Enlarge image

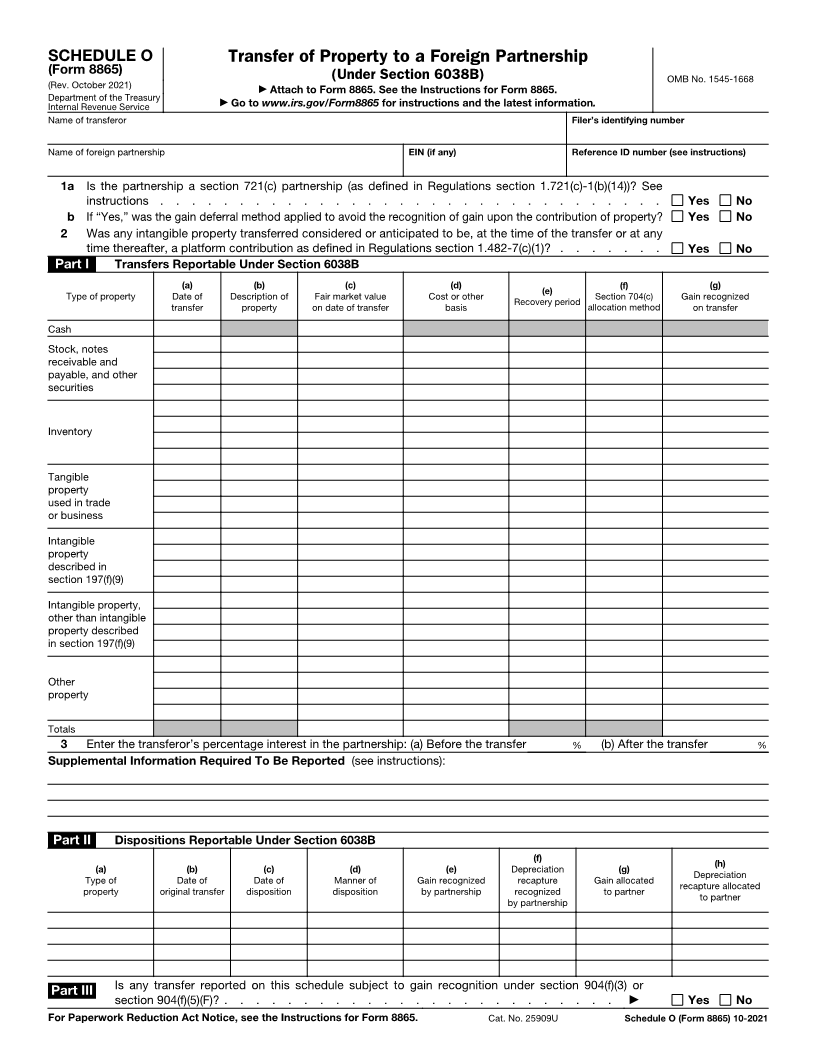

SCHEDULE O Transfer of Property to a Foreign Partnership

(Form 8865) (Under Section 6038B) OMB No. 1545-1668

(Rev. October 2021) ▶ Attach to Form 8865. See the Instructions for Form 8865.

Department of the Treasury ▶ Go to www.irs.gov/Form8865 for instructions and the latest information.

Internal Revenue Service

Name of transferor Filer’s identifying number

Name of foreign partnership EIN (if any) Reference ID number (see instructions)

1 a Is the partnership a section 721(c) partnership (as defined in Regulations section 1.721(c)-1(b)(14))? See

instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes No

b If “Yes,” was the gain deferral method applied to avoid the recognition of gain upon the contribution of property? Yes No

2 Was any intangible property transferred considered or anticipated to be, at the time of the transfer or at any

time thereafter, a platform contribution as defined in Regulations section 1.482-7(c)(1)? . . . . . . . Yes No

Part I Transfers Reportable Under Section 6038B

(a) (b) (c) (d)

Type of property Date of Description of Fair market value Cost or other (e) (f) (g)

transfer property on date of transfer basis Recovery period Section 704(c) Gain recognized

allocation method on transfer

Cash

Stock, notes

receivable and

payable, and other

securities

Inventory

Tangible

property

used in trade

or business

Intangible

property

described in

section 197(f)(9)

Intangible property,

other than intangible

property described

in section 197(f)(9)

Other

property

Totals

3 Enter the transferor’s percentage interest in the partnership: (a) Before the transfer % (b) After the transfer %

Supplemental Information Required To Be Reported (see instructions):

Part II Dispositions Reportable Under Section 6038B

(f)

(a) (b) (c) (d) (e) Depreciation (g) (h)

Type of Date of Date of Manner of Gain recognized recapture Gain allocated Depreciation

property original transfer disposition disposition by partnership recognized to partner recapture allocated

by partnership to partner

Part III Is any transfer reported on this schedule subject to gain recognition under section 904(f)(3) or

section 904(f)(5)(F)? . . . . . . . . . . . . . . . . . . . . . . . . . ▶ Yes No

For Paperwork Reduction Act Notice, see the Instructions for Form 8865. Cat. No. 25909U Schedule O (Form 8865) 10-2021