Enlarge image

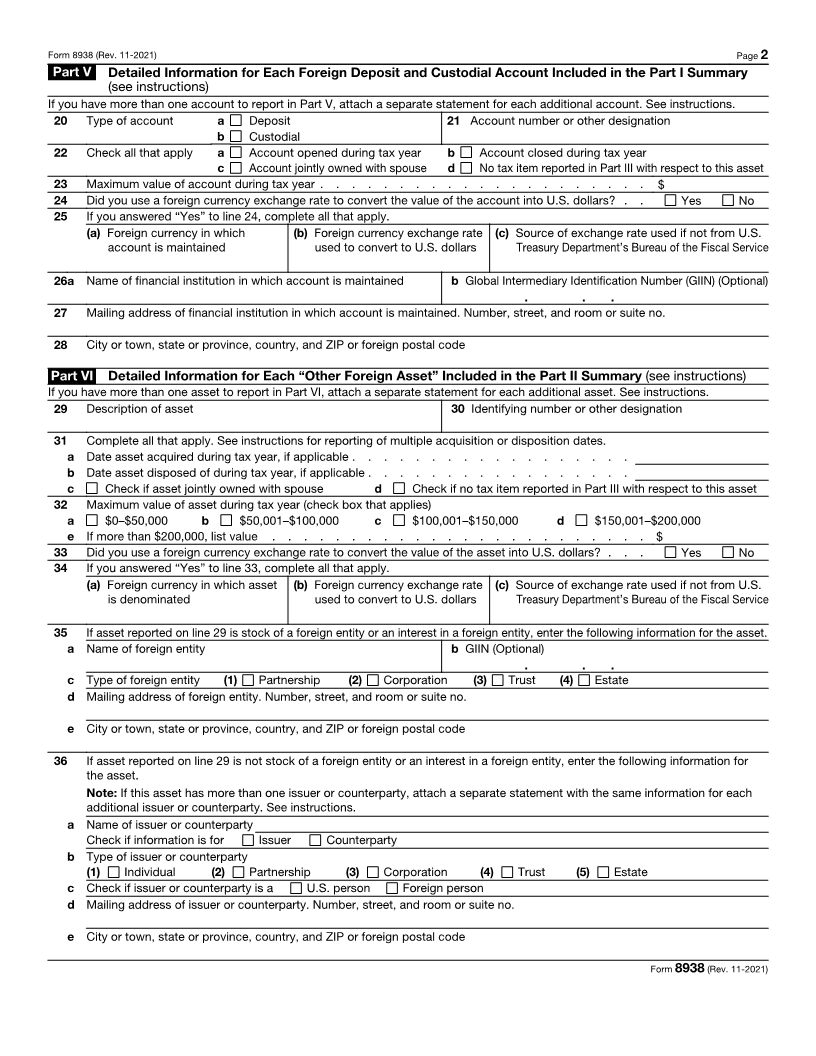

Statement of Specified Foreign Financial Assets OMB No. 1545-2195

Form 8938 ▶ Go to www.irs.gov/Form8938 for instructions and the latest information.

(Rev. November 2021) ▶ Attach to your tax return. Attachment

Department of the Treasury For calendar year 20 or tax year beginning , 20 , and ending , 20 Sequence No. 938

Internal Revenue Service

If you have attached additional statements, check here Number of additional statements

1 Name(s) shown on return 2 Taxpayer identification number (TIN)

3 Type of filer

a Specified individual b Partnership c Corporation d Trust

4 If you checked box 3a, skip this line 4. If you checked box 3b or 3c, enter the name and TIN of the specified individual who

closely holds the partnership or corporation. If you checked box 3d, enter the name and TIN of the specified person who is a

current beneficiary of the trust. (See instructions for definitions and what to do if you have more than one specified individual or

specified person to list.)

a Name b TIN

Part I Foreign Deposit and Custodial Accounts Summary

5 Number of deposit accounts (reported in Part V) . . . . . . . . . . . . . . . . . . ▶

6 Maximum value of all deposit accounts . . . . . . . . . . . . . . . . . . . . . . $

7 Number of custodial accounts (reported in Part V) . . . . . . . . . . . . . . . . . ▶

8 Maximum value of all custodial accounts . . . . . . . . . . . . . . . . . . . . . $

9 Were any foreign deposit or custodial accounts closed during the tax year? . . . . . . . . . . Yes No

Part II Other Foreign Assets Summary

10 Number of foreign assets (reported in Part Vl) . . . . . . . . . . . . . . . . . . . ▶

11 Maximum value of all assets (reported in Part Vl) . . . . . . . . . . . . . . . . . . . $

12 Were any foreign assets acquired or sold during the tax year? . . . . . . . . . . . . . . Yes No

Part III Summary of Tax Items Attributable to Specified Foreign Financial Assets (see instructions)

(c) Amount reported on Where reported

(a) Asset category (b) Tax item form or schedule (d) Form and line (e) Schedule and line

13 Foreign deposit and a Interest $

custodial accounts b Dividends $

c Royalties $

d Other income $

e Gains (losses) $

f Deductions $

g Credits $

14 Other foreign assets a Interest $

b Dividends $

c Royalties $

d Other income $

e Gains (losses) $

f Deductions $

g Credits $

Part IV Excepted Specified Foreign Financial Assets (see instructions)

If you reported specified foreign financial assets on one or more of the following forms, enter the number of such forms filed. You do

not need to include these assets on Form 8938 for the tax year.

15 Number of Forms 3520 16 Number of Forms 3520-A 17 Number of Forms 5471

18 Number of Forms 8621 19 Number of Forms 8865

For Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 37753A Form 8938 (Rev. 11-2021)