Enlarge image

Schedule A Penalty for Underpayment of Estimated OMB No. 1545-0123

(Form 8804) Section 1446 Tax by Partnerships

Department of the Treasury ▶ Attach to Form 8804.

2021

Internal Revenue Service ▶ Go to www.irs.gov/Form8804 for instructions and the latest information.

Name Employer identification number

Note: Generally, the partnership isn’t required to file this Schedule A (see Part I below for exceptions) because the IRS will figure any penalty

owed and bill the partnership. However, the partnership may still use this Schedule A to figure the penalty. If so, enter the amount from line 65

of this Schedule A on line 8 of Form 8804, but don’t attach this Schedule A.

Part I Reasons for Filing—Check the boxes below that apply. If any boxes are checked, the partnership must file

Schedule A (Form 8804) even if it doesn’t owe a penalty. See instructions.

The partnership is using the adjusted seasonal installment method.

The partnership is using the annualized income installment method.

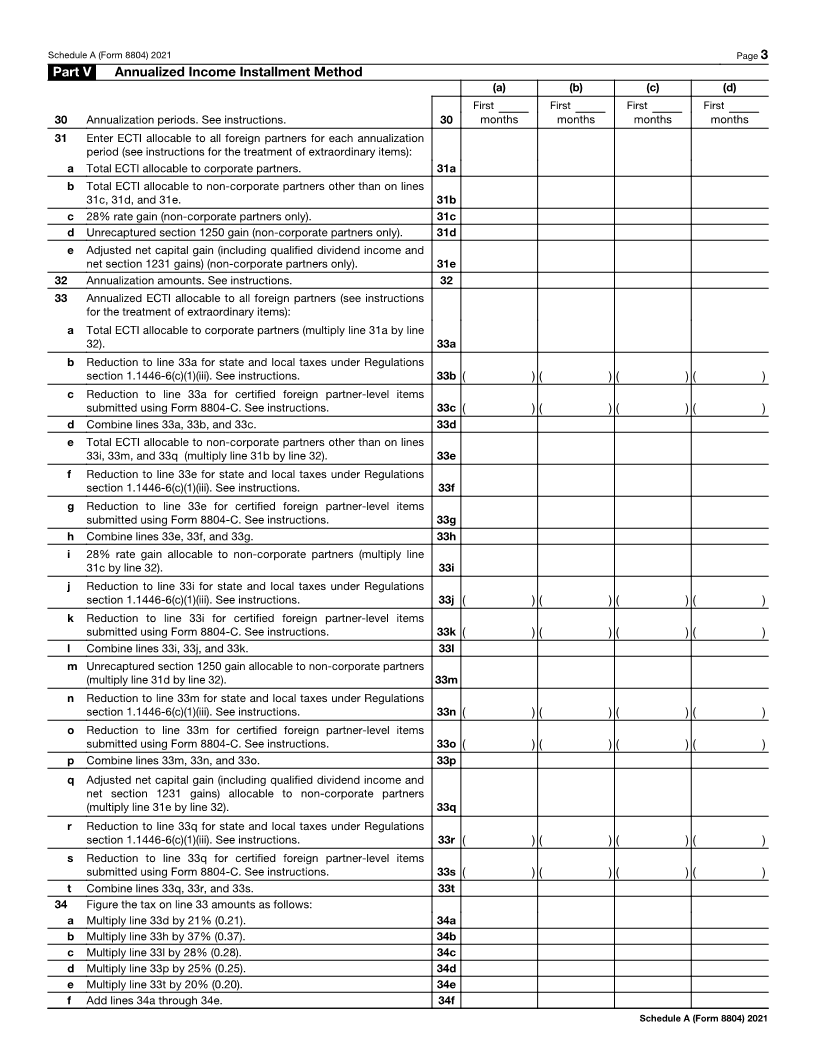

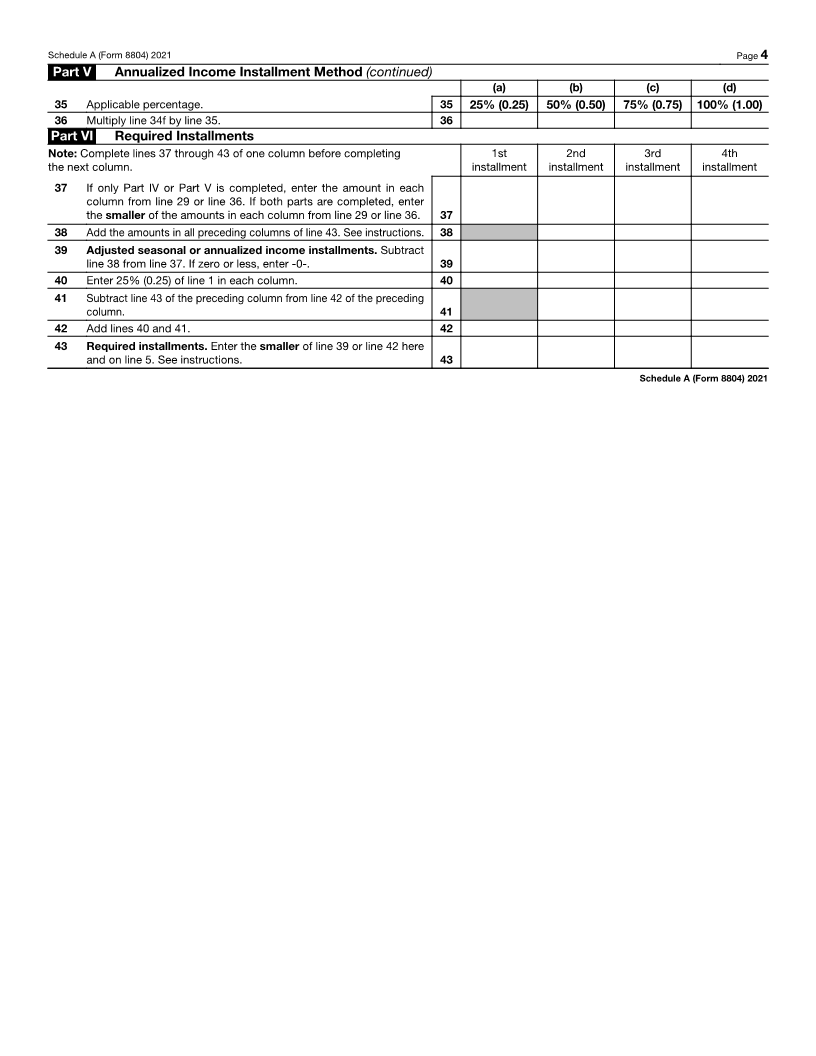

Part II Current Year and Prior Year Safe Harbors

1 Enter the total section 1446 tax shown on the partnership’s 2021 Form 8804, line 5f. If less than $500,

don’t complete or file this form. The partnership doesn’t owe the penalty . . . . . . . . . . 1

2 Enter the total section 1446 tax that would have been due for 2020, without regard to reductions for

certified foreign partner-level items, on the effectively connected taxable income (ECTI) allocable to

foreign partners for 2020.

Caution: This line 2 amount only applies if certain conditions are met. See instructions . . . . . . 2

3 Enter the smaller of line 1 or line 2. If the partnership is required to skip line 2, enter the amount from

line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

Part III Figuring the Underpayment

(a) (b) (c) (d)

4 Installment due dates. Enter in columns (a) through (d)

the 15th day of the 4th, 6th, 9th, and 12th months of the

partnership’s tax year . . . . . . . . . . . 4

5 Required installments. If the partnership uses the

adjusted seasonal installment method and/or the

annualized income installment method, enter the amounts

from line 43. If neither of those methods is used, enter

25% (0.25) of line 3 above in each column . . . . . 5

6 Estimated section 1446 tax paid or credited for each

period. See instructions. For column (a) only, enter the

amount from line 6 on line 10 . . . . . . . . . 6

Complete lines 7 through 13 of one column before

going to the next column.

7 Enter amount, if any, from line 13 of the preceding column 7

8 Add lines 6 and 7 . . . . . . . . . . . . 8

9 Add amounts on lines 11 and 12 of the preceding column 9

10 Subtract line 9 from line 8. If zero or less, enter -0- . . 10

11 If the amount on line 10 is zero, subtract line 8 from line 9.

Otherwise, enter -0- . . . . . . . . . . . . 11

12 Underpayment. If line 10 is less than or equal to line 5,

subtract line 10 from line 5. Then, go to line 7 of the next

column. Otherwise, go to line 13 . . . . . . . . 12

13 Overpayment. If line 5 is less than line 10, subtract line 5

from line 10. Then, go to line 7 of the next column . . 13

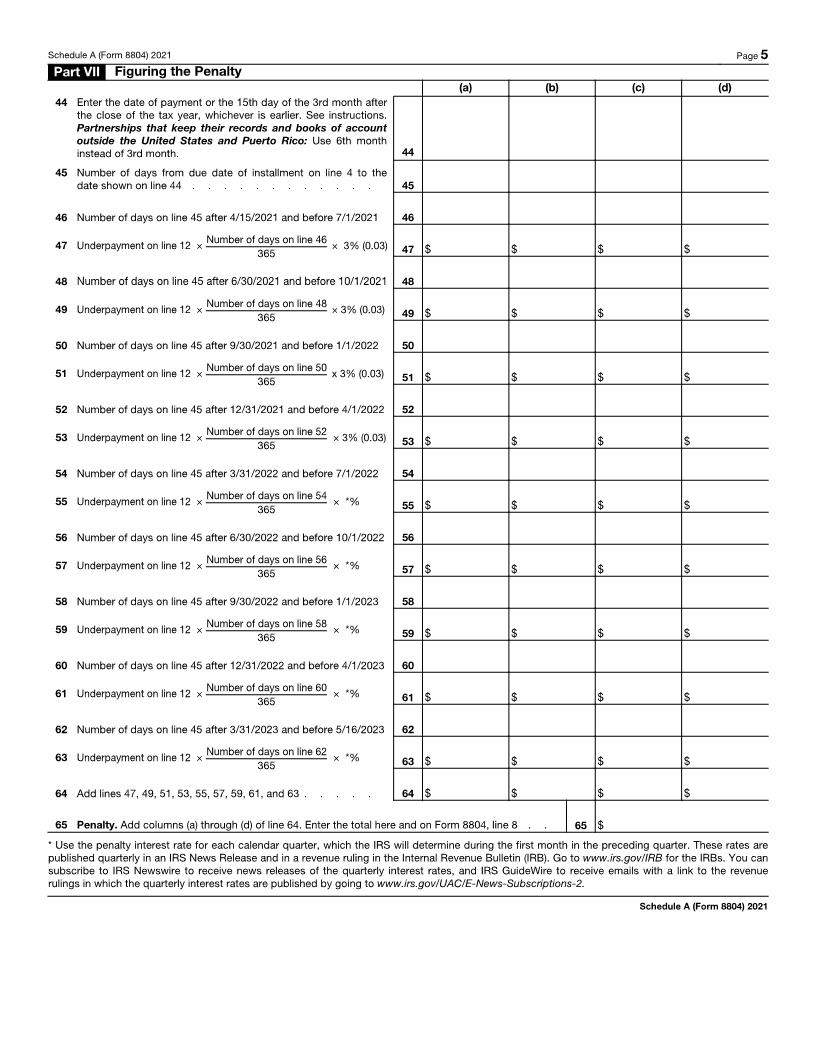

Go to Part VII on page 5 to figure the penalty. Don’t go to Part VII if there are no entries on line 12—no penalty is owed.

For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 40853F Schedule A (Form 8804) 2021