Enlarge image

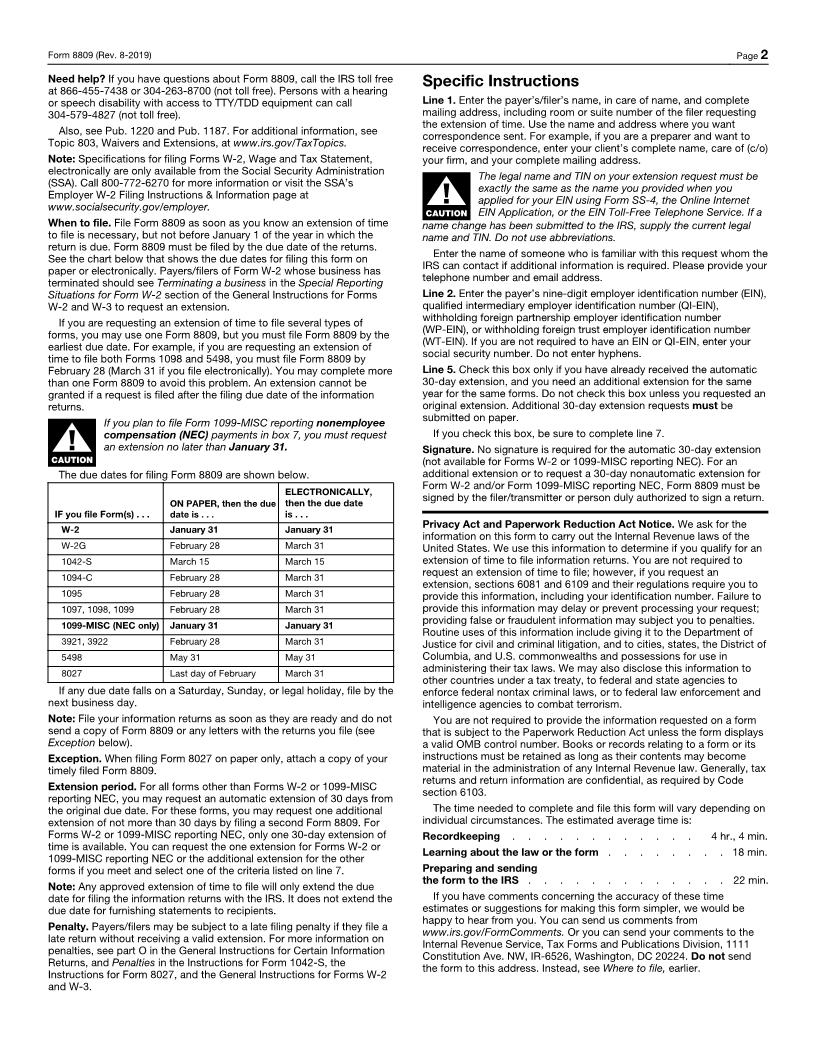

Application for Extension of Time

Form 8809 To File Information Returns

(Rev. August 2019) (For Forms W-2, W-2G, 1042-S, 1094-C, 1095, 1097, 1098, 1099, 3921, 3922, 5498, and 8027) OMB No. 1545-1081

Department of the Treasury ▶ This form may be filled out online. See How to file below.

Internal Revenue Service ▶ Go to www.irs.gov/Form8809 for the latest information.

Do not use this form to request an extension of time to (1) file Form 1040 or 1040-SR (use Form 4868),(2) file Form 1042 (use Form

7004), or (3) furnish statements to recipients (see Extensions under part M in the General Instructions for Certain Information Returns).

1 Payer’s/filer’s information. Type or print clearly in black ink. 2 Taxpayer identification number (TIN)

(Enter the payer’s nine-digit number.

Do not enter hyphens.)

Payer’s/filer’s name

Address

City State ZIP code

Contact name Telephone number

Email address

3 Check your method of filing information returns 4 If you are requesting an extension for more than one

(check only one box). Use a separate Form 8809 payer/filer, enter the total number of payers/filers and

for each method. attach a list of names and TINs. See How to file

below for details. ▶

Electronic Paper

5 Check this box only if you already requested the automatic extension and you now need an additional extension. See instructions. ▶

6 Check only the box(es) that apply. Do not enter the number of returns.

Form(s) ✓ here Form(s) ✓ here Form(s) ✓ here

W-2 5498 8027

1097, 1098, 1099, 3921, 3922, W-2G 5498-ESA 1094-C, 1095-C

1099-MISC reporting NEC only 5498-QA 1095-B

1042-S 5498-SA 1099-QA

7 If you are requesting an extension for Forms W-2 or 1099-MISC reporting NEC only, or if you checked the box on line 5, you

must meet one of the following criteria. Check the applicable box(es) that describes your need for an extension.

The filer suffered a catastrophic event in a federally declared Death, serious illness, or unavoidable absence of the individual

disaster area that made the filer unable to resume operations or responsible for filing the information returns affected the operation

made necessary records unavailable . . . . . . . . of the filer . . . . . . . . . . . . . . . .

Fire, casualty, or natural disaster affected the operation of the The filer was in the first year of establishment . . . . .

filer . . . . . . . . . . . . . . . . . . The filer did not receive data on a payee statement such as

Schedule K-1, Form 1042-S, or the statement of sick pay required

under section 31.6051-3(a)(1) in time to prepare an accurate

information return . . . . . . . . . . . . . .

Under penalties of perjury, I declare that I have examined this form, including any accompanying statements, and, to the best of my knowledge and belief, it is true, correct,

and complete.

Signature ▶ Title ▶ Date ▶

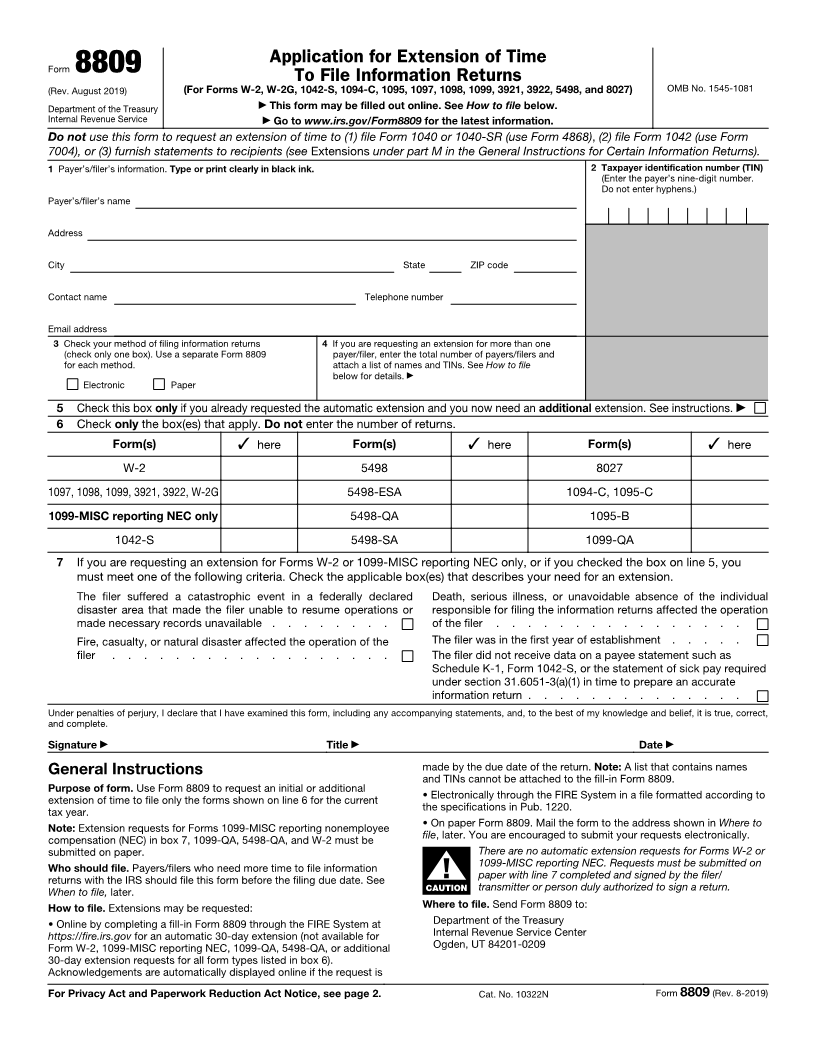

General Instructions made by the due date of the return. Note: A list that contains names

and TINs cannot be attached to the fill-in Form 8809.

Purpose of form. Use Form 8809 to request an initial or additional

extension of time to file only the forms shown on line 6 for the current • Electronically through the FIRE System in a file formatted according to

tax year. the specifications in Pub. 1220.

Note: Extension requests for Forms 1099-MISC reporting nonemployee • On paper Form 8809. Mail the form to the address shown in Where to

compensation (NEC) in box 7, 1099-QA, 5498-QA, and W-2 must be file, later. You are encouraged to submit your requests electronically.

submitted on paper. There are no automatic extension requests for Forms W-2 or

Who should file. Payers/filers who need more time to file information 1099-MISC reporting NEC. Requests must be submitted on

returns with the IRS should file this form before the filing due date. See ▲! paper with line 7 completed and signed by the filer/

When to file, later. CAUTION transmitter or person duly authorized to sign a return.

How to file. Extensions may be requested: Where to file. Send Form 8809 to:

• Online by completing a fill-in Form 8809 through the FIRE System at Department of the Treasury

https://fire.irs.gov for an automatic 30-day extension (not available for Internal Revenue Service Center

Form W-2, 1099-MISC reporting NEC, 1099-QA, 5498-QA, or additional Ogden, UT 84201-0209

30-day extension requests for all form types listed in box 6).

Acknowledgements are automatically displayed online if the request is

For Privacy Act and Paperwork Reduction Act Notice, see page 2. Cat. No. 10322N Form 8809 (Rev. 8-2019)