Enlarge image

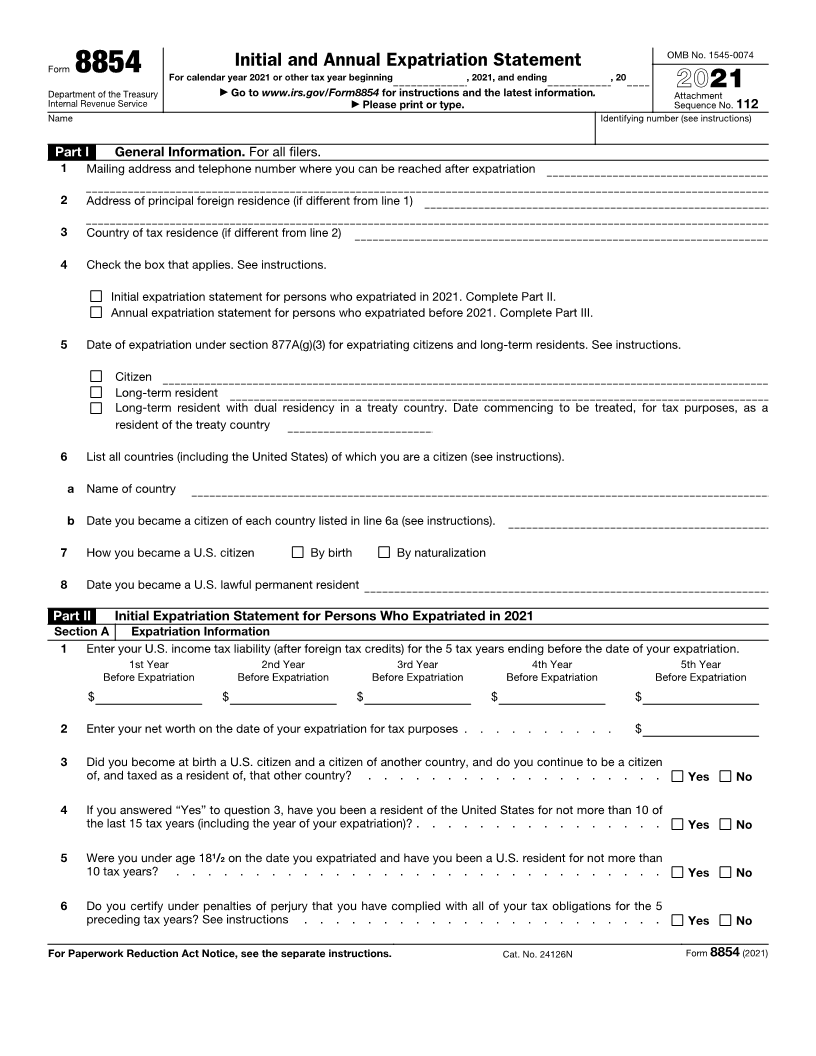

OMB No. 1545-0074

Initial and Annual Expatriation Statement

Form 8854 For calendar year 2021 or other tax year beginning , 2021, and ending , 20

Department of the Treasury ▶ Go to www.irs.gov/Form8854 for instructions and the latest information . Attachment 2021

Internal Revenue Service ▶ Please print or type. Sequence No. 112

Name Identifying number (see instructions)

Part I General Information. For all filers.

1 Mailing address and telephone number where you can be reached after expatriation

2 Address of principal foreign residence (if different from line 1)

3 Country of tax residence (if different from line 2)

4 Check the box that applies. See instructions.

Initial expatriation statement for persons who expatriated in 2021. Complete Part II.

Annual expatriation statement for persons who expatriated before 2021. Complete Part III.

5 Date of expatriation under section 877A(g)(3) for expatriating citizens and long-term residents. See instructions.

Citizen

Long-term resident

Long-term resident with dual residency in a treaty country. Date commencing to be treated, for tax purposes, as a

resident of the treaty country

6 List all countries (including the United States) of which you are a citizen (see instructions).

a Name of country

b Date you became a citizen of each country listed in line 6a (see instructions).

7 How you became a U.S. citizen By birth By naturalization

8 Date you became a U.S. lawful permanent resident

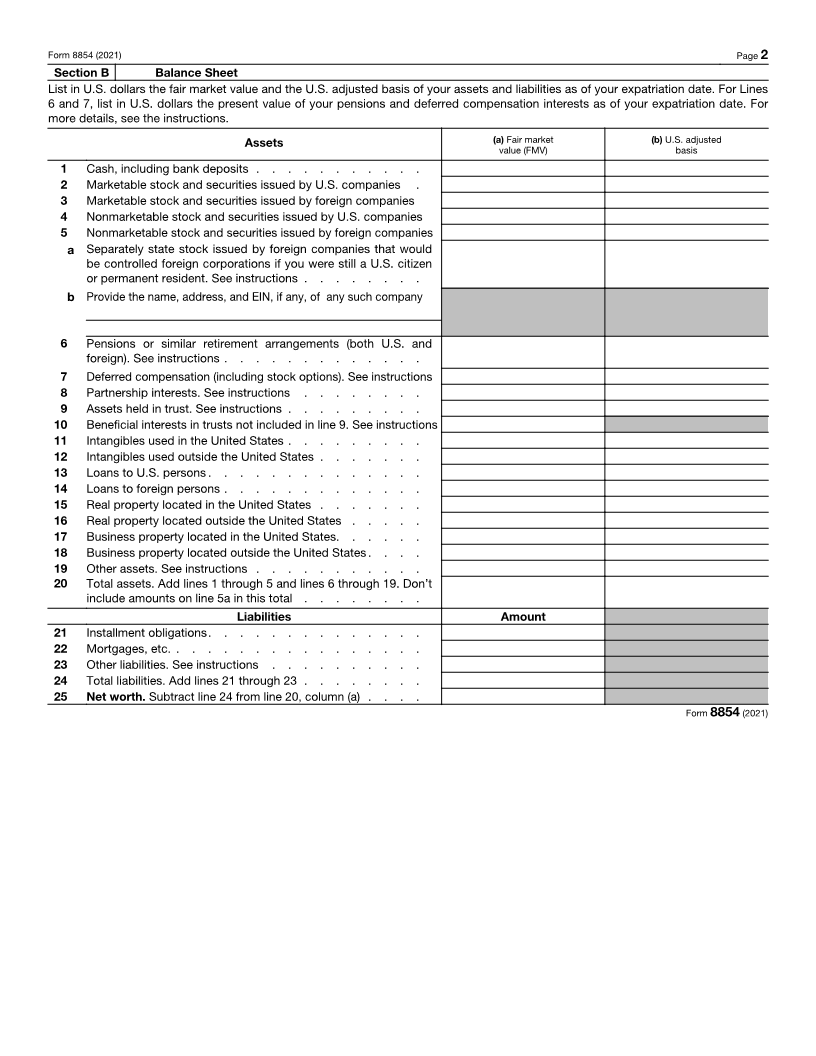

Part II Initial Expatriation Statement for Persons Who Expatriated in 2021

Section A Expatriation Information

1 Enter your U.S. income tax liability (after foreign tax credits) for the 5 tax years ending before the date of your expatriation.

1st Year 2nd Year 3rd Year 4th Year 5th Year

Before Expatriation Before Expatriation Before Expatriation Before Expatriation Before Expatriation

$ $ $ $ $

2 Enter your net worth on the date of your expatriation for tax purposes . . . . . . . . . . $

3 Did you become at birth a U.S. citizen and a citizen of another country, and do you continue to be a citizen

of, and taxed as a resident of, that other country? . . . . . . . . . . . . . . . . . . . Yes No

4 If you answered “Yes” to question 3, have you been a resident of the United States for not more than 10 of

the last 15 tax years (including the year of your expatriation)? . . . . . . . . . . . . . . . . Yes No

5 Were you under age 181/2 on the date you expatriated and have you been a U.S. resident for not more than

10 tax years? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes No

6 Do you certify under penalties of perjury that you have complied with all of your tax obligations for the 5

preceding tax years? See instructions . . . . . . . . . . . . . . . . . . . . . . . Yes No

For Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 24126N Form 8854 (2021)