Enlarge image

Form 990-BL Information and Initial Excise Tax Return for Black

(Rev. December 2013) Lung Benefit Trusts and Certain Related Persons OMB No. 1545-0049

Department of the Treasury Under section 501(c)(21) of the Internal Revenue Code.

Internal Revenue Service ▶ Information about Form 990-BL and its instructions is available at www.irs.gov/form990bl.

For calendar year , or fiscal year beginning , , and ending ,

Name of trust Employer identification number (EIN) of trust

Name of other person filing return Social security number (SSN) or EIN of other filer

Number, street, and room or suite no. (If a P.O. box, see instructions.) If application pending, check here . . ▶

If address changed, check here . . . ▶

City or town, state or province, country, ZIP or foreign postal code FMV of assets at beginning

of operator’s tax year . ▶

Return filed by (check box that applies): Trust (Open for public inspection—other than Part IV) Trustee (Not open for public inspection)

Disqualified person (Not open for public inspection)

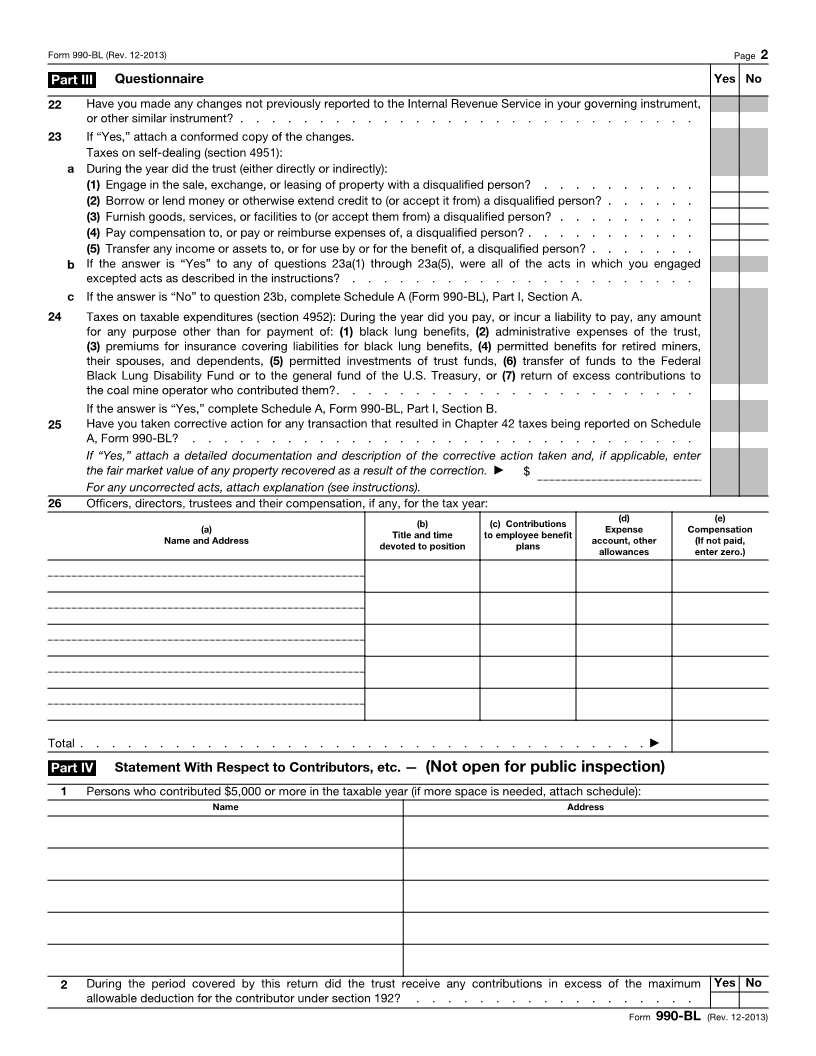

Part I Analysis of Revenue and Expenses

1 Contributions received . . . . . . . . . . . . . . . . . . . . . . . 1

2 Investment income:

a Interest on certain securities of the U.S., state, and local governments . . . . . . . 2a

b Interest on time or demand deposits in a bank or insured credit union (described in

section 501(c)(21)(D)(ii)(III)) . . . . . . . . . . . . . . . . . . . . . . 2b

c Gross amount received from sale of assets . . . . . . . .

Revenue Less cost or other basis and sales expenses . . . . . . . .

Net gain or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . 2c

d Other income (attach schedule) . . . . . . . . . . . . . . . . . . . . 2d

3 Total revenue (add lines 1 through 2d) . . . . . . . . . . . . . . . . ▶ 3

4 Contributions to the Federal Black Lung Disability Trust Fund . . . . . . . . . . 4

5 Premiums for insurance to cover liabilities described in section 501(c)(21)(A)(i)(I) and

501(c)(21)(A)(i)(IV) . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Other payments to or for benefit of eligible coal miners, retired miners, or beneficiaries . . 6

7 Compensation of trustees . . . . . . . . . . . . . . . . . . . . . . 7

8 Other salaries and wages . . . . . . . . . . . . . . . . . . . . . . 8

Expenses

9 Administrative expenses not included on lines 7 and 8 (attach schedule) . . . . . . . 9

10 Other expenses (attach schedule) . . . . . . . . . . . . . . . . . . . 10

11 Total expenses (add lines 4 through 10) . . . . . . . . . . . . . . . . . 11

12 Excess of revenue over expenses (subtract line 11 from line 3) . . . . . . . . ▶ 12

Part II Balance Sheets Beginning of year End of year

13 Cash . . . . . . . . . . . . . . . . . . . . . 13

14 Savings and interest-bearing accounts . . . . . . . . . . 14

15 Investments in approved securities . . . . . . . . . . . 15

Assets 16 Office supplies and equipment . . . . . . . . . . . . 16

17 Other assets (attach schedule) . . . . . . . . . . . . 17

18 Total assets (add lines 13 through 17) . . . . . . . . . . ▶ 18

19 Liabilities (see instructions) . . . . . . . . . . . . . . 19

20 Net assets . . . . . . . . . . . . . . . . . . . 20

and

Liabilities Net Assets 21 Total liabilities and net assets (add lines 19 and 20) . . . . . . ▶ 21

The books are in care of ▶ Telephone number ▶

Located at ▶

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct,

and complete. Declaration of preparer (other than officer or trustee) is based on all information of which preparer has any knowledge.

▲▲

Sign Signature of officer or trustee Date

Here

Type or print name and title

Print/Type preparer’s name Preparer's signature Date PTIN

Paid Check if

self-employed

Preparer

Use Only Firm’s name ▶ Firm's EIN ▶

Firm's address ▶ Phone no.

May the IRS discuss this return with the preparer shown above? (see instructions) . . . . . . . . . . . Yes No

For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 10315Y Form 990-BL (Rev. 12-2013)