Enlarge image

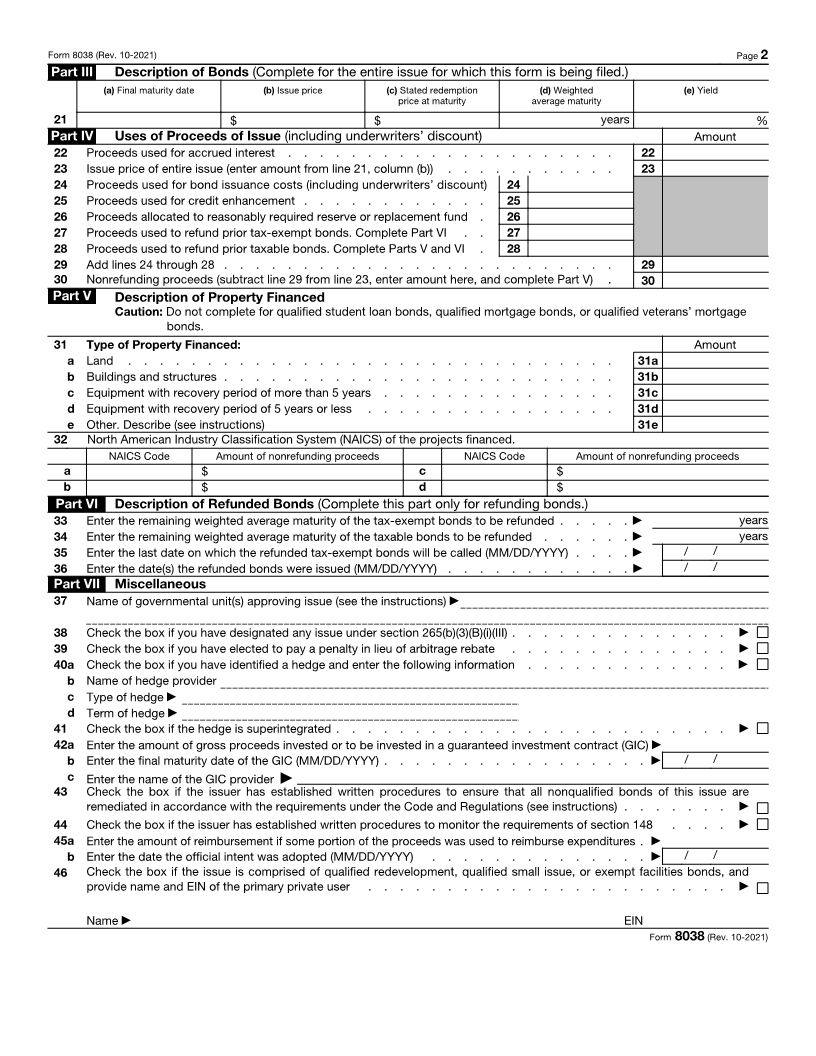

Information Return for Tax-Exempt Private Activity Bond Issues

Form 8038 (Under Internal Revenue Code section 149(e)) OMB No. 1545-0047

(Rev. October 2021)

Department of the Treasury ▶ See separate instructions.

Internal Revenue Service ▶ Go to www.irs.gov/Form8038 for instructions and the latest information.

Part I Reporting Authority Check box if Amended Return ▶

1 Issuer’s name 2 Issuer’s employer identification number

3a Name of person (other than issuer) with whom the IRS may communicate about this return (see instructions) 3b Telephone number of other person shown on 3a

4 Number and street (or P.O. box if mail is not delivered to street address) Room/suite 5 Report number (For IRS Use Only)

1

6 City, town, or post office, state, and ZIP code 7 Date of issue (MM/DD/YYYY)

8 Name of issue 9 CUSIP number

10a Name and title of officer or other employee of the issuer whom the IRS may call for more information 10b Telephone number of officer or other employee shown on 10a

Part II Type of Issue (Enter the issue price.) Issue Price

11 Exempt facility bond:

a Airport (sections 142(a)(1) and 142(c)) . . . . . . . . . . . . . . . . . . . . . 11a

b Docks and wharves (sections 142(a)(2) and 142(c)) . . . . . . . . . . . . . . . . 11b

c Water furnishing facilities (sections 142(a)(4) and 142(e)) . . . . . . . . . . . . . . 11c

d Sewage facilities (section 142(a)(5)) . . . . . . . . . . . . . . . . . . . . . 11d

e Solid waste disposal facilities (section 142(a)(6)) . . . . . . . . . . . . . . . . . 11e

f Qualified residential rental projects (sections 142(a)(7) and 142(d)) (see instructions) . . . . . 11f

Meeting 20–50 test (section 142(d)(1)(A)) . . . . . . . . . . . .

Meeting 40–60 test (section 142(d)(1)(B)) . . . . . . . . . . . .

Meeting 25–60 test (NYC only) (section 142(d)(6)) . . . . . . . . . .

Has an election been made for deep rent skewing (section 142(d)(4)(B))? . . Yes No

g Facilities for the local furnishing of electric energy or gas (sections 142(a)(8) and 142(f)) . . . . 11g

h Facilities allowed under a transitional rule of the Tax Reform Act of 1986 (see instructions) . . . 11h

Facility type

1986 Act section

i Qualified enterprise zone facility bonds (section 1394) (see instructions) . . . . . . . . . 11i

j Qualified empowerment zone facility bonds (section 1394(f)) (see instructions) . . . . . . . 11j

k Other (see instructions) 11k

l Qualified public educational facility bonds (sections 142(a)(13) and 142(k)) . . . . . . . . 11l

m Mass commuting facilities (sections 142(a)(3) and 142(c)) . . . . . . . . . . . . . . 11m

n Qualified highway or surface freight transfer facilities (sections 142(a)(15) and 142(m)) . . . . . 11n

o Other (see instructions)

p Local district heating or cooling facilities (sections 142(a)(9) and 142(g)) 11p

q Other (see instructions) 11q

12a Qualified mortgage bond (section 143(a)) . . . . . . . . . . . . . . . . . . . 12a

b Other (see instructions) 12b

13 Qualified veterans’ mortgage bond (section 143(b)) (see instructions) . . . . . . . . . ▶ 13

Check the box if you elect to rebate arbitrage profits to the United States . . . . .

14 Qualified small issue bond (section 144(a)) (see instructions) . . . . . . . . . . . . ▶ 14

Check the box for $10 million small issue exemption . . . . . . . . . . . .

15 Qualified student loan bond (section 144(b)) . . . . . . . . . . . . . . . . . . 15

16 Qualified redevelopment bond (section 144(c)) . . . . . . . . . . . . . . . . . 16

17 Qualified hospital bond (section 145(c)) (attach schedule—see instructions) . . . . . . . . 17

18 Qualified 501(c)(3) nonhospital bond (section 145(b)) (attach schedule—see instructions) . . . . 18

Check box if 95% or more of net proceeds will be used only for capital expenditures . ▶

19 Nongovernmental output property bond (treated as private activity bond) (section 141(d)) . . . 19

20a Other (see instructions)

b Reissuance (see instructions) 20b

c Other. Describe (see instructions) ▶ 20c

For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 49973K Form 8038 (Rev. 10-2021)