Enlarge image

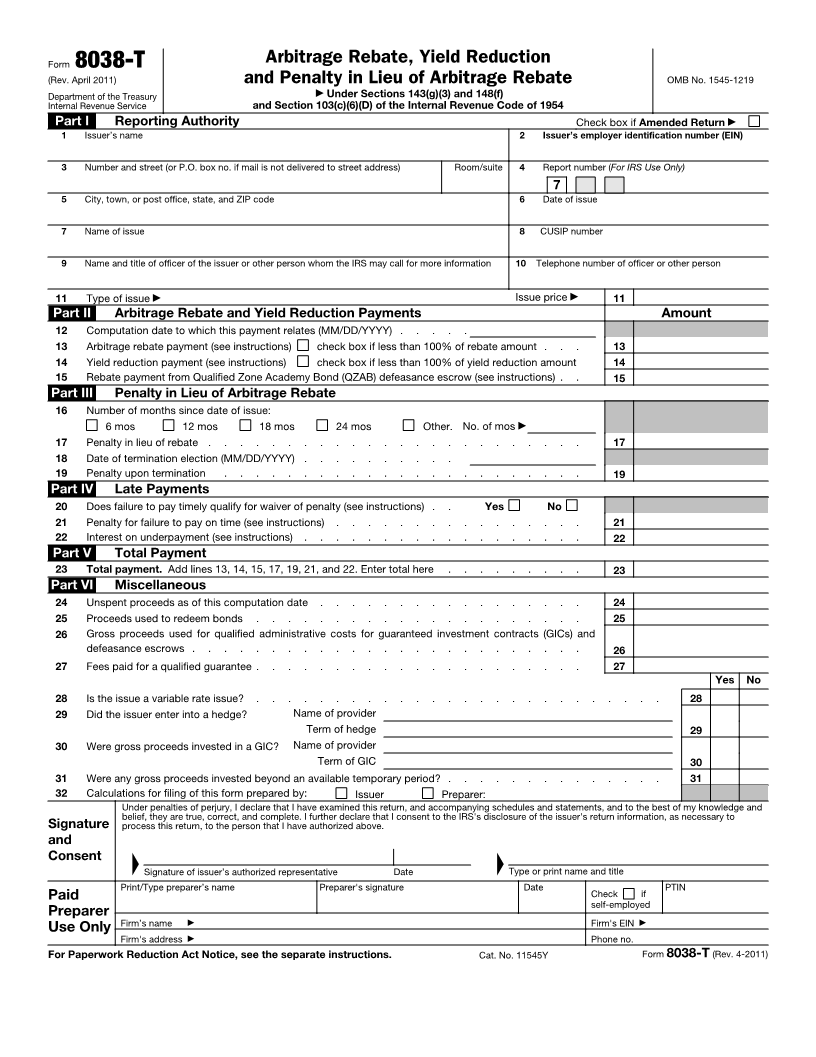

Form 8038-T Arbitrage Rebate, Yield Reduction

(Rev. April 2011) and Penalty in Lieu of Arbitrage Rebate OMB No. 1545-1219

Department of the Treasury ▶ Under Sections 143(g)(3) and 148(f)

Internal Revenue Service and Section 103(c)(6)(D) of the Internal Revenue Code of 1954

Part I Reporting Authority Check box if Amended Return ▶

1 Issuer’s name 2 Issuer’s employer identification number (EIN)

3 Number and street (or P.O. box no. if mail is not delivered to street address) Room/suite 4 Report number (For IRS Use Only)

7

5 City, town, or post office, state, and ZIP code 6 Date of issue

7 Name of issue 8 CUSIP number

9 Name and title of officer of the issuer or other person whom the IRS may call for more information 10 Telephone number of officer or other person

11 Type of issue ▶ Issue price ▶ 11

Part II Arbitrage Rebate and Yield Reduction Payments Amount

12 Computation date to which this payment relates (MM/DD/YYYY) . . . . .

13 Arbitrage rebate payment (see instructions) check box if less than 100% of rebate amount . . . 13

14 Yield reduction payment (see instructions) check box if less than 100% of yield reduction amount 14

15 Rebate payment from Qualified Zone Academy Bond (QZAB) defeasance escrow (see instructions) . . 15

Part III Penalty in Lieu of Arbitrage Rebate

16 Number of months since date of issue:

6 mos 12 mos 18 mos 24 mos Other. No. of mos ▶

17 Penalty in lieu of rebate . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Date of termination election (MM/DD/YYYY) . . . . . . . . . .

19 Penalty upon termination . . . . . . . . . . . . . . . . . . . . . . . 19

Part IV Late Payments

20 Does failure to pay timely qualify for waiver of penalty (see instructions) . . Yes No

21 Penalty for failure to pay on time (see instructions) . . . . . . . . . . . . . . . . 21

22 Interest on underpayment (see instructions) . . . . . . . . . . . . . . . . . . 22

Part V Total Payment

23 Total payment. Add lines 13, 14, 15, 17, 19, 21, and 22. Enter total here . . . . . . . . . 23

Part VI Miscellaneous

24 Unspent proceeds as of this computation date . . . . . . . . . . . . . . . . . 24

25 Proceeds used to redeem bonds . . . . . . . . . . . . . . . . . . . . . 25

26 Gross proceeds used for qualified administrative costs for guaranteed investment contracts (GICs) and

defeasance escrows . . . . . . . . . . . . . . . . . . . . . . . . . 26

27 Fees paid for a qualified guarantee . . . . . . . . . . . . . . . . . . . . . 27

Yes No

28 Is the issue a variable rate issue? . . . . . . . . . . . . . . . . . . . . . . . . . . 28

29 Did the issuer enter into a hedge? Name of provider

Term of hedge 29

30 Were gross proceeds invested in a GIC? Name of provider

Term of GIC 30

31 Were any gross proceeds invested beyond an available temporary period? . . . . . . . . . . . . . . 31

32 Calculations for filing of this form prepared by: Issuer Preparer:

Under penalties of perjury, I declare that I have examined this return, and accompanying schedules and statements, and to the best of my knowledge and

belief, they are true, correct, and complete. I further declare that I consent to the IRS's disclosure of the issuer's return information, as necessary to

Signature process this return, to the person that I have authorized above.

and ▲ ▲

Consent

Signature of issuer’s authorized representative Date Type or print name and title

Print/Type preparer’s name Preparer's signature Date PTIN

Paid Check if

self-employed

Preparer

Use Only Firm’s name ▶ Firm's EIN ▶

Firm's address ▶ Phone no.

For Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 11545Y Form 8038-T (Rev. 4-2011)