Enlarge image

OMB No. 1545-1362

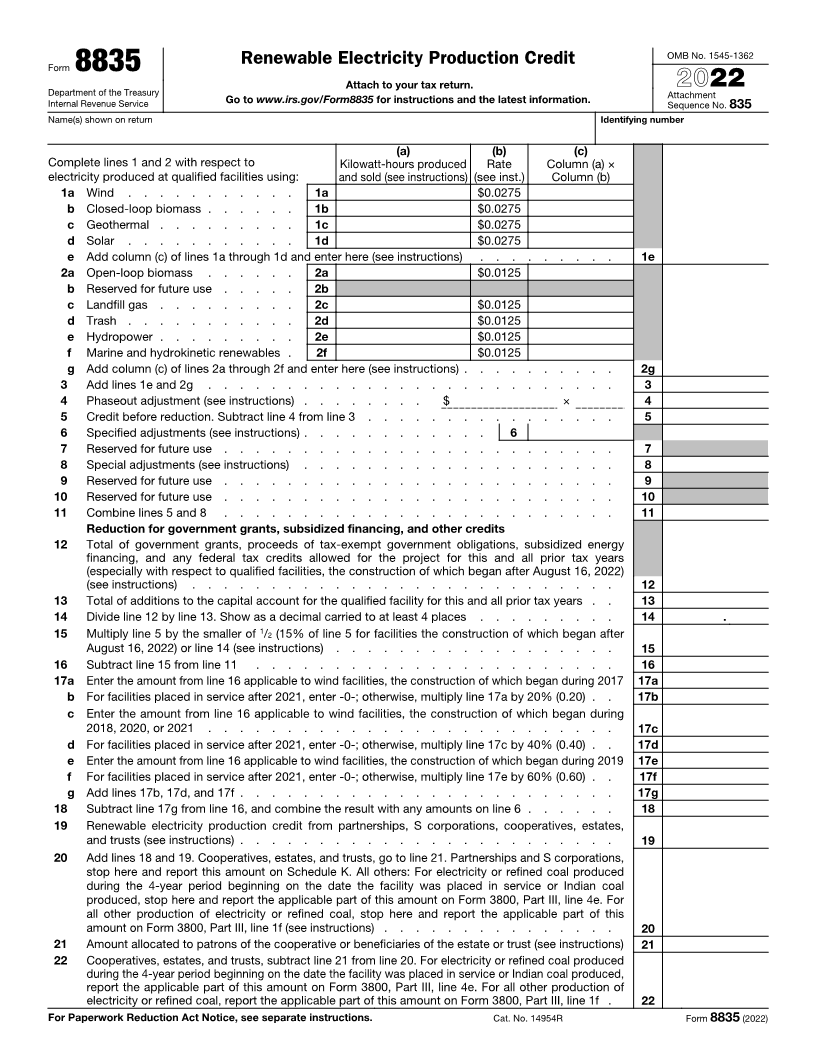

Renewable Electricity Production Credit

Form 8835

Attach to your tax return.

Department of the Treasury Attachment2022

Internal Revenue Service Go to www.irs.gov/Form8835 for instructions and the latest information. Sequence No. 835

Name(s) shown on return Identifying number

(a) (b) (c)

Complete lines 1 and 2 with respect to Kilowatt-hours produced Rate Column (a) ×

electricity produced at qualified facilities using: and sold (see instructions) (see inst.) Column (b)

1a Wind . . . . . . . . . . . 1a $0.0275

b Closed-loop biomass . . . . . . 1b $0.0275

c Geothermal . . . . . . . . . 1c $0.0275

d Solar . . . . . . . . . . . 1d $0.0275

e Add column (c) of lines 1a through 1d and enter here (see instructions) . . . . . . . . . 1e

2a Open-loop biomass . . . . . . 2a $0.0125

b Reserved for future use . . . . . 2b

c Landfill gas . . . . . . . . . 2c $0.0125

d Trash . . . . . . . . . . . 2d $0.0125

e Hydropower . . . . . . . . . 2e $0.0125

f Marine and hydrokinetic renewables . 2f $0.0125

g Add column (c) of lines 2a through 2f and enter here (see instructions) . . . . . . . . . . 2g

3 Add lines 1e and 2g . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Phaseout adjustment (see instructions) . . . . . . . . $ × 4

5 Credit before reduction. Subtract line 4 from line 3 . . . . . . . . . . . . . . . . 5

6 Specified adjustments (see instructions) . . . . . . . . . . . . 6

7 Reserved for future use . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Special adjustments (see instructions) . . . . . . . . . . . . . . . . . . . . 8

9 Reserved for future use . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Reserved for future use . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Combine lines 5 and 8 . . . . . . . . . . . . . . . . . . . . . . . . . 11

Reduction for government grants, subsidized financing, and other credits

12 Total of government grants, proceeds of tax-exempt government obligations, subsidized energy

financing, and any federal tax credits allowed for the project for this and all prior tax years

(especially with respect to qualified facilities, the construction of which began after August 16, 2022)

(see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Total of additions to the capital account for the qualified facility for this and all prior tax years . . 13

14 Divide line 12 by line 13. Show as a decimal carried to at least 4 places . . . . . . . . . 14 .

15 Multiply line 5 by the smaller of / 12(15% of line 5 for facilities the construction of which began after

August 16, 2022) or line 14 (see instructions) . . . . . . . . . . . . . . . . . . 15

16 Subtract line 15 from line 11 . . . . . . . . . . . . . . . . . . . . . . . 16

17a Enter the amount from line 16 applicable to wind facilities, the construction of which began during 2017 17a

b For facilities placed in service after 2021, enter -0-; otherwise, multiply line 17a by 20% (0.20) . . 17b

c Enter the amount from line 16 applicable to wind facilities, the construction of which began during

2018, 2020, or 2021 . . . . . . . . . . . . . . . . . . . . . . . . . . 17c

d For facilities placed in service after 2021, enter -0-; otherwise, multiply line 17c by 40% (0.40) . . 17d

e Enter the amount from line 16 applicable to wind facilities, the construction of which began during 2019 17e

f For facilities placed in service after 2021, enter -0-; otherwise, multiply line 17e by 60% (0.60) . . 17f

g Add lines 17b, 17d, and 17f . . . . . . . . . . . . . . . . . . . . . . . . 17g

18 Subtract line 17g from line 16, and combine the result with any amounts on line 6 . . . . . . 18

19 Renewable electricity production credit from partnerships, S corporations, cooperatives, estates,

and trusts (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . 19

20 Add lines 18 and 19. Cooperatives, estates, and trusts, go to line 21. Partnerships and S corporations,

stop here and report this amount on Schedule K. All others: For electricity or refined coal produced

during the 4-year period beginning on the date the facility was placed in service or Indian coal

produced, stop here and report the applicable part of this amount on Form 3800, Part III, line 4e. For

all other production of electricity or refined coal, stop here and report the applicable part of this

amount on Form 3800, Part III, line 1f (see instructions) . . . . . . . . . . . . . . . 20

21 Amount allocated to patrons of the cooperative or beneficiaries of the estate or trust (see instructions) 21

22 Cooperatives, estates, and trusts, subtract line 21 from line 20. For electricity or refined coal produced

during the 4-year period beginning on the date the facility was placed in service or Indian coal produced,

report the applicable part of this amount on Form 3800, Part III, line 4e. For all other production of

electricity or refined coal, report the applicable part of this amount on Form 3800, Part III, line 1f . 22

For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 14954R Form 8835 (2022)