Enlarge image

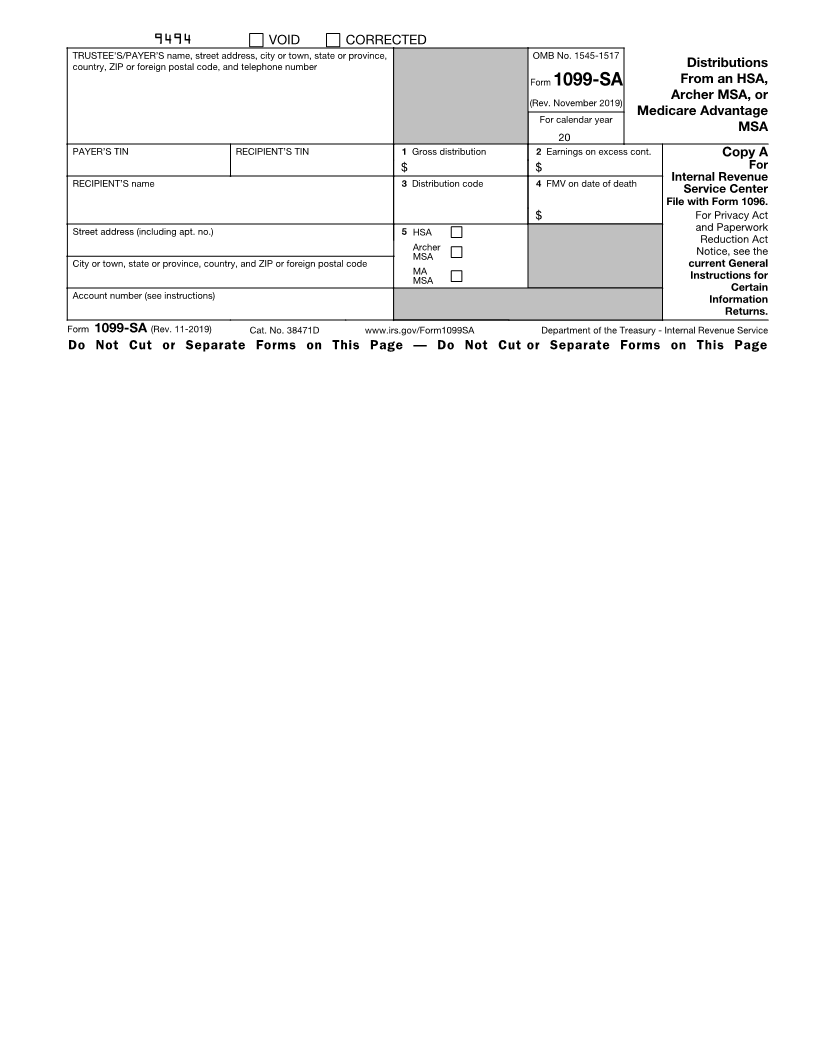

9494 VOID CORRECTED

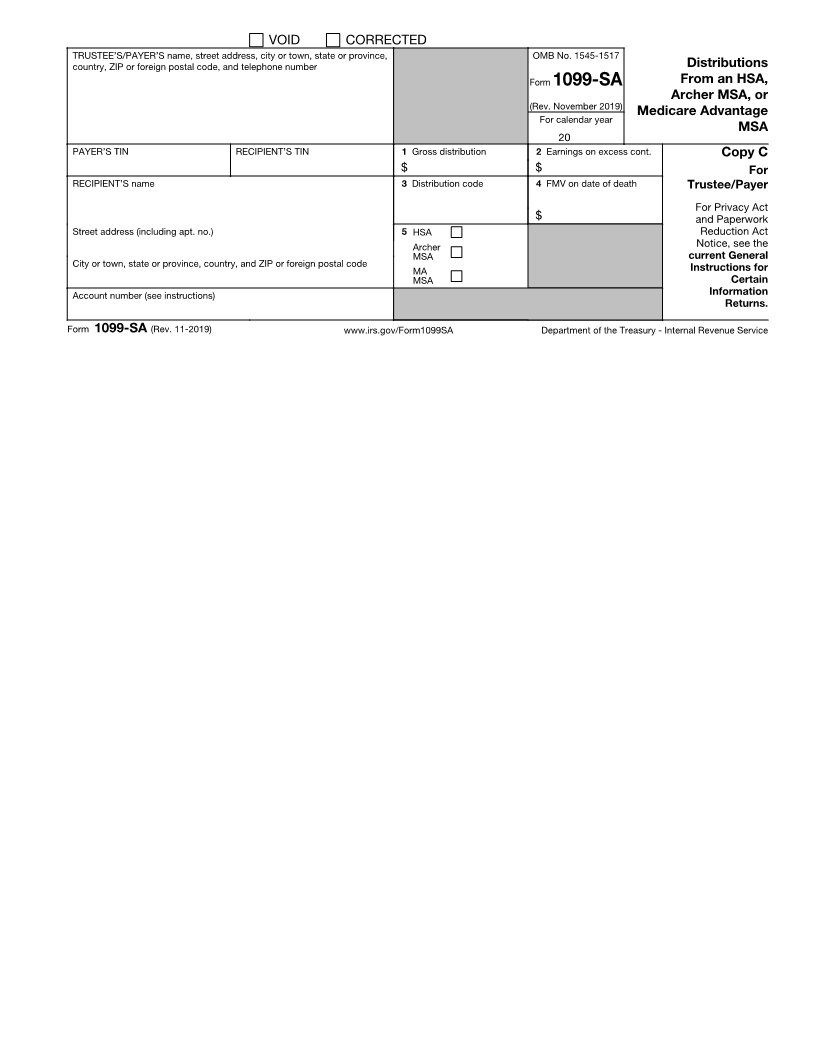

TRUSTEE'S/PAYERS’ name, street address, city or town, state or province, OMB No. 1545-1517

country, ZIP or foreign postal code, and telephone number Distributions

Form 1099-SA From an HSA,

(Rev. November 2019) Archer MSA, or

Medicare Advantage

For calendar year

MSA

20

PAYER’S TIN RECIPIENT’S TIN 1 Gross distribution 2 Earnings on excess cont. Copy A

$ $ For

RECIPIENT’S name 3 Distribution code 4 FMV on date of death Internal Revenue

Service Center

File with Form 1096.

$ For Privacy Act

Street address (including apt. no.) 5 HSA and Paperwork

Reduction Act

Archer Notice, see the

MSA

City or town, state or province, country, and ZIP or foreign postal code current General

MA Instructions for

MSA

Certain

Account number (see instructions) Information

Returns.

Form 1099-SA (Rev. 11-2019) Cat. No. 38471D www.irs.gov/Form1099SA Department of the Treasury - Internal Revenue Service

Do Not Cut or Separate Forms on This Page — Do Not Cut or Separate Forms on This Page