Enlarge image

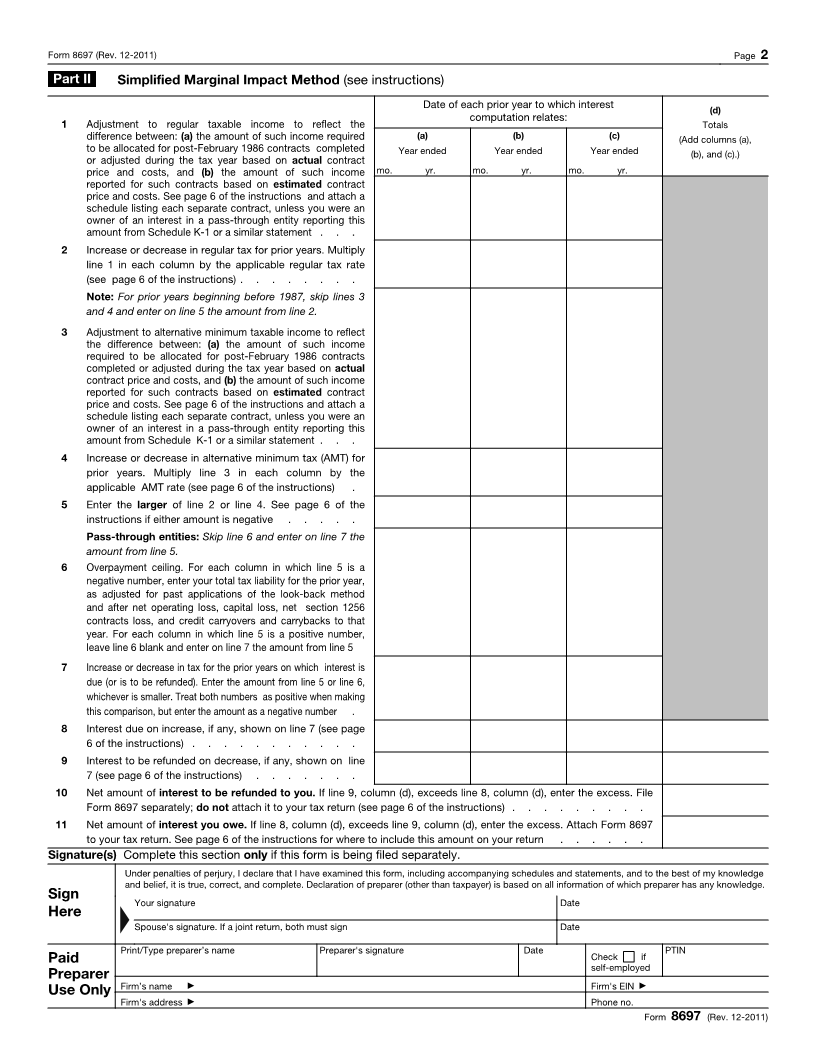

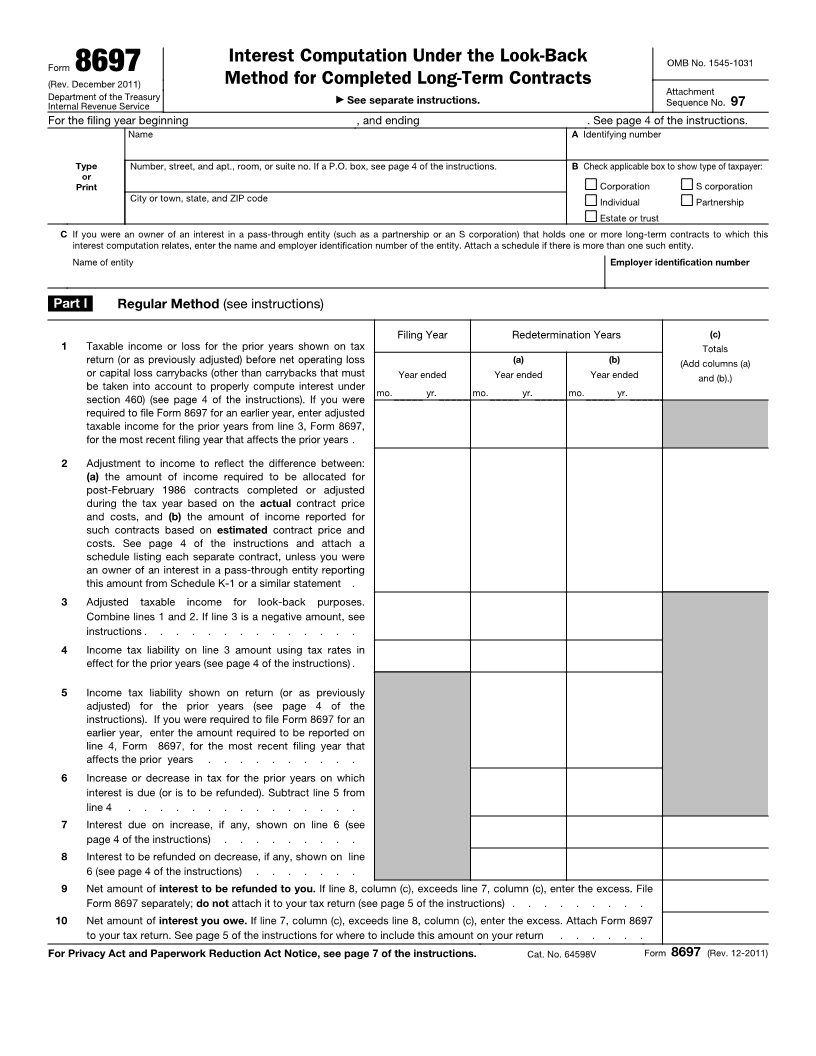

Interest Computation Under the Look-Back OMB No. 1545-1031

Form 8697

(Rev. December 2011) Method for Completed Long-Term Contracts

Attachment

Department of the Treasury ▶ See separate instructions. Sequence No. 97

Internal Revenue Service

For the filing year beginning , and ending . See page 4 of the instructions.

Name A Identifying number

Type Number, street, and apt., room, or suite no. If a P.O. box, see page 4 of the instructions. B Check applicable box to show type of taxpayer:

or

Print Corporation S corporation

City or town, state, and ZIP code Individual Partnership

Estate or trust

C If you were an owner of an interest in a pass-through entity (such as a partnership or an S corporation) that holds one or more long-term contracts to which this

interest computation relates, enter the name and employer identification number of the entity. Attach a schedule if there is more than one such entity.

Name of entity Employer identification number

Part I Regular Method (see instructions)

Filing Year Redetermination Years (c)

1 Taxable income or loss for the prior years shown on tax Totals

return (or as previously adjusted) before net operating loss (a) (b) (Add columns (a)

or capital loss carrybacks (other than carrybacks that must Year ended Year ended Year ended and (b).)

be taken into account to properly compute interest under mo. yr. mo. yr. mo. yr.

section 460) (see page 4 of the instructions). If you were

required to file Form 8697 for an earlier year, enter adjusted

taxable income for the prior years from line 3, Form 8697,

for the most recent filing year that affects the prior years .

2 Adjustment to income to reflect the difference between:

(a) the amount of income required to be allocated for

post-February 1986 contracts completed or adjusted

during the tax year based on the actual contract price

and costs, and (b) the amount of income reported for

such contracts based on estimated contract price and

costs. See page 4 of the instructions and attach a

schedule listing each separate contract, unless you were

an owner of an interest in a pass-through entity reporting

this amount from Schedule K-1 or a similar statement .

3 Adjusted taxable income for look-back purposes.

Combine lines 1 and 2. If line 3 is a negative amount, see

instructions . . . . . . . . . . . . . .

4 Income tax liability on line 3 amount using tax rates in

effect for the prior years (see page 4 of the instructions) .

5 Income tax liability shown on return (or as previously

adjusted) for the prior years (see page 4 of the

instructions). If you were required to file Form 8697 for an

earlier year, enter the amount required to be reported on

line 4, Form 8697, for the most recent filing year that

affects the prior years . . . . . . . . . .

6 Increase or decrease in tax for the prior years on which

interest is due (or is to be refunded). Subtract line 5 from

line 4 . . . . . . . . . . . . . . .

7 Interest due on increase, if any, shown on line 6 (see

page 4 of the instructions) . . . . . . . . .

8 Interest to be refunded on decrease, if any, shown on line

6 (see page 4 of the instructions) . . . . . . .

9 Net amount of interest to be refunded to you. If line 8, column (c), exceeds line 7, column (c), enter the excess. File

Form 8697 separately; do not attach it to your tax return (see page 5 of the instructions) . . . . . . . . .

10 Net amount of interest you owe. If line 7, column (c), exceeds line 8, column (c), enter the excess. Attach Form 8697

to your tax return. See page 5 of the instructions for where to include this amount on your return . . . . . .

For Privacy Act and Paperwork Reduction Act Notice, see page 7 of the instructions. Cat. No. 64598V Form 8697 (Rev. 12-2011)