- 2 -

Enlarge image

|

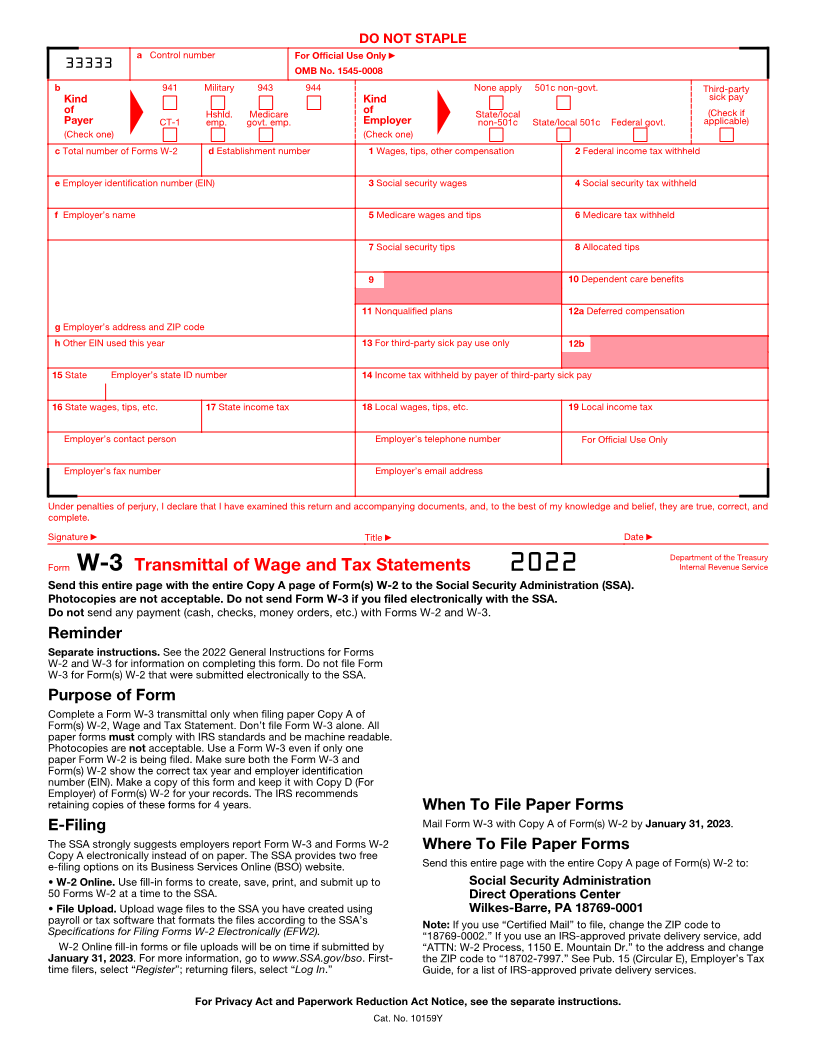

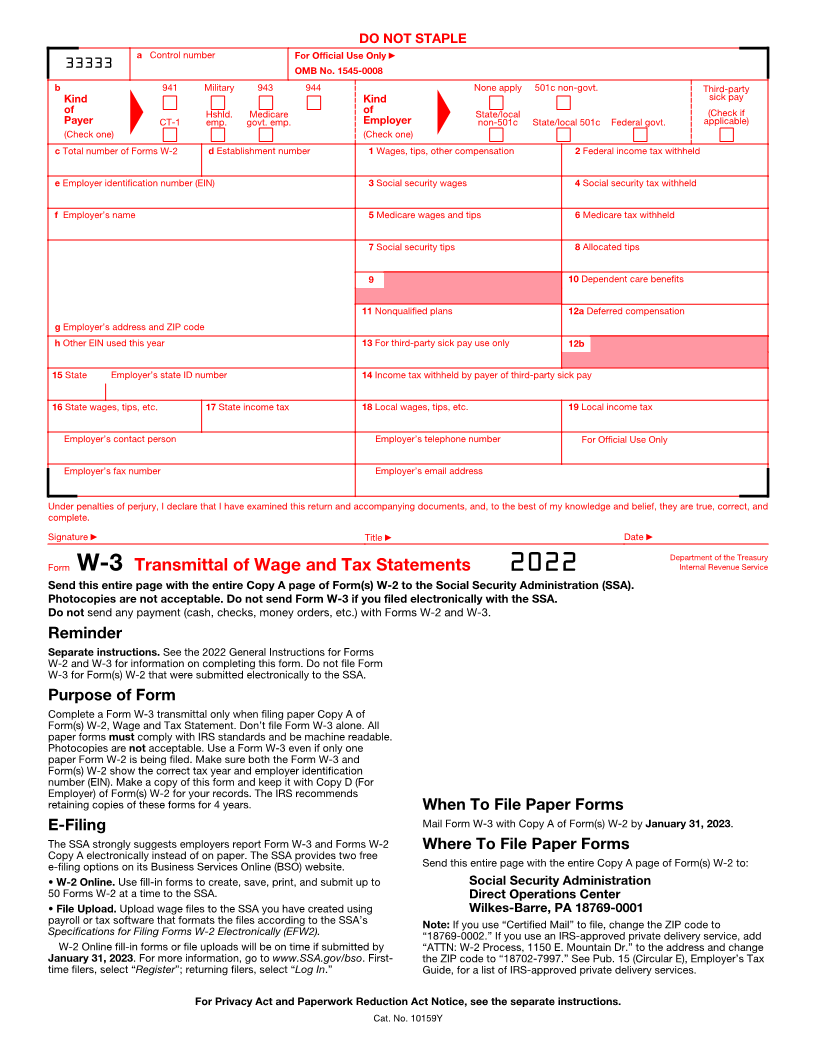

DO NOT STAPLE

a Control number For Official Use Only ▶

33333 OMB No. 1545-0008

b ▲ 941 Military 943 944 ▲ None apply 501c non-govt. Third-party

Kind Kind sick pay

of Hshld. Medicare of State/local (Check if

Payer CT-1 emp. govt. emp. Employer non-501c State/local 501c Federal govt. applicable)

(Check one) (Check one)

c Total number of Forms W-2 d Establishment number 1 Wages, tips, other compensation 2 Federal income tax withheld

e Employer identification number (EIN) 3 Social security wages 4 Social security tax withheld

f Employer’s name 5 Medicare wages and tips 6 Medicare tax withheld

7 Social security tips 8 Allocated tips

9 10 Dependent care benefits

11 Nonqualified plans 12a Deferred compensation

g Employer’s address and ZIP code

h Other EIN used this year 13 For third-party sick pay use only 12b

15 State Employer’s state ID number 14 Income tax withheld by payer of third-party sick pay

16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax

Employer’s contact person Employer’s telephone number For Official Use Only

Employer’s fax number Employer’s email address

Under penalties of perjury, I declare that I have examined this return and accompanying documents, and, to the best of my knowledge and belief, they are true, correct, and

complete.

Signature ▶ Title ▶ Date ▶

Department of the Treasury

Form W-3 Transmittal of Wage and Tax Statements 2022 Internal Revenue Service

Send this entire page with the entire Copy A page of Form(s) W-2 to the Social Security Administration (SSA).

Photocopies are not acceptable. Do not send Form W-3 if you filed electronically with the SSA.

Do not send any payment (cash, checks, money orders, etc.) with Forms W-2 and W-3.

Reminder

Separate instructions. See the 2022 General Instructions for Forms

W-2 and W-3 for information on completing this form. Do not file Form

W-3 for Form(s) W-2 that were submitted electronically to the SSA.

Purpose of Form

Complete a Form W-3 transmittal only when filing paper Copy A of

Form(s) W-2, Wage and Tax Statement. Don’t file Form W-3 alone. All

paper forms must comply with IRS standards and be machine readable.

Photocopies are not acceptable. Use a Form W-3 even if only one

paper Form W-2 is being filed. Make sure both the Form W-3 and

Form(s) W-2 show the correct tax year and employer identification

number (EIN). Make a copy of this form and keep it with Copy D (For

Employer) of Form(s) W-2 for your records. The IRS recommends

retaining copies of these forms for 4 years. When To File Paper Forms

E-Filing Mail Form W-3 with Copy A of Form(s) W-2 by January 31, 2023.

The SSA strongly suggests employers report Form W-3 and Forms W-2 Where To File Paper Forms

Copy A electronically instead of on paper. The SSA provides two free

e-filing options on its Business Services Online (BSO) website. Send this entire page with the entire Copy A page of Form(s) W-2 to:

• W-2 Online. Use fill-in forms to create, save, print, and submit up to Social Security Administration

50 Forms W-2 at a time to the SSA. Direct Operations Center

• File Upload. Upload wage files to the SSA you have created using Wilkes-Barre, PA 18769-0001

payroll or tax software that formats the files according to the SSA’s Note: If you use “Certified Mail” to file, change the ZIP code to

Specifications for Filing Forms W-2 Electronically (EFW2). “18769-0002.” If you use an IRS-approved private delivery service, add

W-2 Online fill-in forms or file uploads will be on time if submitted by “ATTN: W-2 Process, 1150 E. Mountain Dr.” to the address and change

January 31, 2023. For more information, go to www.SSA.gov/bso . First- the ZIP code to “18702-7997.” See Pub. 15 (Circular E), Employer’s Tax

time filers, select “Register”; returning filers, select “Log In.” Guide, for a list of IRS-approved private delivery services.

For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions.

Cat. No. 10159Y

|