Enlarge image

661117

Final K-1 Amended K-1 OMB No. 1545-0092

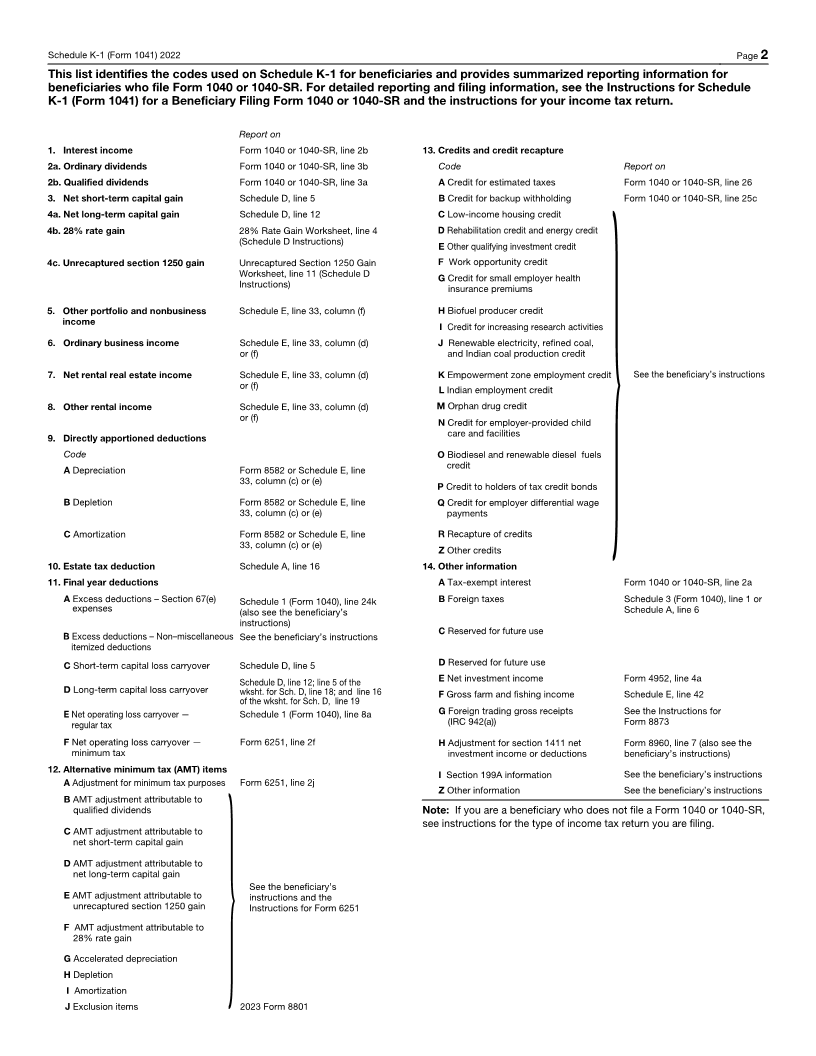

Schedule K-1 Part III Beneficiary’s Share of Current Year Income,

(Form 1041) 2022 Deductions, Credits, and Other Items

Department of the Treasury For calendar year 2022, or tax year 1 Interest income 11 Final year deductions

Internal Revenue Service

beginning / / ending / / 2a Ordinary dividends

Beneficiary’s Share of Income, Deductions, 2b Qualified dividends

Credits, etc. See back of form and instructions.

Part I Information About the Estate or Trust 3 Net short-term capital gain

A Estate’s or trust’s employer identification number

4a Net long-term capital gain

B Estate’s or trust’s name 4b 28% rate gain 12 Alternative minimum tax adjustment

4c Unrecaptured section 1250 gain

5 Other portfolio and

C Fiduciary’s name, address, city, state, and ZIP code nonbusiness income

6 Ordinary business income

7 Net rental real estate income

13 Credits and credit recapture

8 Other rental income

9 Directly apportioned deductions

D Check if Form 1041-T was filed and enter the date it was filed

14 Other information

E Check if this is the final Form 1041 for the estate or trust

Part II Information About the Beneficiary 10 Estate tax deduction

F Beneficiary’s identifying number

G Beneficiary’s name, address, city, state, and ZIP code

*See attached statement for additional information.

Note: A statement must be attached showing the

beneficiary’s share of income and directly apportioned

deductions from each business, rental real estate, and

other rental activity.

H Domestic beneficiary Foreign beneficiary For IRS Use Only

For Paperwork Reduction Act Notice, see the Instructions for Form 1041. www.irs.gov/Form1041 Cat. No. 11380D Schedule K-1 (Form 1041) 2022