- 6 -

Enlarge image

|

Form 8832 (Rev. 12-2013) Page 5

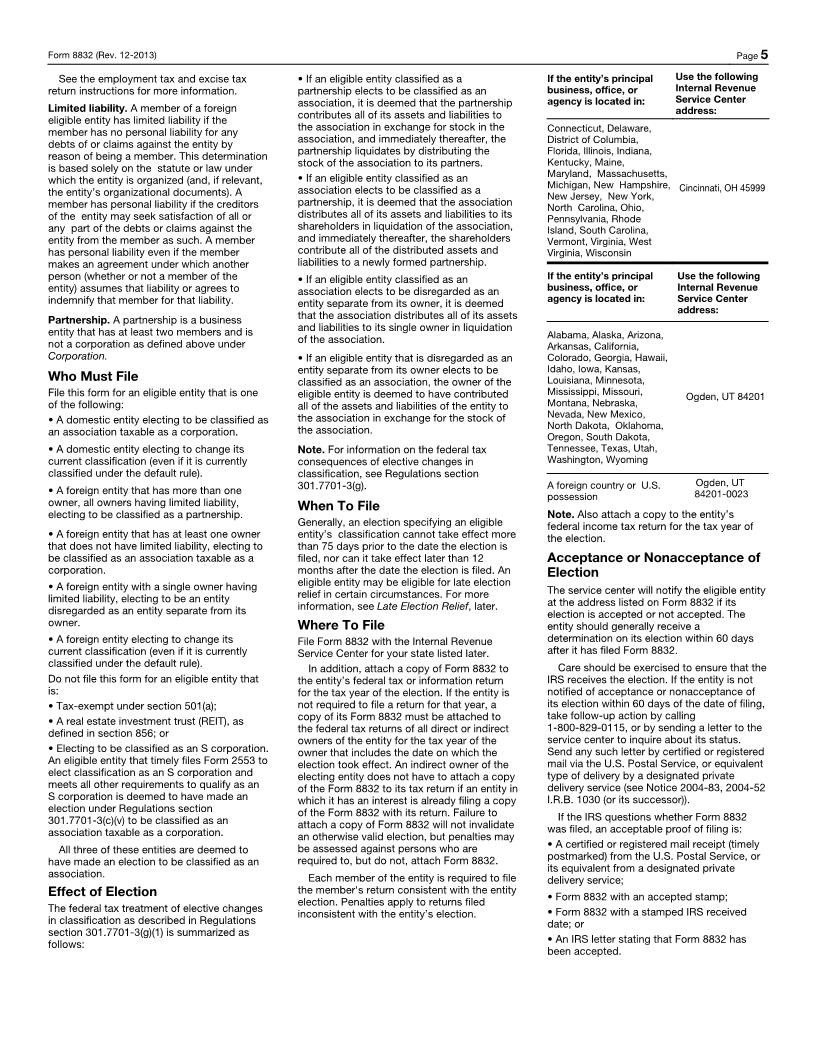

See the employment tax and excise tax • If an eligible entity classified as a If the entity’s principal Use the following

return instructions for more information. partnership elects to be classified as an business, office, or Internal Revenue

Limited liability. A member of a foreign association, it is deemed that the partnership agency is located in: Service Center

eligible entity has limited liability if the contributes all of its assets and liabilities to address:

member has no personal liability for any the association in exchange for stock in the Connecticut, Delaware,

debts of or claims against the entity by association, and immediately thereafter, the District of Columbia,

reason of being a member. This determination partnership liquidates by distributing the Florida, Illinois, Indiana,

is based solely on the statute or law under stock of the association to its partners. Kentucky, Maine,

which the entity isorganized (and, if relevant, • If an eligible entity classified as an Maryland, Massachusetts,

the entity’sorganizational documents). A association elects to be classified as a Michigan, New Hampshire, Cincinnati, OH 45999

member haspersonal liability if the creditors partnership, it is deemed that the association New Jersey, New York,

North Carolina, Ohio,

of the entity may seek satisfaction of all or distributes all of its assets and liabilities to its Pennsylvania, Rhode

any part of the debts or claims against the shareholders in liquidation of the association, Island, South Carolina,

entity from the member as such. Amember and immediately thereafter, the shareholders Vermont, Virginia, West

has personal liability even if themember contribute all of the distributed assets and Virginia, Wisconsin

makes an agreement under whichanother liabilities to a newly formed partnership.

person (whether or not a memberof the • If an eligible entity classified as an If the entity’s principal Use the following

entity) assumes that liability oragrees to association elects to be disregarded as an business, office, or Internal Revenue

indemnify that member for thatliability. entity separate from its owner, it is deemed agency is located in: Service Center

Partnership. A partnership is a business that the association distributes all of its assets address:

entity that has at least two members andis and liabilities to its single owner in liquidation

not a corporation as defined above under of the association. Alabama, Alaska, Arizona,

Arkansas, California,

Corporation. • If an eligible entity that is disregarded as an Colorado, Georgia, Hawaii,

entity separate from its owner elects to be Idaho, Iowa, Kansas,

Who Must File classified as an association, the owner of the Louisiana, Minnesota,

File this form for an eligible entity that is one eligible entity is deemed to have contributed Mississippi, Missouri, Ogden, UT 84201

of the following: all of the assets and liabilities of the entity to Montana, Nebraska,

• A domestic entity electing to be classified as the association in exchange for the stock of Nevada, New Mexico,

an association taxable as a corporation. the association. North Dakota, Oklahoma,

Oregon, South Dakota,

• A domestic entity electing to change its Note. For information on the federal tax Tennessee, Texas, Utah,

current classification (even if it is currently consequences of elective changes in Washington, Wyoming

classified under the default rule). classification, see Regulations section

• A foreign entity that has more than one 301.7701-3(g). A foreign country or U.S. Ogden, UT

possession 84201-0023

owner, all owners having limited liability, When To File

electing to be classified as a partnership. Note. Also attach a copy to the entity’s

Generally, an election specifying an eligible federal income tax return for the tax yearof

• A foreign entity that has at least one owner entity’s classification cannot take effect more the election.

that does not have limited liability, electing to than 75 days prior to the date the election is

be classified as an association taxable as a filed, nor can it take effect later than 12 Acceptance or Nonacceptance of

corporation. months after the date the election is filed. An Election

• A foreign entity with a single owner having eligible entity may be eligible for late election

limited liability, electing to be an entity relief in certain circumstances. For more The service center will notify the eligible entity

disregarded as an entity separate from its information, see Late Election Relief, later. at the address listed on Form 8832 if its

election is accepted or not accepted. The

owner. Where To File entity should generally receive a

• A foreign entity electing to change its File Form 8832 with the Internal Revenue determination on its election within 60 days

current classification (even if it is currently Service Center for your state listed later. after it has filed Form 8832.

classified under the default rule). In addition, attach a copy of Form 8832 to Care should be exercised to ensure that the

Do not file this form for an eligible entity that the entity’s federal tax or information return IRS receives the election. If the entity is not

is: for the tax year of the election. If the entity is notified of acceptance or nonacceptance of

• Tax-exempt under section 501(a); not required to file a return for that year, a its election within 60 days of the date of filing,

• A real estate investment trust (REIT), as copy of its Form 8832 must be attached to take follow-up action by calling

defined in section 856; or the federal tax returns of all direct or indirect 1-800-829-0115, or by sending a letter to the

owners of the entity for the tax year of the service center to inquire about its status.

• Electing to be classified as an S corporation. owner that includes the date on which the Send any such letter by certified or registered

An eligible entity that timely files Form 2553 to election took effect. An indirect owner of the mail via the U.S. Postal Service, or equivalent

elect classification as an S corporation and electing entity does not have to attach a copy type of delivery by a designated private

meets all other requirements to qualify as an of the Form 8832 to its tax return if an entity in delivery service (see Notice 2004-83, 2004-52

S corporation is deemed to have made an which it has an interest is already filing a copy I.R.B. 1030 (or its successor)).

election under Regulations section of the Form 8832 with its return. Failure to If the IRS questions whether Form 8832

301.7701-3(c)(v) to be classified as an attach a copy of Form 8832 will not invalidate was filed, an acceptable proof of filing is:

association taxable as a corporation. an otherwise valid election, but penalties may

All three of these entities are deemed to be assessed against persons who are • A certified or registered mail receipt (timely

have made an election to be classified as an required to, but do not, attach Form 8832. postmarked) from the U.S. Postal Service, or

its equivalent from a designated private

association. Each member of the entity is required to file delivery service;

Effect of Election the member's return consistent with the entity

The federal tax treatment of elective changes election. Penalties apply to returns filed • Form 8832 with an accepted stamp;

in classification as described in Regulations inconsistent with the entity’s election. • Form 8832 with a stamped IRS received

date; or

section 301.7701-3(g)(1) is summarized as

follows: • An IRS letter stating that Form 8832 has

been accepted.

|