Enlarge image

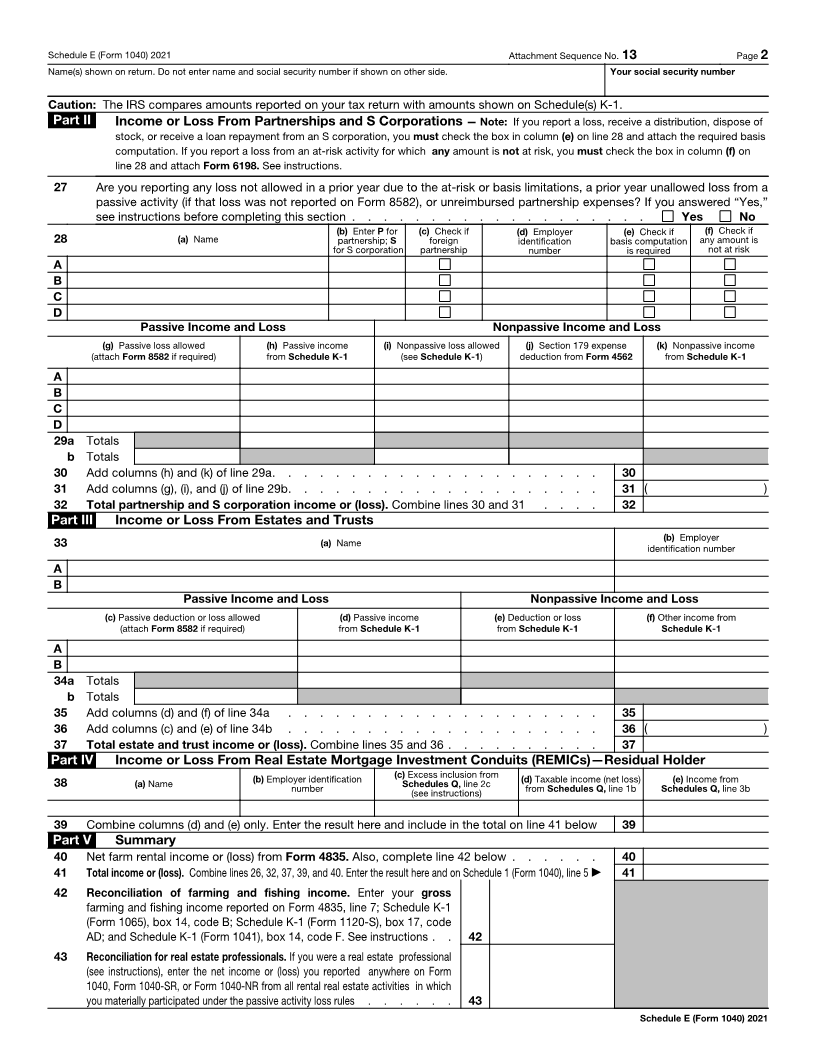

SCHEDULE E Supplemental Income and Loss OMB No. 1545-0074

(Form 1040) (From rental real estate, royalties, partnerships, S corporations, estates, trusts, REMICs, etc.)

Department of the Treasury ▶ Attach to Form 1040, 1040-SR, 1040-NR, or 1041. 2021

Attachment

Internal Revenue Service (99) ▶Go to www.irs.gov/ScheduleE for instructions and the latest information. Sequence No.13

Name(s) shown on return Your social security number

Part I Income or Loss From Rental Real Estate and Royalties Note: If you are in the business of renting personal property, use

Schedule C. See instructions. If you are an individual, report farm rental income or loss from Form 4835 on page 2, line 40.

A Did you make any payments in 2021 that would require you to file Form(s) 1099? See instructions . . . . . Yes No

B If “Yes,” did you or will you file required Form(s) 1099? . . . . . . . . . . . . . . . . . . . Yes No

1a Physical address of each property (street, city, state, ZIP code)

A

B

C

1b Type of Property 2 For each rental real estate property listed Fair Rental Personal Use

QJV

(from list below) above, report the number of fair rental and Days Days

personal use days. Check the QJV box only

A if you meet the requirements to file as a A

B qualified joint venture. See instructions. B

C C

Type of Property:

1 Single Family Residence 3 Vacation/Short-Term Rental 5 Land 7 Self-Rental

2 Multi-Family Residence 4 Commercial 6 Royalties 8 Other (describe)

Income: Properties: A B C

3 Rents received . . . . . . . . . . . . . 3

4 Royalties received . . . . . . . . . . . . 4

Expenses:

5 Advertising . . . . . . . . . . . . . . 5

6 Auto and travel (see instructions) . . . . . . . 6

7 Cleaning and maintenance . . . . . . . . . 7

8 Commissions. . . . . . . . . . . . . . 8

9 Insurance . . . . . . . . . . . . . . . 9

10 Legal and other professional fees . . . . . . . 10

11 Management fees . . . . . . . . . . . . 11

12 Mortgage interest paid to banks, etc. (see instructions) 12

13 Other interest. . . . . . . . . . . . . . 13

14 Repairs. . . . . . . . . . . . . . . . 14

15 Supplies . . . . . . . . . . . . . . . 15

16 Taxes . . . . . . . . . . . . . . . . 16

17 Utilities . . . . . . . . . . . . . . . . 17

18 Depreciation expense or depletion . . . . . . 18

19 Other (list) ▶ 19

20 Total expenses. Add lines 5 through 19 . . . . . 20

21 Subtract line 20 from line 3 (rents) and/or 4 (royalties). If

result is a (loss), see instructions to find out if you must

file Form 6198 . . . . . . . . . . . . . 21

22 Deductible rental real estate loss after limitation, if any,

on Form 8582 (see instructions) . . . . . . . 22 ( ) ( ) ( )

23a Total of all amounts reported on line 3 for all rental properties . . . . 23a

b Total of all amounts reported on line 4 for all royalty properties . . . . 23b

c Total of all amounts reported on line 12 for all properties . . . . . . 23c

d Total of all amounts reported on line 18 for all properties . . . . . . 23d

e Total of all amounts reported on line 20 for all properties . . . . . . 23e

24 Income. Add positive amounts shown on line 21. Do not include any losses . . . . . . . 24

25 Losses. Add royalty losses from line 21 and rental real estate losses from line 22. Enter total losses here . 25 ( )

26 Total rental real estate and royalty income or (loss). Combine lines 24 and 25. Enter the result

here. If Parts II, III, IV, and line 40 on page 2 do not apply to you, also enter this amount on

Schedule 1 (Form 1040), line 5. Otherwise, include this amount in the total on line 41 on page 2 . 26

For Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 11344L Schedule E (Form 1040) 2021