Enlarge image

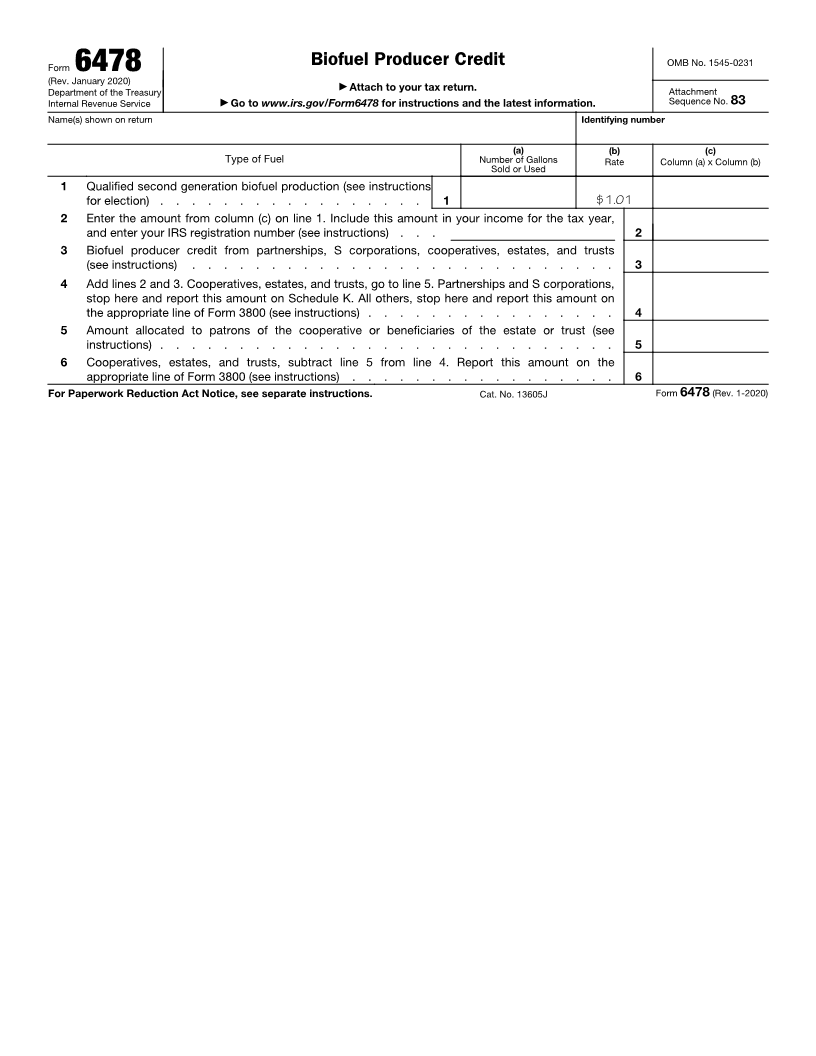

Biofuel Producer Credit OMB No. 1545-0231

Form 6478

(Rev. January 2020) ▶ Attach to your tax return. Attachment

Department of the Treasury

Internal Revenue Service ▶ Go to www.irs.gov/Form6478 for instructions and the latest information. Sequence No. 83

Name(s) shown on return Identifying number

(a) (b) (c)

Type of Fuel Number of Gallons Rate Column (a) x Column (b)

Sold or Used

1 Qualified second generation biofuel production (see instructions

for election) . . . . . . . . . . . . . . . . . 1 $1.01

2 Enter the amount from column (c) on line 1. Include this amount in your income for the tax year,

and enter your IRS registration number (see instructions) . . . 2

3 Biofuel producer credit from partnerships, S corporations, cooperatives, estates, and trusts

(see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Add lines 2 and 3. Cooperatives, estates, and trusts, go to line 5. Partnerships and S corporations,

stop here and report this amount on Schedule K. All others, stop here and report this amount on

the appropriate line of Form 3800 (see instructions) . . . . . . . . . . . . . . . . 4

5 Amount allocated to patrons of the cooperative or beneficiaries of the estate or trust (see

instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Cooperatives, estates, and trusts, subtract line 5 from line 4. Report this amount on the

appropriate line of Form 3800 (see instructions) . . . . . . . . . . . . . . . . . 6

For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 13605J Form 6478 (Rev. 1-2020)