Enlarge image

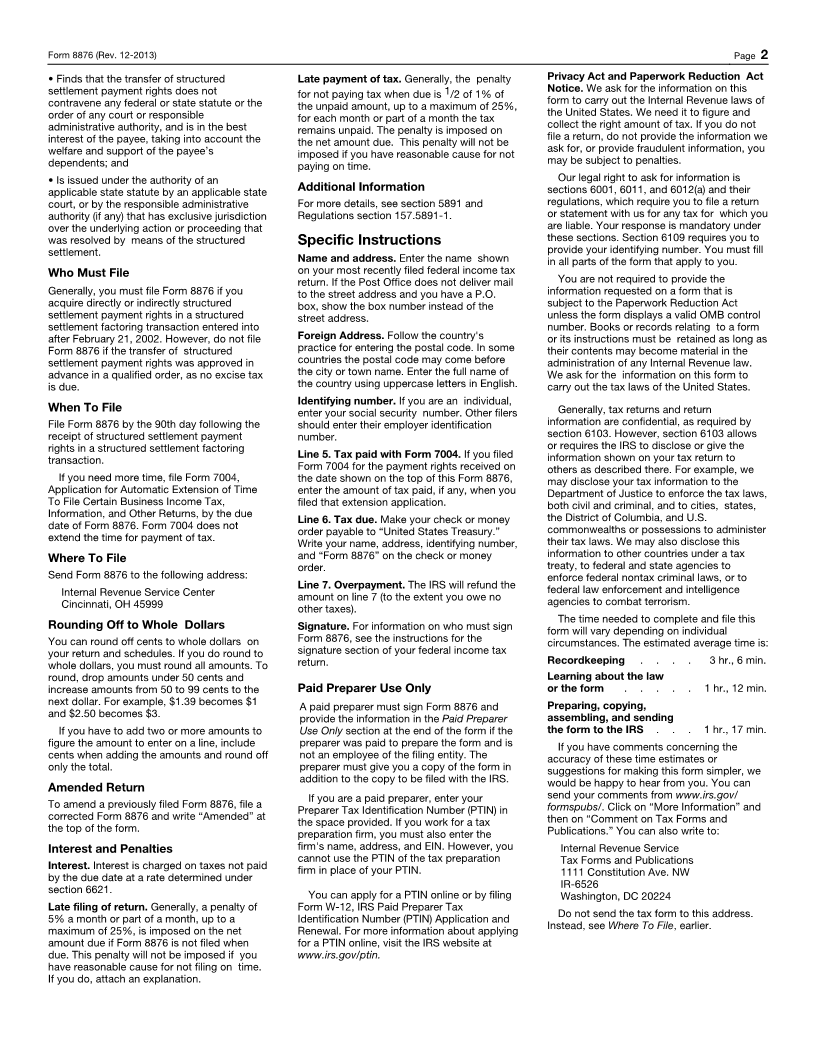

Excise Tax on Structured

Form 8876 Settlement Factoring Transactions OMB No. 1545-1826

(Rev. December 2013)

Department of the Treasury ▶ Information about Form 8876 and its instructions is at www.irs.gov/form8876.

Internal Revenue Service

Date of receipt of structured settlement payment rights . . . . . . . . . . . . . . . . ▶

Name Identifying number

Please

Type Number, street, and room or suite no. (If a P.O. box, see instructions.)

or

Print City or town, state or province, country, and ZIP or foreign postal code

1 Total undiscounted amount of structured settlement payments being acquired . . . . . . 1

2 Total amount paid for the above structured settlement payment rights . . . . . . . . . 2

3 Factoring discount. Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . 3

4 Tax. Multiply line 3 by 40% (.40) . . . . . . . . . . . . . . . . . . . . . 4

5 Less: Tax paid with Form 7004 . . . . . . . . . . . . . . . . . . . . . . 5

6 Tax due. Subtract line 5 from line 4. If zero or less, enter -0- . . . . . . . . . . . . 6

7 Overpayment. If line 5 is greater than line 4, subtract line 4 from line 5 . . . . . . . . 7

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my

knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any

Sign knowledge.

Here ▲ ▲

Signature Date Title (if any)

Print/Type preparer’s name Preparer's signature Date PTIN

Paid Check if

self-employed

Preparer

Use Only Firm’s name ▶ Firm's EIN ▶

Firm's address ▶ Phone no.

Section references are to the Internal • Established (a) by suit or agreement for the • The creation or perfection of a security

Revenue Code unless otherwise noted. periodic payment of damages excludable interest in structured settlement payment

from the gross income of the recipient under rights under a blanket security agreement

Future Developments section 104(a)(2) or (b) by agreement for the entered into with an insured depository

For the latest information about developments periodic payment of compensation under any institution in the absence of any action to

related to Form 8876 and its instructions, workers’ compensation law excludable from redirect the structured settlement payments

such as legislation enacted after they were the gross income of the recipient under to that institution (or agent or successor

published, go to www.irs.gov/form8876. section 104(a)(1); and thereof) or otherwise to enforce such blanket

• Under which the periodic payments are (a) security interest as against the structured

General Instructions of the character described in section 130(c)(2) settlement payment rights.

Purpose of Form (A) and (B) and (b) payable by a person who is • A subsequent transfer of structured

a party to the suit or agreement or to the settlement payment rights acquired in a

Use Form 8876 to report and pay the 40% workers’ compensation claim or by a person structured settlement factoring transaction.

excise tax imposed under section 5891 on the who has assumed the liability for such Structured settlement payment rights.

factoring discount of a structured settlement periodic payments under a qualified Structured settlement payment rights are

factoring transaction. File a separate Form assignment in accordance with section 130. rights to receive payments under a structured

8876 for each date on which you received

structured settlement payment rights in one Structured settlement factoring settlement.

or more structured settlement factoring transaction. A structured settlement Factoring discount. The factoring discount is

transactions. factoring transaction is a transfer of the difference between the total undiscounted

structured settlement payment rights amount of structured settlement payments

Definitions (including portions of structured settlement being acquired (line 1) and the total amount

payments) made for consideration by means paid by the acquirer to the person(s) from

Structured settlement. A structured of sale, assignment, pledge, or other form of whom the structured settlement payment

settlement is an arrangement: encumbrance or alienation for consideration. rights are acquired (line 2).

The following are not structured settlement

factoring transactions. Qualified order. A qualified order is a final

order, judgment, or decree that:

For Privacy Act and Paperwork Reduction Act Notice, see instructions. Cat. No. 33529K Form 8876 (Rev. 12-2013)