Enlarge image

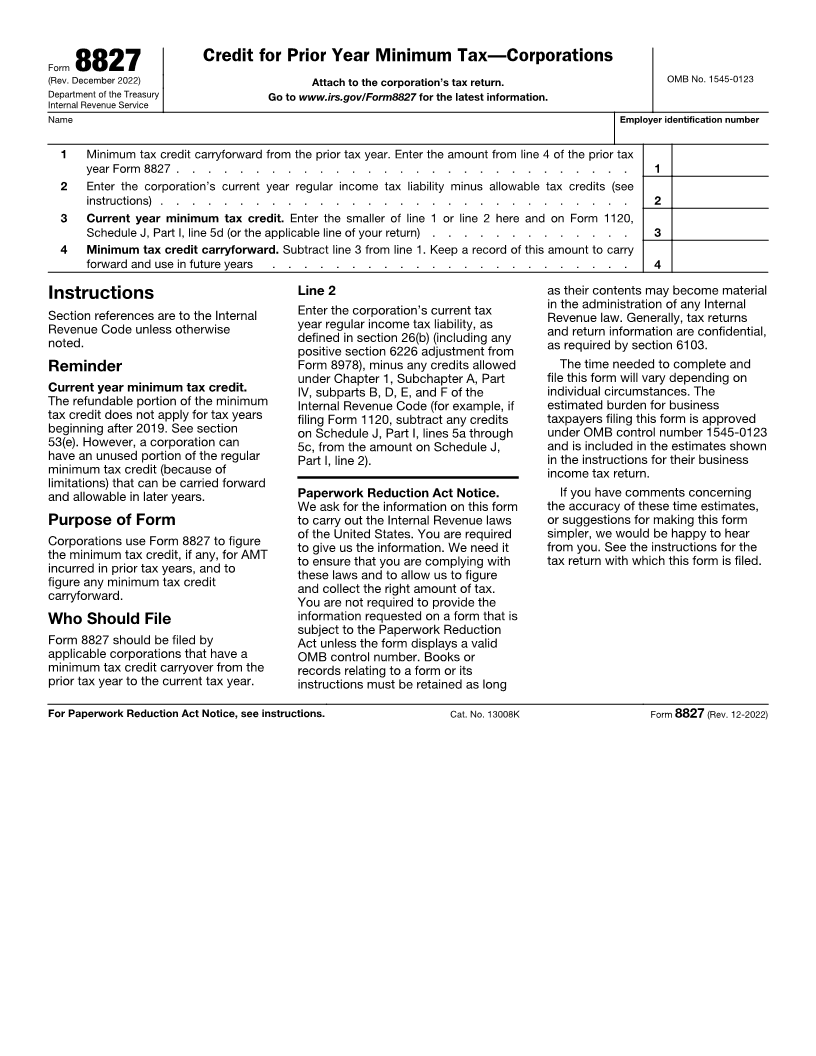

Credit for Prior Year Minimum Tax—Corporations

Form 8827 OMB No. 1545-0123

(Rev. December 2022) Attach to the corporation’s tax return.

Department of the Treasury Go to www.irs.gov/Form8827 for the latest information.

Internal Revenue Service

Name Employer identification number

1 Minimum tax credit carryforward from the prior tax year. Enter the amount from line 4 of the prior tax

year Form 8827 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Enter the corporation’s current year regular income tax liability minus allowable tax credits (see

instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Current year minimum tax credit. Enter the smaller of line 1 or line 2 here and on Form 1120,

Schedule J, Part I, line 5d (or the applicable line of your return) . . . . . . . . . . . . . 3

4 Minimum tax credit carryforward. Subtract line 3 from line 1. Keep a record of this amount to carry

forward and use in future years . . . . . . . . . . . . . . . . . . . . . . . 4

Instructions Line 2 as their contents may become material

Section references are to the Internal Enter the corporation’s current tax in the administration of any Internal

Revenue Code unless otherwise year regular income tax liability, as Revenue law. Generally, tax returns

noted. defined in section 26(b) (including any and return information are confidential,

positive section 6226 adjustment from as required by section 6103.

Reminder Form 8978), minus any credits allowed The time needed to complete and

under Chapter 1, Subchapter A, Part file this form will vary depending on

Current year minimum tax credit. IV, subparts B, D, E, and F of the individual circumstances. The

The refundable portion of the minimum Internal Revenue Code (for example, if estimated burden for business

tax credit does not apply for tax years filing Form 1120, subtract any credits taxpayers filing this form is approved

beginning after 2019. See section on Schedule J, Part I, lines 5a through under OMB control number 1545-0123

53(e). However, a corporation can 5c, from the amount on Schedule J, and is included in the estimates shown

have an unused portion of the regular Part I, line 2). in the instructions for their business

minimum tax credit (because of income tax return.

limitations) that can be carried forward

and allowable in later years. Paperwork Reduction Act Notice. If you have comments concerning

We ask for the information on this form the accuracy of these time estimates,

Purpose of Form to carry out the Internal Revenue laws or suggestions for making this form

of the United States. You are required simpler, we would be happy to hear

Corporations use Form 8827 to figure from you. See the instructions for the

to give us the information. We need it

the minimum tax credit, if any, for AMT tax return with which this form is filed.

to ensure that you are complying with

incurred in prior tax years, and to

these laws and to allow us to figure

figure any minimum tax credit

and collect the right amount of tax.

carryforward.

You are not required to provide the

Who Should File information requested on a form that is

subject to the Paperwork Reduction

Form 8827 should be filed by Act unless the form displays a valid

applicable corporations that have a OMB control number. Books or

minimum tax credit carryover from the records relating to a form or its

prior tax year to the current tax year. instructions must be retained as long

For Paperwork Reduction Act Notice, see instructions. Cat. No. 13008K Form 8827 (Rev. 12-2022)