Enlarge image

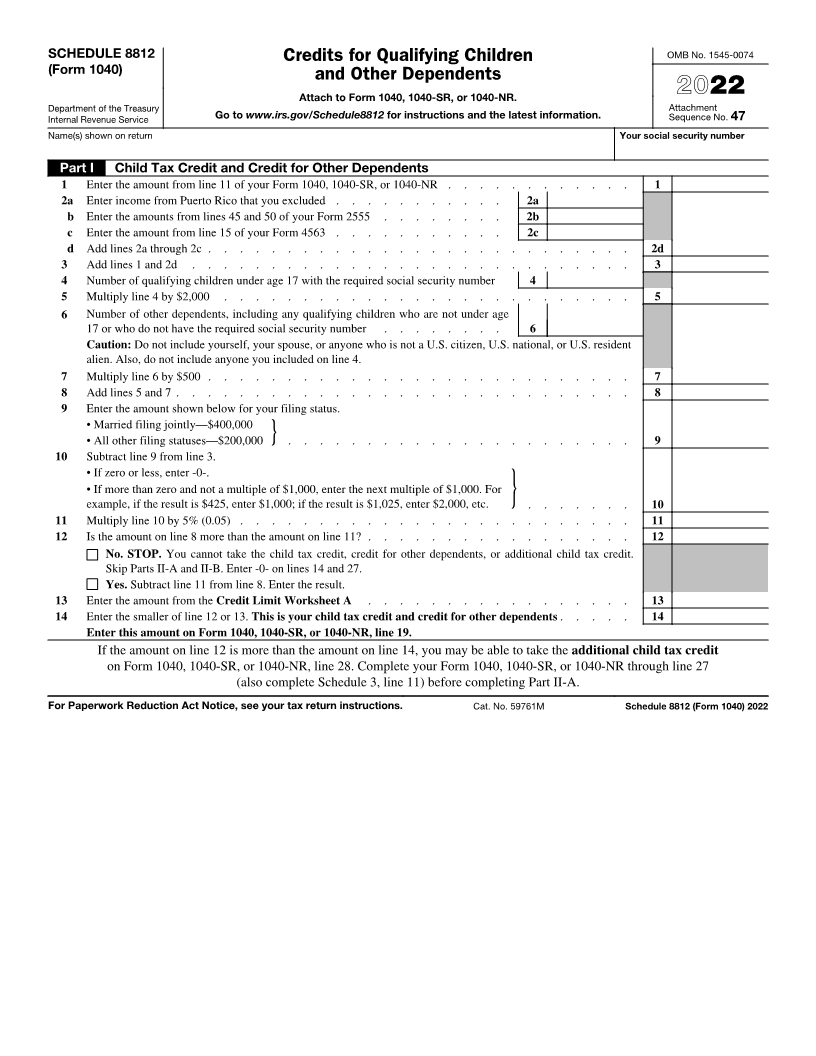

SCHEDULE 8812 Credits for Qualifying Children OMB No. 1545-0074

(Form 1040)

and Other Dependents

Attach to Form 1040, 1040-SR, or 1040-NR. 2022

Department of the Treasury Attachment

Internal Revenue Service Go to www.irs.gov/Schedule8812 for instructions and the latest information. Sequence No. 47

Name(s) shown on return Your social security number

Part I Child Tax Credit and Credit for Other Dependents

1 Enter the amount from line 11 of your Form 1040, 1040-SR, or 1040-NR . . . . . . . . . . . . 1

2a Enter income from Puerto Rico that you excluded . . . . . . . . . . . 2a

b Enter the amounts from lines 45 and 50 of your Form 2555 . . . . . . . . 2b

c Enter the amount from line 15 of your Form 4563 . . . . . . . . . . . 2c

d Add lines 2a through 2c . . . . . . . . . . . . . . . . . . . . . . . . . . . 2d

3 Add lines 1 and 2d . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Number of qualifying children under age 17 with the required social security number 4

5 Multiply line 4 by $2,000 . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Number of other dependents, including any qualifying children who are not under age

17 or who do not have the required social security number . . . . . . . . 6

Caution: Do not include yourself, your spouse, or anyone who is not a U.S. citizen, U.S. national, or U.S. resident

alien. Also, do not include anyone you included on line 4.

7 Multiply line 6 by $500 . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Add lines 5 and 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Enter the amount shown below for your filing status.

• Married filing jointly—$400,000

• All other filing statuses—$200,000 } . . . . . . . . . . . . . . . . . . . . . . 9

10 Subtract line 9 from line 3.

• If zero or less, enter -0-.

• If more than zero and not a multiple of $1,000, enter the next multiple of $1,000. For

example, if the result is $425, enter $1,000; if the result is $1,025, enter $2,000, etc. } . . . . . . . 10

11 Multiply line 10 by 5% (0.05) . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Is the amount on line 8 more than the amount on line 11? . . . . . . . . . . . . . . . . . 12

No. STOP. You cannot take the child tax credit, credit for other dependents, or additional child tax credit.

Skip Parts II-A and II-B. Enter -0- on lines 14 and 27.

Yes. Subtract line 11 from line 8. Enter the result.

13 Enter the amount from the Credit Limit Worksheet A . . . . . . . . . . . . . . . . . 13

14 Enter the smaller of line 12 or 13. This is your child tax credit and credit for other dependents . . . . . 14

Enter this amount on Form 1040, 1040-SR, or 1040-NR, line 19.

If the amount on line 12 is more than the amount on line 14, you may be able to take the additional child tax credit

on Form 1040, 1040-SR, or 1040-NR, line 28. Complete your Form 1040, 1040-SR, or 1040-NR through line 27

(also complete Schedule 3, line 11) before completing Part II-A.

For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 59761M Schedule 8812 (Form 1040) 2022