Enlarge image

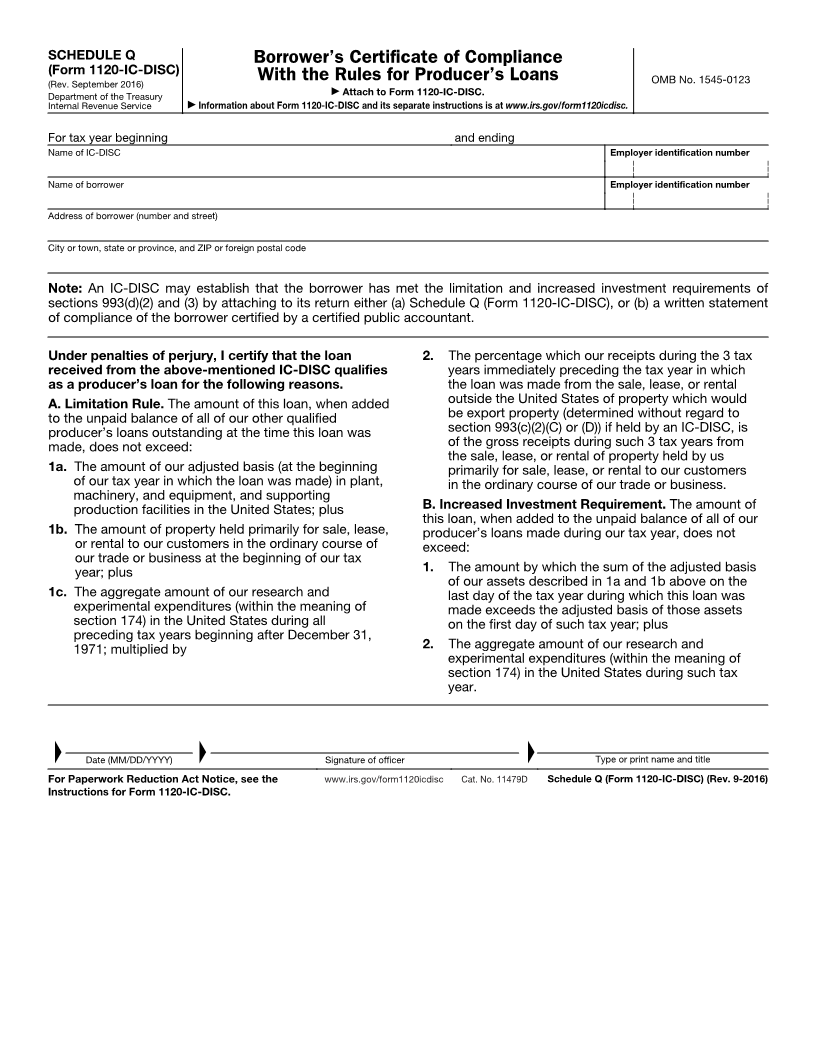

SCHEDULE Q Borrower’s Certificate of Compliance

(Form 1120-IC-DISC)

(Rev. September 2016) With the Rules for Producer’s Loans OMB No. 1545-0123

▶

Department of the Treasury Attach to Form 1120-IC-DISC.

Internal Revenue Service ▶ Information about Form 1120-IC-DISC and its separate instructions is at www.irs.gov/form1120icdisc.

For tax year beginning and ending

Name of IC-DISC Employer identification number

Name of borrower Employer identification number

Address of borrower (number and street)

City or town, state or province, and ZIP or foreign postal code

Note: An IC-DISC may establish that the borrower has met the limitation and increased investment requirements of

sections 993(d)(2) and (3) by attaching to its return either (a) Schedule Q (Form 1120-IC-DISC), or (b) a written statement

of compliance of the borrower certified by a certified public accountant.

Under penalties of perjury, I certify that the loan 2. The percentage which our receipts during the 3 tax

received from the above-mentioned IC-DISC qualifies years immediately preceding the tax year in which

as a producer’s loan for the following reasons. the loan was made from the sale, lease, or rental

A. Limitation Rule. The amount of this loan, when added outside the United States of property which would

to the unpaid balance of all of our other qualified be export property (determined without regard to

producer’s loans outstanding at the time this loan was section 993(c)(2)(C) or (D)) if held by an IC-DISC, is

made, does not exceed: of the gross receipts during such 3 tax years from

the sale, lease, or rental of property held by us

1a. The amount of our adjusted basis (at the beginning primarily for sale, lease, or rental to our customers

of our tax year in which the loan was made) in plant, in the ordinary course of our trade or business.

machinery, and equipment, and supporting

production facilities in the United States; plus B. Increased Investment Requirement. The amount of

this loan, when added to the unpaid balance of all of our

1b. The amount of property held primarily for sale, lease, producer’s loans made during our tax year, does not

or rental to our customers in the ordinary course of exceed:

our trade or business at the beginning of our tax

year; plus 1. The amount by which the sum of the adjusted basis

of our assets described in 1a and 1b above on the

1c. The aggregate amount of our research and last day of the tax year during which this loan was

experimental expenditures (within the meaning of made exceeds the adjusted basis of those assets

section 174) in the United States during all on the first day of such tax year; plus

preceding tax years beginning after December 31,

1971; multiplied by 2. The aggregate amount of our research and

experimental expenditures (within the meaning of

section 174) in the United States during such tax

year.

▲ ▲ ▲

Date (MM/DD/YYYY) Signature of officer Type or print name and title

For Paperwork Reduction Act Notice, see the www.irs.gov/form1120icdisc Cat. No. 11479D Schedule Q (Form 1120-IC-DISC) (Rev. 9-2016)

Instructions for Form 1120-IC-DISC.