accepting wagers on your own account? . . . . . Yes No

If “Yes,” complete a, b, and c.

a Name and address where each business is or will be conducted:

Name of location Address (number and street) City or town, state or province, country, and ZIP or foreign postal code

b Number of agents engaged in receiving wagers on your behalf ▶

c True name, address, and employer identification number of each agent:

True name Address Employer identification number

For Privacy Act and Paperwork Reduction Act Notice, see instructions. Cat. No. 16166V Form 11-C (Rev. 12-2017)