Enlarge image

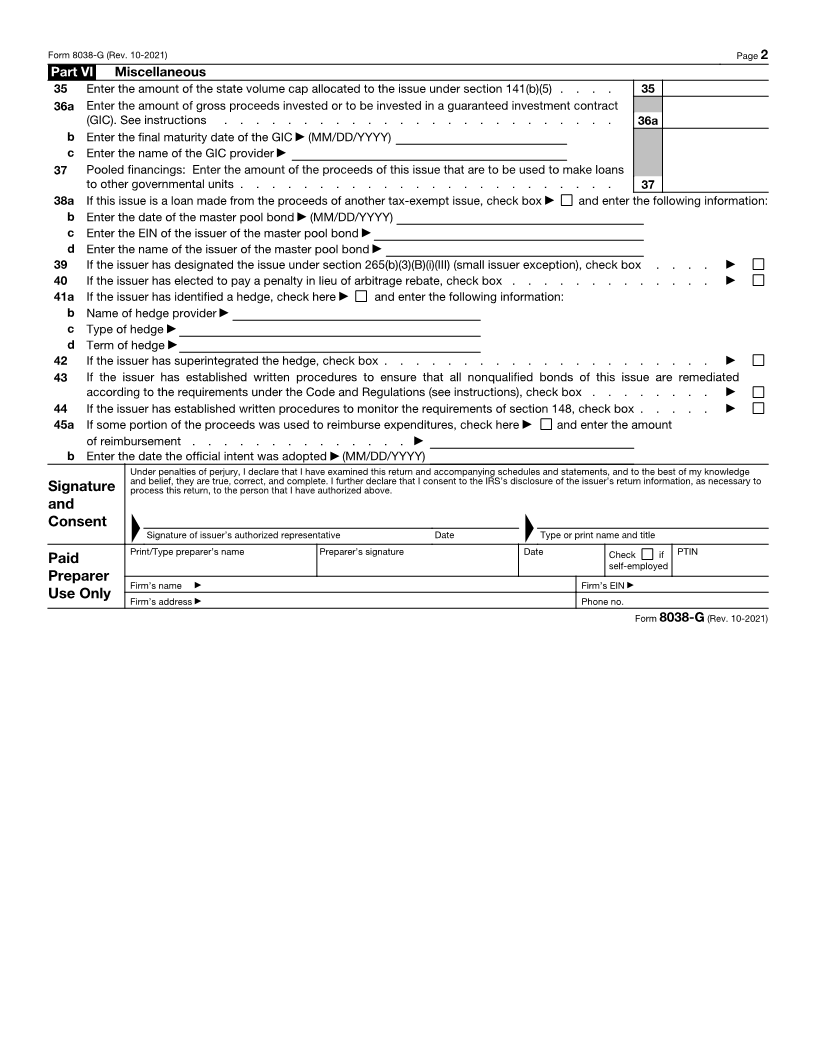

Information Return for Tax-Exempt Governmental Bonds

Form 8038-G ▶ Under Internal Revenue Code section 149(e)

(Rev. October 2021) ▶ See separate instructions. OMB No. 1545-0047

Department of the Treasury Caution: If the issue price is under $100,000, use Form 8038-GC.

Internal Revenue Service ▶ Go to www.irs.gov/F8038G for instructions and the latest information.

Part I Reporting Authority Check box if Amended Return ▶

1 Issuer’s name 2 Issuer’s employer identification number (EIN)

3a Name of person (other than issuer) with whom the IRS may communicate about this return (see instructions) 3b Telephone number of other person shown on 3a

4 Number and street (or P.O. box if mail is not delivered to street address) Room/suite 5 Report number (For IRS Use Only)

3

6 City, town, or post office, state, and ZIP code 7 Date of issue

8 Name of issue 9 CUSIP number

10a Name and title of officer or other employee of the issuer whom the IRS may call for more information 10b Telephone number of officer or other

employee shown on 10a

Part II Type of Issue (Enter the issue price.) See the instructions and attach schedule.

11 Education . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Health and hospital . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Transportation . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Public safety . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Environment (including sewage bonds) . . . . . . . . . . . . . . . . . . . . 15

16 Housing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Utilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Other. Describe ▶ 18

19 a If bonds are TANs or RANs, check only box 19a . . . . . . . . . . . . . . . ▶

b If bonds are BANs, check only box 19b . . . . . . . . . . . . . . . . . . ▶

20 If bonds are in the form of a lease or installment sale, check box . . . . . . . . . ▶

Part III Description of Bonds. Complete for the entire issue for which this form is being filed.

(a) Final maturity date (b) Issue price (c) Stated redemption (d) Weighted (e) Yield

price at maturity average maturity

21 $ $ years %

Part IV Uses of Proceeds of Bond Issue (including underwriters’ discount)

22 Proceeds used for accrued interest . . . . . . . . . . . . . . . . . . . . . 22

23 Issue price of entire issue (enter amount from line 21, column (b)) . . . . . . . . . . . 23

24 Proceeds used for bond issuance costs (including underwriters’ discount) 24

25 Proceeds used for credit enhancement . . . . . . . . . . . . 25

26 Proceeds allocated to reasonably required reserve or replacement fund . 26

27 Proceeds used to refund prior tax-exempt bonds. Complete Part V . . . 27

28 Proceeds used to refund prior taxable bonds. Complete Part V . . . . 28

29 Total (add lines 24 through 28) . . . . . . . . . . . . . . . . . . . . . . . 29

30 Nonrefunding proceeds of the issue (subtract line 29 from line 23 and enter amount here) . . . 30

Part V Description of Refunded Bonds. Complete this part only for refunding bonds.

31 Enter the remaining weighted average maturity of the tax-exempt bonds to be refunded . . . ▶ years

32 Enter the remaining weighted average maturity of the taxable bonds to be refunded . . . . ▶ years

33 Enter the last date on which the refunded tax-exempt bonds will be called (MM/DD/YYYY) . . ▶

34 Enter the date(s) the refunded bonds were issued ▶(MM/DD/YYYY)

For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 63773S Form 8038-G (Rev. 10-2021)