Enlarge image

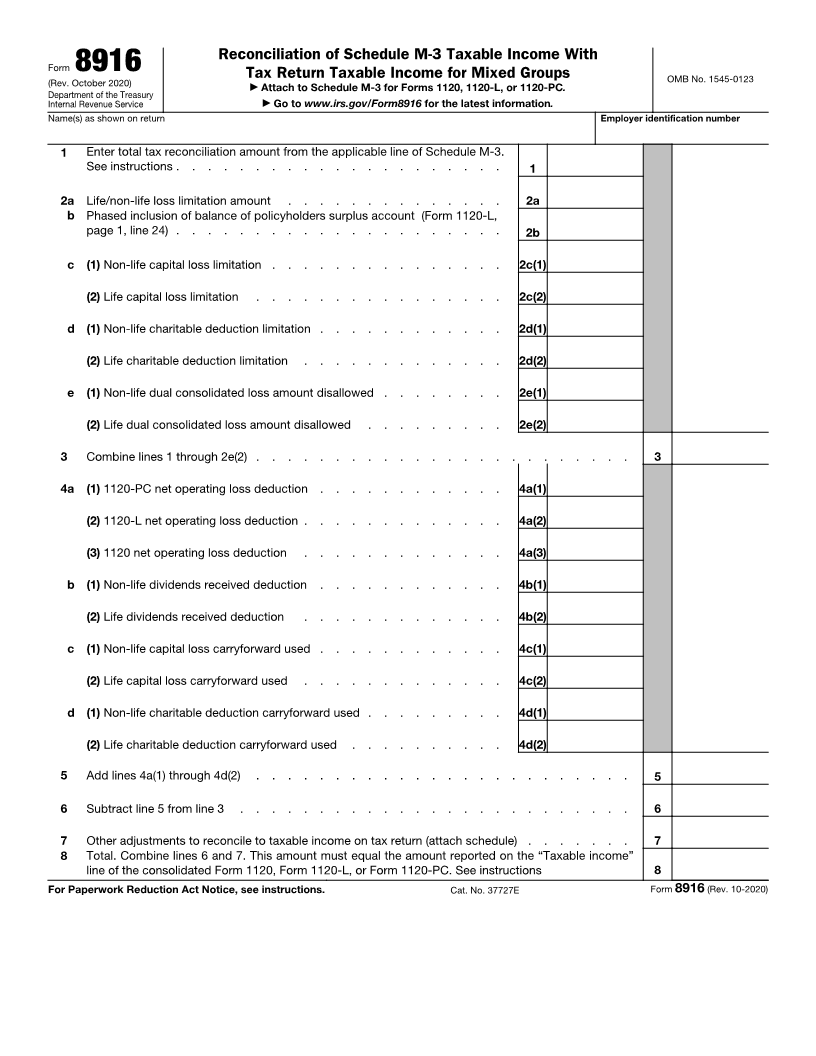

Reconciliation of Schedule M-3 Taxable Income With

Form 8916 Tax Return Taxable Income for Mixed Groups OMB No. 1545-0123

(Rev. October 2020) ▶ Attach to Schedule M-3 for Forms 1120, 1120-L, or 1120-PC.

Department of the Treasury

Internal Revenue Service ▶ Go to www.irs.gov/Form8916 for the latest information.

Name(s) as shown on return Employer identification number

1 Enter total tax reconciliation amount from the applicable line of Schedule M-3.

See instructions . . . . . . . . . . . . . . . . . . . . . 1

2 a Life/non-life loss limitation amount . . . . . . . . . . . . . . 2a

b Phased inclusion of balance of policyholders surplus account (Form 1120-L,

page 1, line 24) . . . . . . . . . . . . . . . . . . . . . 2b

c (1) Non-life capital loss limitation . . . . . . . . . . . . . . . 2c(1)

(2) Life capital loss limitation . . . . . . . . . . . . . . . . 2c(2)

d (1) Non-life charitable deduction limitation . . . . . . . . . . . . 2d(1)

(2) Life charitable deduction limitation . . . . . . . . . . . . . 2d(2)

e (1) Non-life dual consolidated loss amount disallowed . . . . . . . . 2e(1)

(2) Life dual consolidated loss amount disallowed . . . . . . . . . 2e(2)

3 Combine lines 1 through 2e(2) . . . . . . . . . . . . . . . . . . . . . . . . 3

4a (1) 1120-PC net operating loss deduction . . . . . . . . . . . . 4a(1)

(2) 1120-L net operating loss deduction . . . . . . . . . . . . . 4a(2)

(3) 1120 net operating loss deduction . . . . . . . . . . . . . 4a(3)

b (1) Non-life dividends received deduction . . . . . . . . . . . . 4b(1)

(2) Life dividends received deduction . . . . . . . . . . . . . 4b(2)

c (1) Non-life capital loss carryforward used . . . . . . . . . . . . 4c(1)

(2) Life capital loss carryforward used . . . . . . . . . . . . . 4c(2)

d (1) Non-life charitable deduction carryforward used . . . . . . . . . 4d(1)

(2) Life charitable deduction carryforward used . . . . . . . . . . 4d(2)

5 Add lines 4a(1) through 4d(2) . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Subtract line 5 from line 3 . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Other adjustments to reconcile to taxable income on tax return (attach schedule) . . . . . . . 7

8 Total. Combine lines 6 and 7. This amount must equal the amount reported on the “Taxable income”

line of the consolidated Form 1120, Form 1120-L, or Form 1120-PC. See instructions 8

For Paperwork Reduction Act Notice, see instructions. Cat. No. 37727E Form 8916 (Rev. 10-2020)