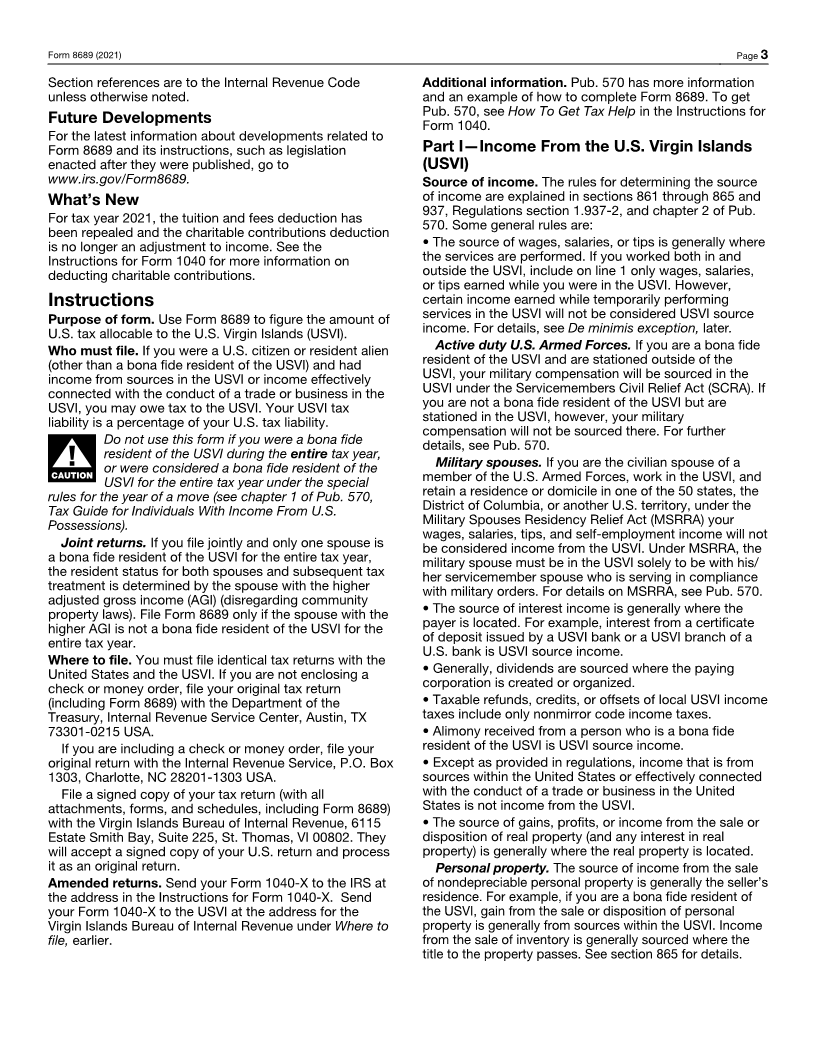

Enlarge image

OMB No. 1545-0074

Allocation of Individual Income Tax

Form 8689 to the U.S. Virgin Islands

Department of the Treasury ▶ Attach to Form 1040 or 1040-SR. 2021

Attachment

Internal Revenue Service ▶ Go to www.irs.gov/Form8689 for the latest information. Sequence No. 869

Name(s) shown on Form 1040 or 1040-SR (your tax return) Your social security number

Part I Income From the U.S. Virgin Islands (USVI)

1 Wages, salaries, tips, etc. . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Taxable interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Ordinary dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Taxable refunds, credits, or offsets of local USVI income taxes . . . . . . . . . . . . . 4

5 Alimony received . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Business income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Capital gain or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Other gains or (losses) . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 IRA distributions (taxable amount) . . . . . . . . . . . . . . . . . . . . . . . 9

10 Pensions and annuities (taxable amount) . . . . . . . . . . . . . . . . . . . . 10

11 Rental real estate, royalties, partnerships, S corporations, trusts, etc. . . . . . . . . . . . 11

12 Farm income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Unemployment compensation . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Social security benefits (taxable amount) . . . . . . . . . . . . . . . . . . . . 14

15 Other income. List type and amount ▶ 15

16 Add lines 1 through 15. This is your total USVI income . . . . . . . . . . . . . . ▶ 16

Part II Adjusted Gross Income From the USVI

17 Educator expenses . . . . . . . . . . . . . . . . . . . 17

18 Certain business expenses of reservists, performing artists, and fee-basis government officials 18

19 Health savings account deduction . . . . . . . . . . . . . . 19

20 Moving expenses for members of the armed forces . . . . . . . . . 20

21 Deductible part of self-employment tax . . . . . . . . . . . . . 21

22 Self-employed SEP, SIMPLE, and qualified plans . . . . . . . . . . 22

23 Self-employed health insurance deduction . . . . . . . . . . . . 23

24 Penalty on early withdrawal of savings . . . . . . . . . . . . . 24

25 IRA deduction . . . . . . . . . . . . . . . . . . . . . 25

26 Student loan interest deduction . . . . . . . . . . . . . . . 26

27 Reserved for future use . . . . . . . . . . . . . . . . . . 27

28 Reserved for future use . . . . . . . . . . . . . . . . . . 28

29 Add lines 17 through 28 . . . . . . . . . . . . . . . . . . . . . . . . . . 29

30 Subtract line 29 from line 16. This is your USVI adjusted gross income . . . . . . . . . ▶ 30

Part III Allocation of Tax to the USVI

31 Enter the amount from the total tax line on your tax return . . . . . . . . . . . . . . 31

32 Enter total of certain amounts from your tax return. See instructions on page 4 for amount to enter . . . 32

33 Subtract line 32 from line 31 . . . . . . . . . . . . . . . . . . . . . . . . 33

34 Enter the amount from the adjusted gross income line on your tax return . 34

35 Divide line 30 above by line 34. Enter the result as a decimal (rounded to at least 3 places). Do not

enter more than 1.000 . . . . . . . . . . . . . . . . . . . . . . . . . . 35 .

36 Multiply line 33 by line 35. This is your tax allocated to the USVI . . . . . . . . . . . . 36

Part IV Payments of Income Tax to the USVI

37 Income tax withheld by the USVI . . . . . . . . . . . . . . . 37

38 2021 estimated tax payments and amount applied from 2020 return . . . 38

39 Amount paid with Form 4868 (extension request) . . . . . . . . . . 39

40 Add lines 37 through 39. These are your total payments to the USVI . . . . . . . . . . ▶ 40

41 Enter the smaller of line 36 or line 40. Add this amount to the total payments line of your tax return.

On the dotted line next to it, enter “Form 8689” and show this amount . . . . . . . . . . . 41

42 Overpayment to the USVI. If line 40 is more than line 36, subtract line 36 from line 40 . . . . . 42

43 Amount of line 42 you want refunded to you . . . . . . . . . . . . . . . . . . ▶ 43

44 Amount of line 42 you want applied to your 2022 estimated tax . . . . 44

45 Amount you owe to the USVI. If line 40 is less than line 36, subtract line 40 from line 36 . . . . . 45

46 Enter the amount from line 45 that you will pay when you file your income tax return. Add this amount

to the total payments line of your tax return. On the dotted line next to it, enter “Form 8689” and

show this amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46

For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 64603D Form 8689 (2021)