Enlarge image

OMB No. 1545-0123

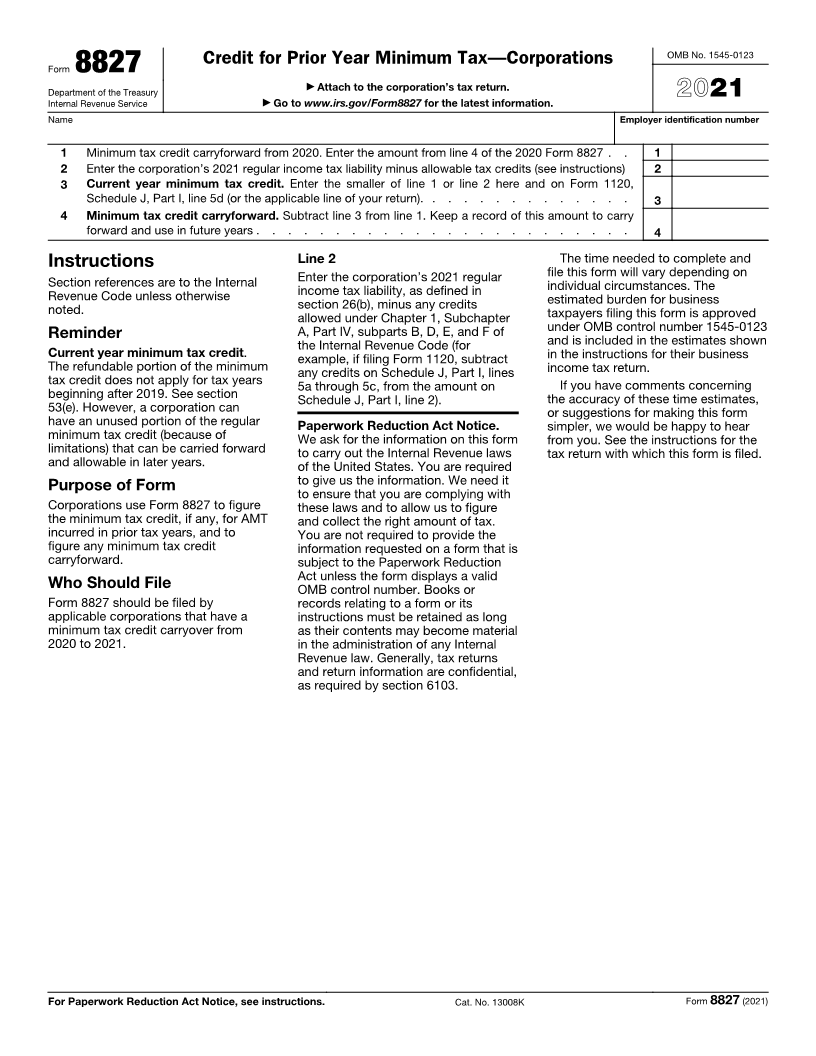

Credit for Prior Year Minimum Tax—Corporations

Form 8827

▶

Department of the Treasury Attach to the corporation’s tax return.

Internal Revenue Service ▶ Go to www.irs.gov/Form8827 for the latest information. 2021

Name Employer identification number

1 Minimum tax credit carryforward from 2020. Enter the amount from line 4 of the 2020 Form 8827 . . 1

2 Enter the corporation’s 2021 regular income tax liability minus allowable tax credits (see instructions) 2

3 Current year minimum tax credit. Enter the smaller of line 1 or line 2 here and on Form 1120,

Schedule J, Part I, line 5d (or the applicable line of your return). . . . . . . . . . . . . . 3

4 Minimum tax credit carryforward. Subtract line 3 from line 1. Keep a record of this amount to carry

forward and use in future years . . . . . . . . . . . . . . . . . . . . . . . . 4

Instructions Line 2 The time needed to complete and

Section references are to the Internal Enter the corporation’s 2021 regular file this form will vary depending on

Revenue Code unless otherwise income tax liability, as defined in individual circumstances. The

noted. section 26(b), minus any credits estimated burden for business

allowed under Chapter 1, Subchapter taxpayers filing this form is approved

Reminder A, Part IV, subparts B, D, E, and F of under OMB control number 1545-0123

the Internal Revenue Code (for and is included in the estimates shown

Current year minimum tax credit. example, if filing Form 1120, subtract in the instructions for their business

The refundable portion of the minimum any credits on Schedule J, Part I, lines income tax return.

tax credit does not apply for tax years 5a through 5c, from the amount on If you have comments concerning

beginning after 2019. See section Schedule J, Part I, line 2). the accuracy of these time estimates,

53(e). However, a corporation can or suggestions for making this form

have an unused portion of the regular Paperwork Reduction Act Notice. simpler, we would be happy to hear

minimum tax credit (because of We ask for the information on this form from you. See the instructions for the

limitations) that can be carried forward to carry out the Internal Revenue laws tax return with which this form is filed.

and allowable in later years. of the United States. You are required

Purpose of Form to give us the information. We need it

to ensure that you are complying with

Corporations use Form 8827 to figure these laws and to allow us to figure

the minimum tax credit, if any, for AMT and collect the right amount of tax.

incurred in prior tax years, and to You are not required to provide the

figure any minimum tax credit information requested on a form that is

carryforward. subject to the Paperwork Reduction

Act unless the form displays a valid

Who Should File OMB control number. Books or

Form 8827 should be filed by records relating to a form or its

applicable corporations that have a instructions must be retained as long

minimum tax credit carryover from as their contents may become material

2020 to 2021. in the administration of any Internal

Revenue law. Generally, tax returns

and return information are confidential,

as required by section 6103.

For Paperwork Reduction Act Notice, see instructions. Cat. No. 13008K Form 8827 (2021)