- 4 -

Enlarge image

|

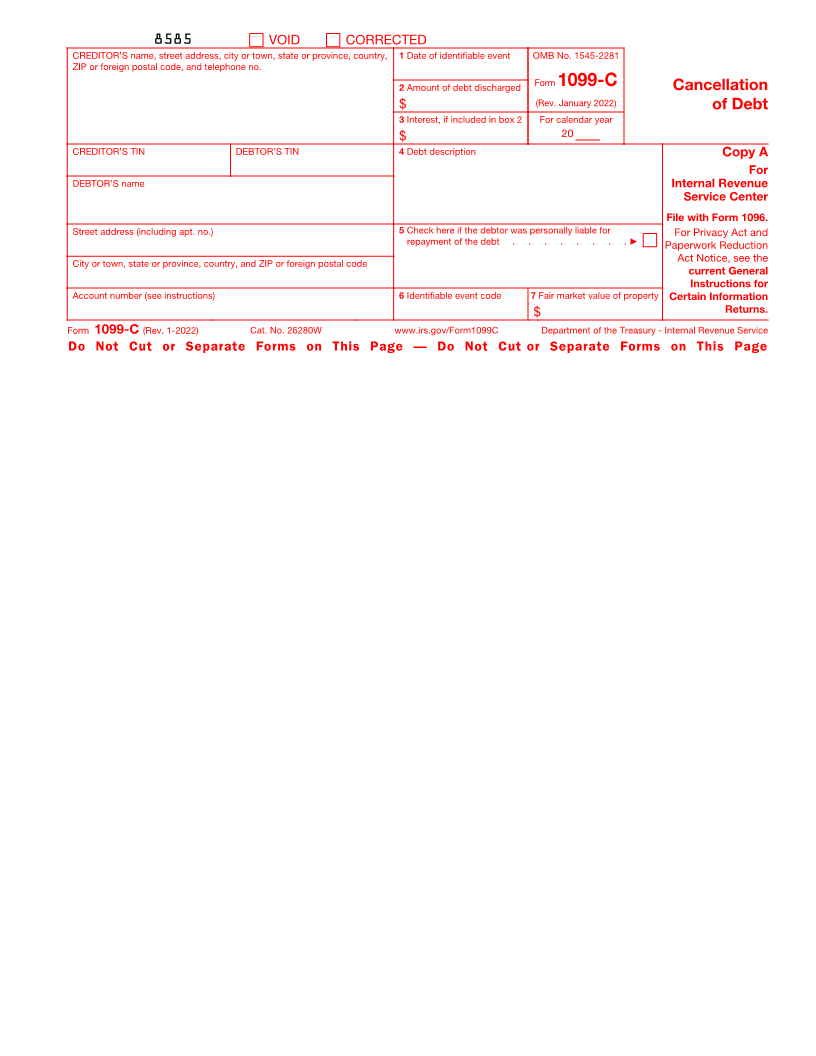

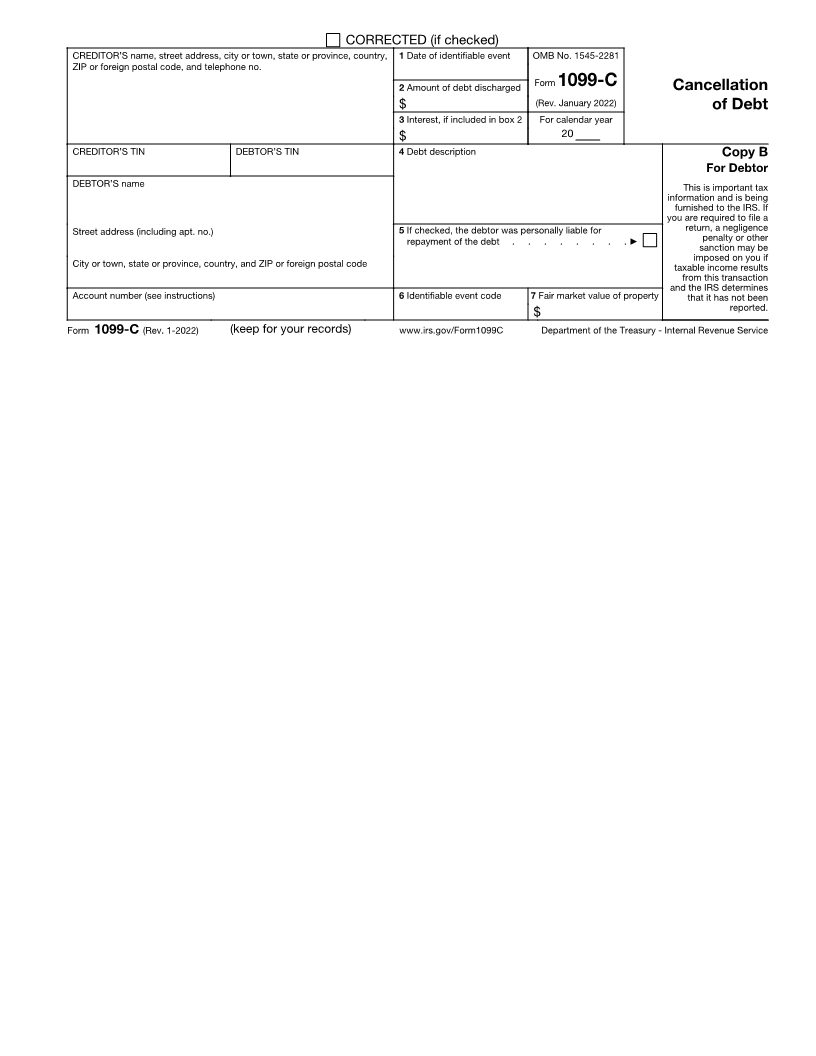

Instructions for Debtor see if you must include the interest in gross income.

You received this form because a federal government agency or an applicable Box 4. Shows a description of the debt. If box 7 is completed, box 4 also shows

financial entity (a creditor) has discharged (canceled or forgiven) a debt you a description of the property.

owed, or because an identifiable event has occurred that either is or is deemed Box 5. Shows whether you were personally liable for repayment of the debt

to be a discharge of a debt of $600 or more. If a creditor has discharged a debt when the debt was created or, if modified, at the time of the last modification.

you owed, you are required to include the discharged amount in your income, See Pub. 4681 for reporting instructions.

even if it is less than $600, on the “Other income” line of your Form 1040 or Box 6. Shows the reason your creditor has filed this form. The codes in this box

1040-SR. However, you may not have to include all of the canceled debt in your are described in more detail in Pub. 4681. A—Bankruptcy; B—Other judicial

income. There are exceptions and exclusions, such as bankruptcy and debt relief; C—Statute of limitations or expiration of deficiency period; D—

insolvency. See Pub. 4681, available at www.irs.gov/Pub4681, for more details. Foreclosure election; E—Debt relief from probate or similar proceeding; F—By

If an identifiable event has occurred but the debt has not actually been agreement; G—Decision or policy to discontinue collection; or H—Other actual

discharged, then include any discharged debt in your income in the year that it discharge before identifiable event.

is actually discharged, unless an exception or exclusion applies to you in that Box 7. If, in the same calendar year, a foreclosure or abandonment of property

year. occurred in connection with the cancellation of the debt, the fair market value

Debtor’s taxpayer identification number (TIN). For your protection, this form (FMV) of the property will be shown, or you will receive a separate Form 1099-A.

may show only the last four digits of your TIN (social security number (SSN), Generally, the gross foreclosure bid price is considered to be the FMV. For an

individual taxpayer identification number (ITIN), adoption taxpayer identification abandonment or voluntary conveyance in lieu of foreclosure, the FMV is

number (ATIN), or employer identification number (EIN)). However, the creditor generally the appraised value of the property. You may have income or loss

has reported your complete TIN to the IRS. because of the acquisition or abandonment. See Pub. 4681 for information

Account number. May show an account or other unique number the creditor about foreclosures and abandonments. If the property was your main home, see

assigned to distinguish your account. Pub. 523 to figure any taxable gain or ordinary income.

Box 1. Shows the date the earliest identifiable event occurred or, at the Future developments. For the latest information about developments related to

creditor’s discretion, the date of an actual discharge that occurred before an Form 1099-C and its instructions, such as legislation enacted after they were

identifiable event. See the code in box 6. published, go to www.irs.gov/Form1099C.

Box 2. Shows the amount of debt either actually or deemed discharged. Note: If Free File Program. Go to www.irs.gov/FreeFile to see if you qualify for no-cost

you don’t agree with the amount, contact your creditor. online federal tax preparation, e-filing, and direct deposit or payment options.

Box 3. Shows interest if included in the debt reported in box 2. See Pub. 4681 to

|