Enlarge image

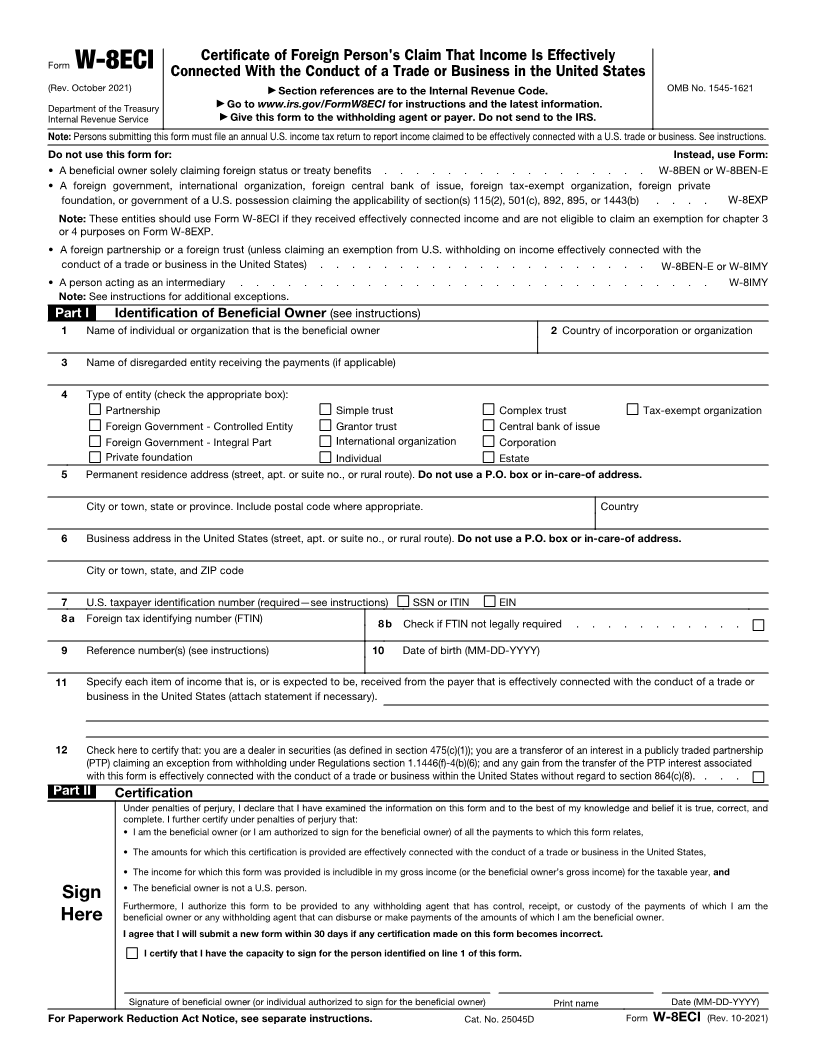

Certificate of Foreign Person's Claim That Income Is Effectively

Form W-8ECI Connected With the Conduct of a Trade or Business in the United States

(Rev. October 2021) ▶ Section references are to the Internal Revenue Code. OMB No. 1545-1621

Department of the Treasury ▶Go to www.irs.gov/FormW8ECI for instructions and the latest information.

Internal Revenue Service ▶ Give this form to the withholding agent or payer. Do not send to the IRS.

Note: Persons submitting this form must file an annual U.S. income tax return to report income claimed to be effectively connected with a U.S. trade or business. See instructions.

Do not use this form for: Instead, use Form:

• A beneficial owner solely claiming foreign status or treaty benefits . . . . . . . . . . . . . . . . . W-8BEN or W-8BEN-E

• A foreign government, international organization, foreign central bank of issue, foreign tax-exempt organization, foreign private

foundation, or government of a U.S. possession claiming the applicability of section(s) 115(2), 501(c), 892, 895, or 1443(b) . . . . W-8EXP

Note: These entities should use Form W-8ECI if they received effectively connected income and are not eligible to claim an exemption for chapter 3

or 4 purposes on Form W-8EXP.

• A foreign partnership or a foreign trust (unless claiming an exemption from U.S. withholding on income effectively connected with the

conduct of a trade or business in the United States) . . . . . . . . . . . . . . . . . . . . . W-8BEN-E or W-8IMY

• A person acting as an intermediary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . W-8IMY

Note: See instructions for additional exceptions.

Part I Identification of Beneficial Owner (see instructions)

1 Name of individual or organization that is the beneficial owner 2 Country of incorporation or organization

3 Name of disregarded entity receiving the payments (if applicable)

4 Type of entity (check the appropriate box):

Partnership Simple trust Complex trust Tax-exempt organization

Foreign Government - Controlled Entity Grantor trust Central bank of issue

Foreign Government - Integral Part International organization Corporation

Private foundation Individual Estate

5 Permanent residence address (street, apt. or suite no., or rural route). Do not use a P.O. box or in-care-of address.

City or town, state or province. Include postal code where appropriate. Country

6 Business address in the United States (street, apt. or suite no., or rural route). Do not use a P.O. box or in-care-of address.

City or town, state, and ZIP code

7 U.S. taxpayer identification number (required—see instructions) SSN or ITIN EIN

8a Foreign tax identifying number (FTIN) 8b Check if FTIN not legally required . . . . . . . . . . .

9 Reference number(s) (see instructions) 10 Date of birth (MM-DD-YYYY)

11 Specify each item of income that is, or is expected to be, received from the payer that is effectively connected with the conduct of a trade or

business in the United States (attach statement if necessary).

12 Check here to certify that: you are a dealer in securities (as defined in section 475(c)(1)); you are a transferor of an interest in a publicly traded partnership

(PTP) claiming an exception from withholding under Regulations section 1.1446(f)-4(b)(6); and any gain from the transfer of the PTP interest associated

with this form is effectively connected with the conduct of a trade or business within the United States without regard to section 864(c)(8). . . .

Part II Certification

Under penalties of perjury, I declare that I have examined the information on this form and to the best of my knowledge and belief it is true, correct, and

complete. I further certify under penalties of perjury that:

• I am the beneficial owner (or I am authorized to sign for the beneficial owner) of all the payments to which this form relates,

• The amounts for which this certification is provided are effectively connected with the conduct of a trade or business in the United States,

• The income for which this form was provided is includible in my gross income (or the beneficial owner’s gross income) for the taxable year, and

• The beneficial owner is not a U.S. person.

Sign

Furthermore, I authorize this form to be provided to any withholding agent that has control, receipt, or custody of the payments of which I am the

Here beneficial owner or any withholding agent that can disburse or make payments of the amounts of which I am the beneficial owner.

I agree that I will submit a new form within 30 days if any certification made on this form becomes incorrect.

I certify that I have the capacity to sign for the person identified on line 1 of this form.

Signature of beneficial owner (or individual authorized to sign for the beneficial owner) Print name Date (MM-DD-YYYY)

For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 25045D Form W-8ECI (Rev. 10-2021)