Enlarge image

OMB No. 1545-0047

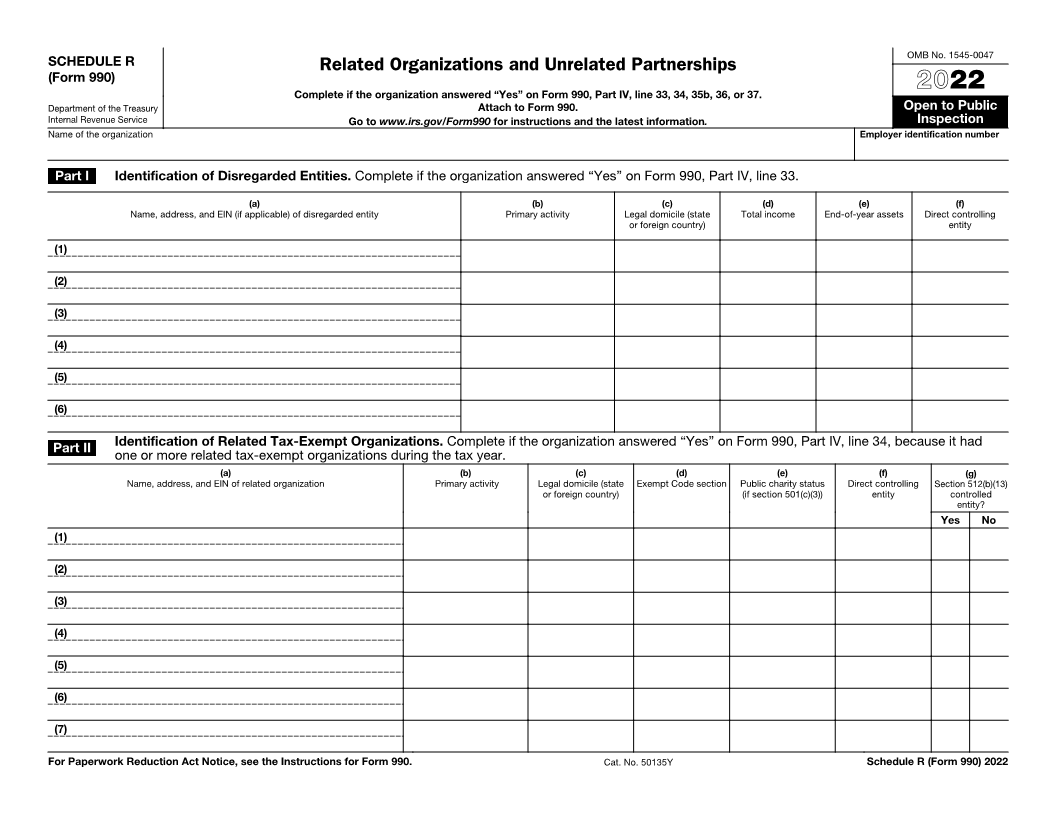

SCHEDULE R Related Organizations and Unrelated Partnerships

(Form 990)

Complete if the organization answered “Yes” on Form 990, Part IV, line 33, 34, 35b, 36, or 37. 2022

Department of the Treasury Attach to Form 990. Open to Public

Internal Revenue Service Go to www.irs.gov/Form990 for instructions and the latest information. Inspection

Name of the organization Employer identification number

Part I Identification of Disregarded Entities. Complete if the organization answered “Yes” on Form 990, Part IV, line 33.

(a) (b) (c) (d) (e) (f)

Name, address, and EIN (if applicable) of disregarded entity Primary activity Legal domicile (state Total income End-of-year assets Direct controlling

or foreign country) entity

(1)

(2)

(3)

(4)

(5)

(6)

Part II Identification of Related Tax-Exempt Organizations. Complete if the organization answered “Yes” on Form 990, Part IV, line 34, because it had

one or more related tax-exempt organizations during the tax year.

(a) (b) (c) (d) (e) (f) (g)

Name, address, and EIN of related organization Primary activity Legal domicile (state Exempt Code section Public charity status Direct controlling Section 512(b)(13)

or foreign country) (if section 501(c)(3)) entity controlled

entity?

Yes No

(1)

(2)

(3)

(4)

(5)

(6)

(7)

For Paperwork Reduction Act Notice, see the Instructions for Form 990. Cat. No. 50135Y Schedule R (Form 990) 2022