Enlarge image

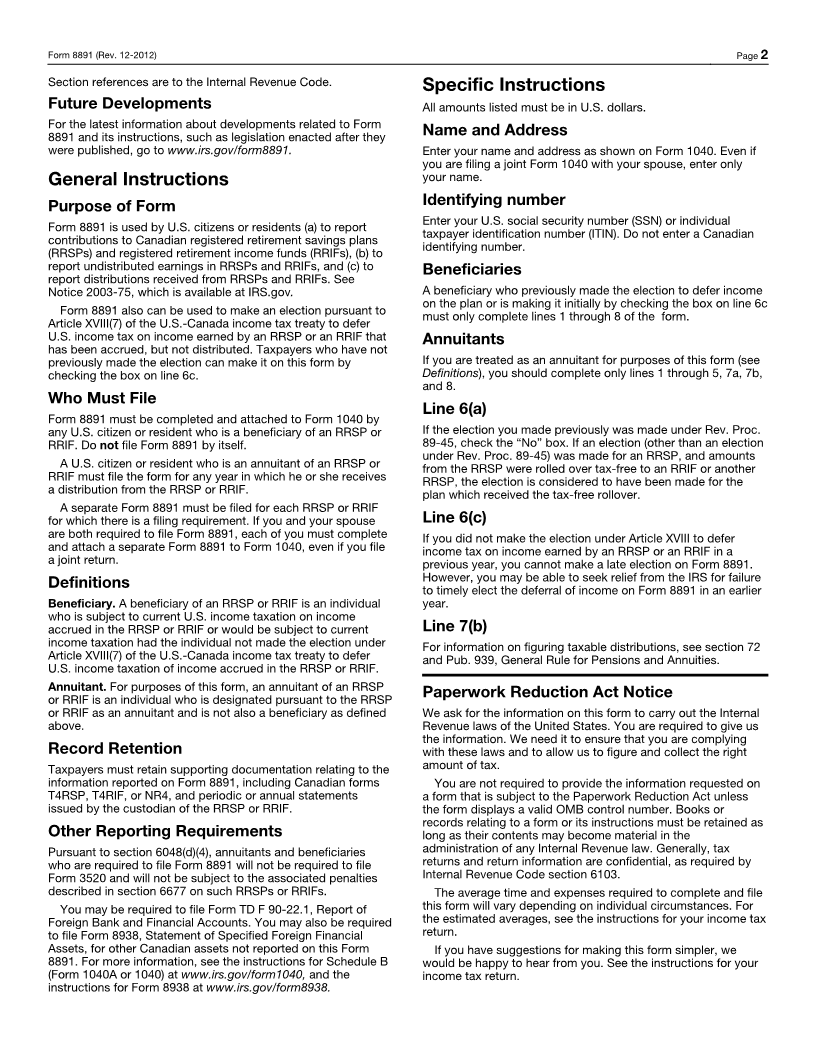

U.S. Information Return for Beneficiaries of OMB No. 1545-0074

Form 8891 Certain Canadian Registered Retirement Plans

(Rev. December 2012) ▶ Attach to Form 1040.

For calendar year 20 , or tax year beginning , 20 , and ending , 20 . Attachment

Department of the Treasury ▶ Information about Form 8891 and its instructions is at www.irs.gov/form8891. Sequence No. 139

Internal Revenue Service

Name as shown on Form 1040 Identifying number (see instructions)

Address

1 Name of plan custodian 2 Account number of plan

3 Address of plan custodian 4 Type of plan (check one box):

Registered Retirement Savings Plan (RRSP)

Registered Retirement Income Fund (RRIF)

5 Check the applicable box for your status in the plan (see Definitions in the instructions):

Beneficiary

Annuitant (Complete only lines 7a, 7b, and 8.)

6 a Have you previously made an election under Article XVIII(7) of the U.S.-Canada income tax treaty to

defer U.S. income tax on the undistributed earnings of the plan? . . . . . . . . . . . ▶ Yes No

b If “Yes,” enter the first year the election came into effect and go to line 7a. If “No,” go to line 6c.

c If you have not previously made the election described on line 6a above, you can make an irrevocable

election for this year and subsequent years by checking this box . . . . . . . . . . . ▶

7 a Distributions received from the plan during the year. Enter here and include on Form 1040, line

16a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7a

b Taxable distributions received from the plan during the year. Enter here and include on Form

1040, line 16b . . . . . . . . . . . . . . . . . . . . . . . . . . . 7b

8 Plan balance at the end of the year. If you checked the “Annuitant” box on line 5, the “Yes” box

on line 6a, or the box on line 6c, stop here. Do not complete the rest of the form . . . . . 8

9 Contributions to the plan during the year . . . . . . . . . . . . . . . . . . 9

10 Undistributed earnings of the plan during the year:

a Interest income. Enter here and include on Form 1040, line 8a . . . . . . . . . . . 10a

b Total ordinary dividends. Enter here and include on Form 1040, line 9a . . . . . . . . 10b

c Qualified dividends. Enter here and include on Form 1040, line 9b . . . . . . . . . . 10c

d Capital gains. Enter here and include on Form 1040, line 13 . . . . . . . . . . . . 10d

e Other income. Enter here and include on Form 1040, line 21. List type and amount ▶

10e

For Paperwork Reduction Act Notice, see instructions. Cat. No. 37699X Form 8891 (Rev. 12-2012)