Enlarge image

OMB No. 1545-0196

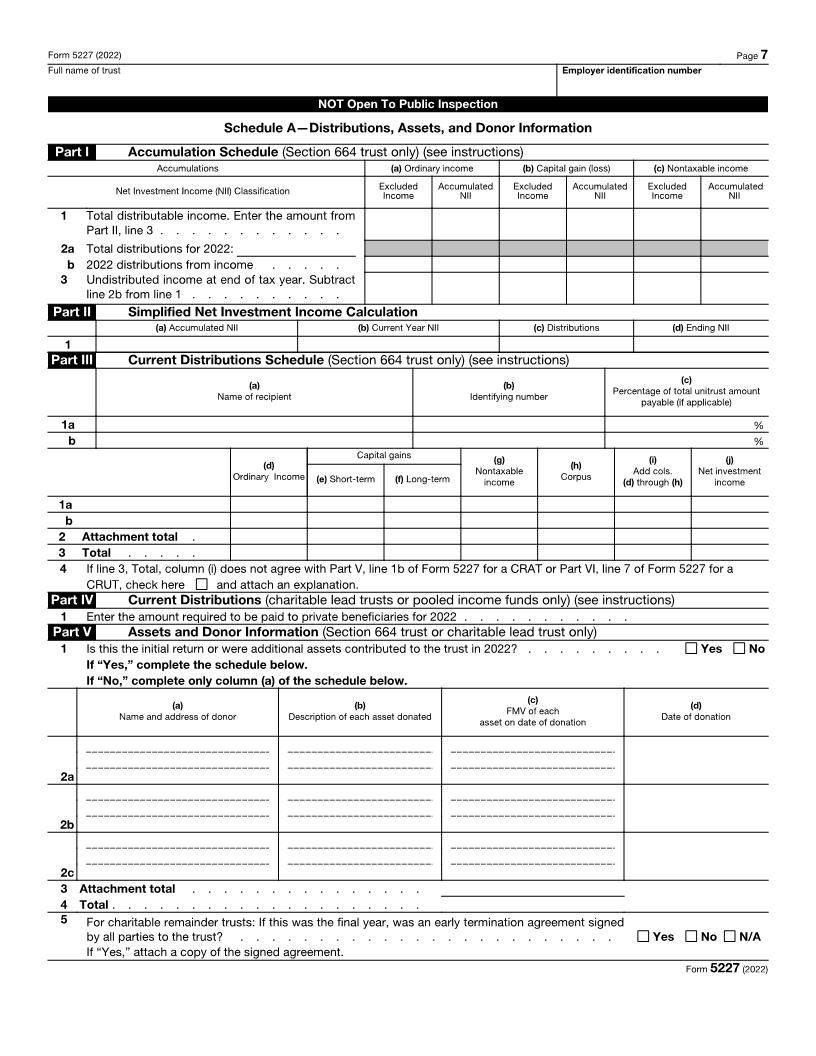

Split-Interest Trust Information Return

Form 5227 See separate instructions.

Go to www.irs.gov/Form5227 for instructions and the latest information. 2022

Department of the Treasury Do not enter social security numbers on this form (except on Schedule A) as it may be made public. Open to Public

Internal Revenue Service For the calendar year 2022 or tax year beginning , 2022, and ending , 20 Inspection

A Full name of trust B Employer identification number

Name of trustee C Type of Entity

Number, street, and room or suite no. (If a P.O. box, see the instructions.) (1) Charitable lead trust

(2) Charitable remainder annuity trust

described in section 664(d)(1)

(3) Charitable remainder unitrust

City or town, state or province, country, and ZIP or foreign postal code described in section 664(d)(2)

(4) Pooled income fund described in

section 642(c)(5)

D Fair market value (FMV) of assets at end of tax year E Gross Income (5) Other—Attach explanation

F Check applicable Initial return Final return Amended return incl. amended K-1s, if nec. G Date the trust was created

boxes (see

instructions) Change in trustee’s Name Address

Part I Income and Deductions (All trusts complete Sections A through D)

Section A—Ordinary Income

1 Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2a Ordinary dividends (including qualified dividends) . . . . . . . . . . . . . . . . 2a

b Qualified dividends (see instructions) . . . . . . . . . . . . . 2b

3 Business income or (loss). Attach Schedule C (Form 1040) . . . . . . . . . . . . . 3

4 Rents, royalties, partnerships, other estates and trusts, etc. Attach Schedule E (Form 1040) . . 4

5 Farm income or (loss). Attach Schedule F (Form 1040) . . . . . . . . . . . . . . . 5

6 Ordinary gain or (loss). Attach Form 4797 . . . . . . . . . . . . . . . . . . . 6

7 Other income. List type and amount 7

8 Total ordinary income. Combine lines 1, 2a, and 3 through 7 . . . . . . . . . . . . 8

Section B—Capital Gains (Losses)

9 Total short-term capital gain or (loss). Attach Schedule D, Part I (Form 1041) . . . . . . . 9

10 Total long-term capital gain or (loss). Attach Schedule D, Part II (Form 1041) . . . . . . . . 10

11 Unrecaptured section 1250 gain . . . . . . . . . . . . . . 11

12 28% gain . . . . . . . . . . . . . . . . . . . . . . 12

13 Total capital gains (losses). Combine lines 9 and 10 . . . . . . . . . . . . . . . 13

Section C—Nontaxable Income

14 Tax-exempt interest . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Other nontaxable income. List type and amount

15

16 Total nontaxable income. Add lines 14 and 15 . . . . . . . . . . . . . . . . . 16

Section D—Deductions

17 Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Taxes (see the instructions) . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Trustee fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

20 Attorney, accountant, and return preparer fees . . . . . . . . . . . . . . . . . 20

21 Other allowable deductions. Attach statement (see the instructions) . . . . . . . . . . 21

22 Total. Add lines 17 through 21 . . . . . . . . . . . . . . . . . . . . . . . 22

23 Charitable deduction . . . . . . . . . . . . . . . . . . 23

Section E—Deductions Allocable to Income Categories (Section 664 trust only)

24a Enter the amount from line 22 allocable to ordinary income . . . . . . . . . . . . . 24a

b Subtract line 24a from line 8 . . . . . . . . . . . . . . . . . . . . . . . 24b

25 a Enter the amount from line 22 allocable to capital gains (losses) . . . . . . . . . . . . 25a

b Subtract line 25a from line 13 . . . . . . . . . . . . . . . . . . . . . . . 25b

26 a Enter the amount from line 22 allocable to nontaxable income . . . . . . . . . . . . 26a

b Subtract line 26a from line 16 . . . . . . . . . . . . . . . . . . . . . . . 26b

For Paperwork Reduction Act Notice, see the instructions. Cat. No. 13227T Form 5227 (2022)