Enlarge image

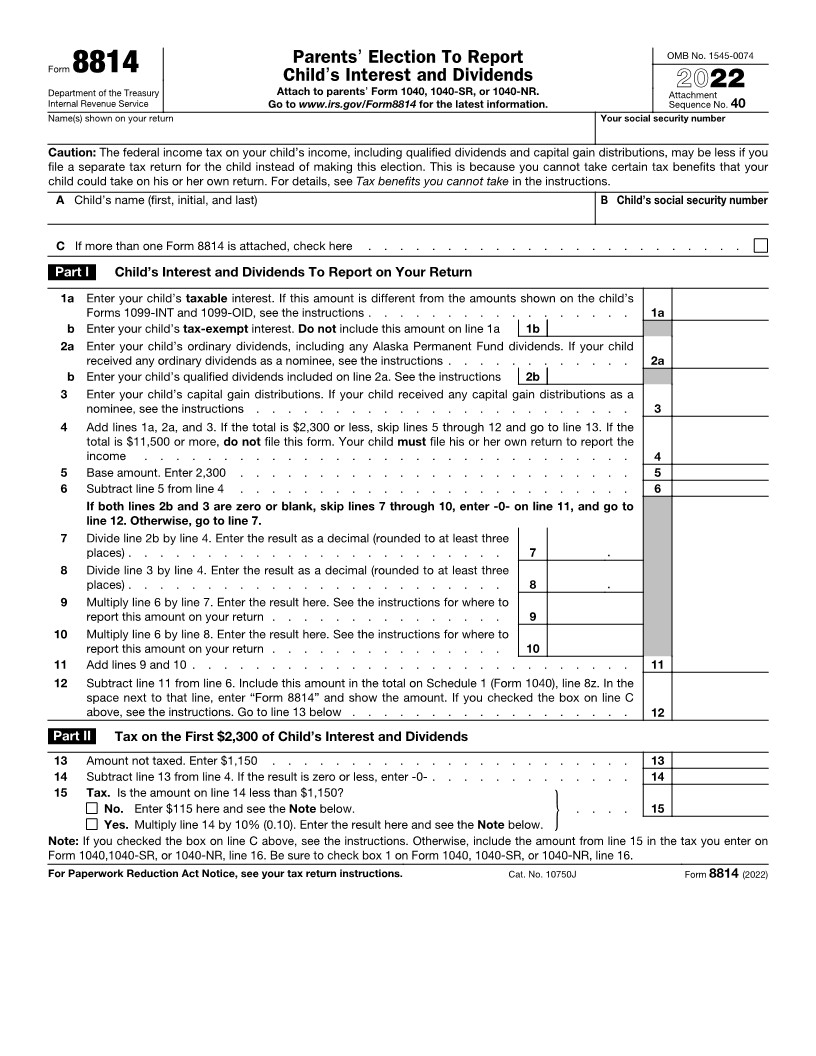

Parents ’ Election To Report OMB No. 1545-0074

Form 8814 Child’ s Interest and Dividends

Department of the Treasury Attach to parents ’Form 1040, 1040-SR, or 1040-NR. 2022

Attachment

Internal Revenue Service Go to www.irs.gov/Form8814 for the latest information. Sequence No. 40

Name(s) shown on your return Your social security number

Caution: The federal income tax on your child’s income, including qualified dividends and capital gain distributions, may be less if you

file a separate tax return for the child instead of making this election. This is because you cannot take certain tax benefits that your

child could take on his or her own return. For details, see Tax benefits you cannot take in the instructions.

A Child’s name (first, initial, and last) B Child’s social security number

C If more than one Form 8814 is attached, check here . . . . . . . . . . . . . . . . . . . . . . . .

Part I Child’s Interest and Dividends To Report on Your Return

1 a Enter your child’s taxable interest. If this amount is different from the amounts shown on the child’s

Forms 1099-INT and 1099-OID, see the instructions . . . . . . . . . . . . . . . . . 1a

b Enter your child’s tax-exempt interest. Do not include this amount on line 1a 1b

2 a Enter your child’s ordinary dividends, including any Alaska Permanent Fund dividends. If your child

received any ordinary dividends as a nominee, see the instructions . . . . . . . . . . . . 2a

b Enter your child’s qualified dividends included on line 2a. See the instructions 2b

3 Enter your child’s capital gain distributions. If your child received any capital gain distributions as a

nominee, see the instructions . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Add lines 1a, 2a, and 3. If the total is $2,300 or less, skip lines 5 through 12 and go to line 13. If the

total is $11,500 or more, do not file this form. Your child must file his or her own return to report the

income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Base amount. Enter 2,300 . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Subtract line 5 from line 4 . . . . . . . . . . . . . . . . . . . . . . . . . 6

If both lines 2b and 3 are zero or blank, skip lines 7 through 10, enter -0- on line 11, and go to

line 12. Otherwise, go to line 7.

7 Divide line 2b by line 4. Enter the result as a decimal (rounded to at least three

places) . . . . . . . . . . . . . . . . . . . . . . . . 7 .

8 Divide line 3 by line 4. Enter the result as a decimal (rounded to at least three

places) . . . . . . . . . . . . . . . . . . . . . . . . 8 .

9 Multiply line 6 by line 7. Enter the result here. See the instructions for where to

report this amount on your return . . . . . . . . . . . . . . . 9

10 Multiply line 6 by line 8. Enter the result here. See the instructions for where to

report this amount on your return . . . . . . . . . . . . . . . 10

11 Add lines 9 and 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Subtract line 11 from line 6. Include this amount in the total on Schedule 1 (Form 1040), line 8z. In the

space next to that line, enter “Form 8814” and show the amount. If you checked the box on line C

above, see the instructions. Go to line 13 below . . . . . . . . . . . . . . . . . . 12

Part II Tax on the First $2,300 of Child’s Interest and Dividends

13 Amount not taxed. Enter $1,150 . . . . . . . . . . . . . . . . . . . . . . . 13

14 Subtract line 13 from line 4. If the result is zero or less, enter -0- . . . . . . . . . . . . . 14

15 Tax. Is the amount on line 14 less than $1,150?

No. Enter $115 here and see the Note below. . . . . 15

Yes. Multiply line 14 by 10% (0.10). Enter the result here and see the Note below. }

Note: If you checked the box on line C above, see the instructions. Otherwise, include the amount from line 15 in the tax you enter on

Form 1040,1040-SR, or 1040-NR, line 16. Be sure to check box 1 on Form 1040, 1040-SR, or 1040-NR, line 16.

For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 10750J Form 8814 (2022)