Enlarge image

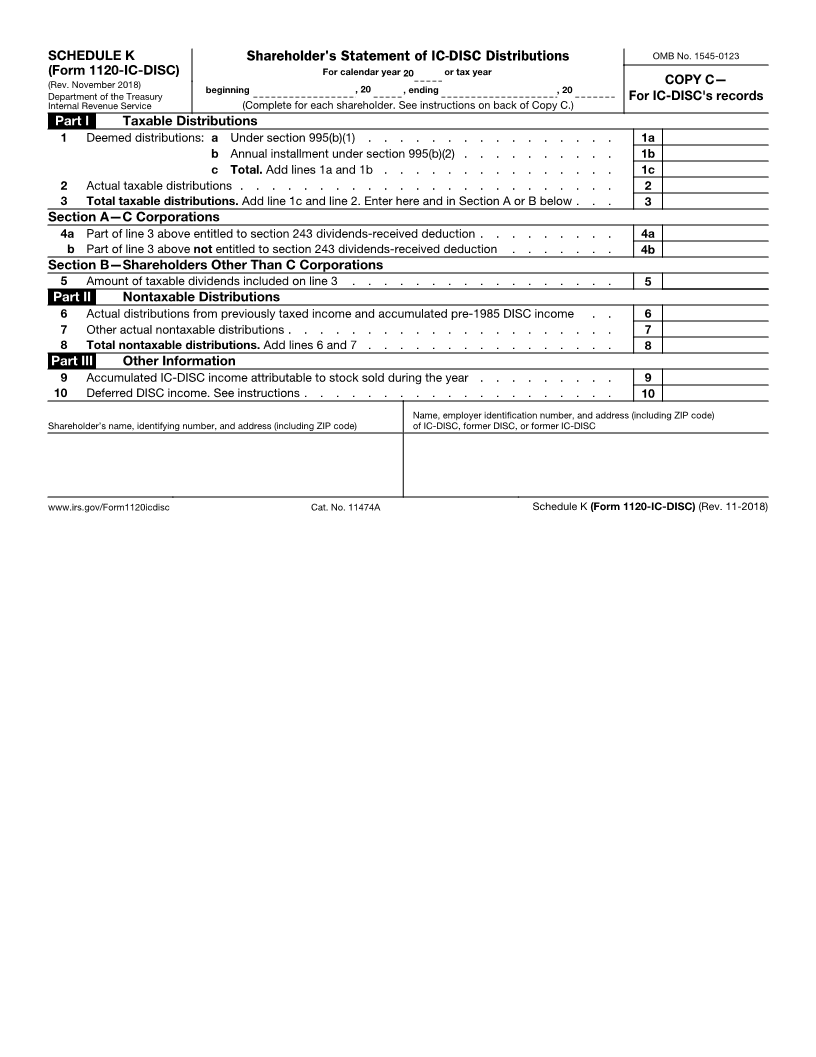

SCHEDULE K Shareholder's Statement of IC-DISC Distributions OMB No. 1545-0123

(Form 1120-IC-DISC) For calendar year 20 or tax year

(Rev. November 2018) COPY A—Attach to

beginning , 20 , ending , 20

Department of the Treasury Form 1120-IC-DISC

Internal Revenue Service (Complete for each shareholder. See instructions on back of Copy C.)

Part I Taxable Distributions

1 Deemed distributions: a Under section 995(b)(1) . . . . . . . . . . . . . . . . 1a

b Annual installment under section 995(b)(2) . . . . . . . . . . 1b

c Total. Add lines 1a and 1b . . . . . . . . . . . . . . . 1c

2 Actual taxable distributions . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Total taxable distributions. Add line 1c and line 2. Enter here and in Section A or B below . . . 3

Section A—C Corporations

4a Part of line 3 above entitled to section 243 dividends-received deduction . . . . . . . . . 4a

b Part of line 3 above not entitled to section 243 dividends-received deduction . . . . . . . 4b

Section B—Shareholders Other Than C Corporations

5 Amount of taxable dividends included on line 3 . . . . . . . . . . . . . . . . . 5

Part II Nontaxable Distributions

6 Actual distributions from previously taxed income and accumulated pre-1985 DISC income . . 6

7 Other actual nontaxable distributions . . . . . . . . . . . . . . . . . . . . . 7

8 Total nontaxable distributions. Add lines 6 and 7 . . . . . . . . . . . . . . . . 8

Part III Other Information

9 Accumulated IC-DISC income attributable to stock sold during the year . . . . . . . . . 9

10 Deferred DISC income. See instructions . . . . . . . . . . . . . . . . . . . . 10

Name, employer identification number, and address (including ZIP code)

Shareholder’s name, identifying number, and address (including ZIP code) of IC-DISC, former DISC, or former IC-DISC

For Paperwork Reduction Act Notice, see the Instructions for Form 1120-IC-DISC. www.irs.gov/Form1120icdisc Cat. No. 11474A Schedule K (Form 1120-IC-DISC) (Rev. 11-2018)