Enlarge image

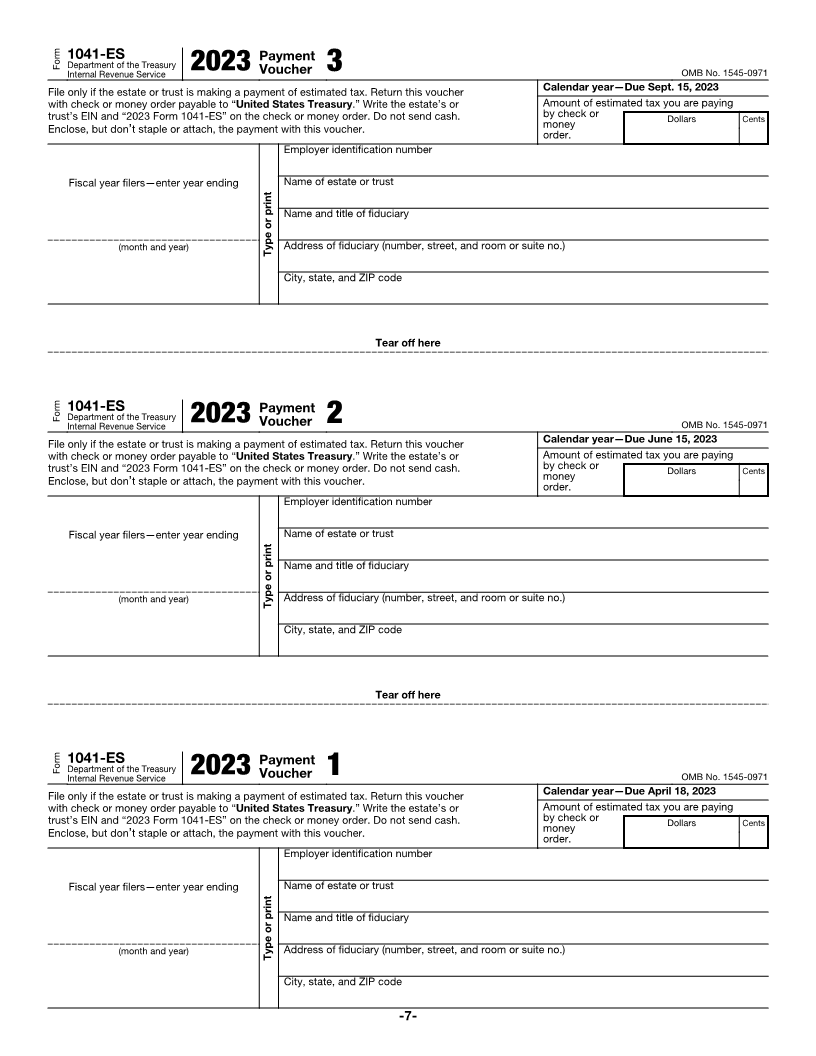

Department of the Treasury

Internal Revenue Service

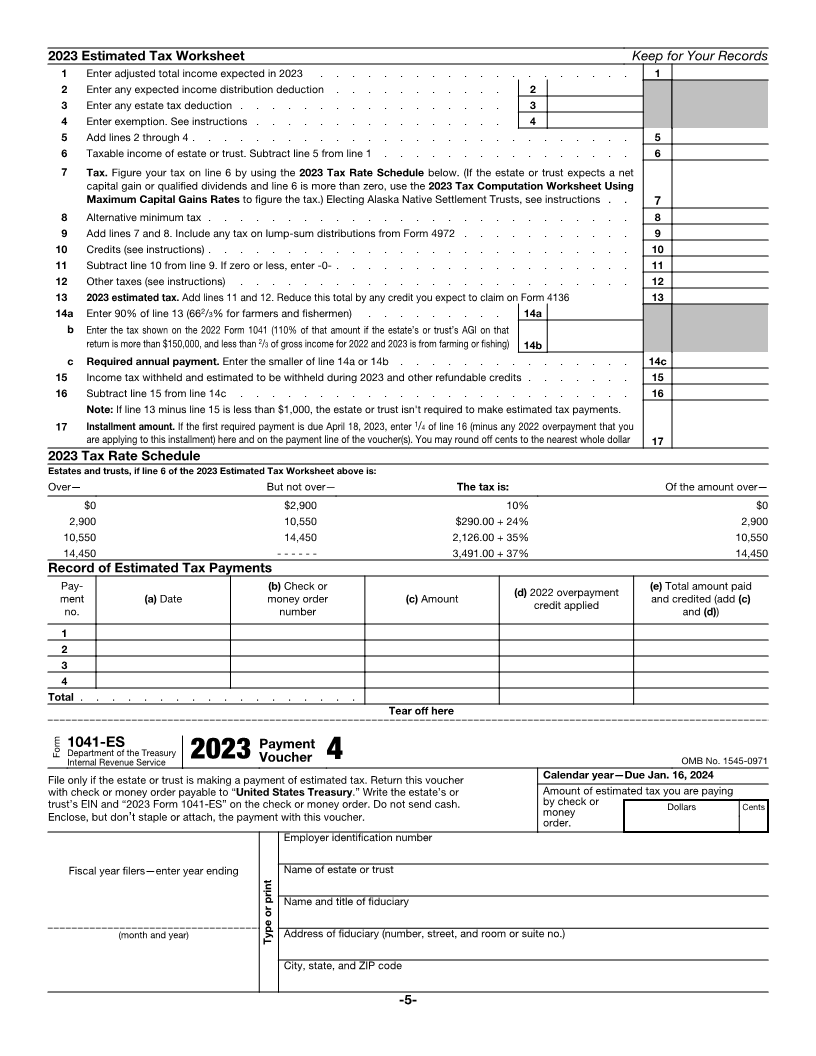

2023

Form 1041-ES

Estimated Income Tax for Estates and Trusts OMB No. 1545-0971

Section references are to the Internal Who Must Make Estimated How To Figure Estimated

Revenue Code unless otherwise noted.

Tax Payments Tax

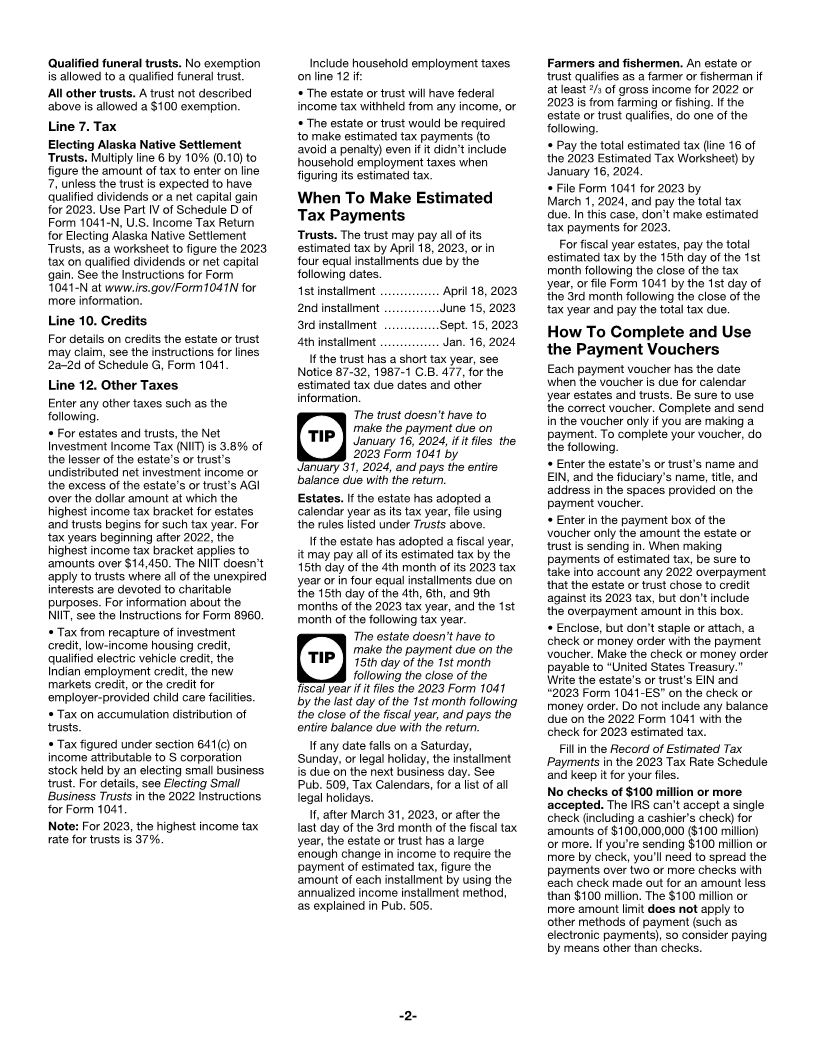

Future Developments Generally, a fiduciary of an estate or trust Use the 2023 Estimated Tax Worksheet

For the latest information about must pay estimated tax if the estate or and 2023 Tax Rate Schedule, later, and

developments related to Form 1041-ES trust is expected to owe, after the estate’s or trust’s 2022 tax return

and its instructions, such as legislation subtracting its withholding and credits, and instructions as a guide for figuring

enacted after they were published, go to at least $1,000 in tax for 2023 and can the 2023 estimated tax.

www.irs.gov/Form1041ES. expect its withholding and credits to be If the estate or trust receives its

less than the smaller of: income unevenly throughout the year, it

What’s New 1. 90% of the tax shown on the 2023 may be able to lower or eliminate the

Capital gains and qualified dividends. tax return (662%/3 of the tax if the estate amount of its required estimated tax

The maximum tax rate for long-term or trust qualifies as a farmer or payment for one or more periods by

capital gains and qualified dividends is fisherman); or using the annualized income installment

20%. For tax year 2023, the 20% rate 2. The tax shown on the 2022 tax method. See Pub. 505, Tax Withholding

applies to amounts above $14,650. The return (110% of that amount if the and Estimated Tax, for details.

0% and 15% rates continue to apply to estate’s or trust’s adjusted gross income

amounts below certain threshold (AGI) on that return is more than Instructions for 2023

amounts. The 0% rate applies to $150,000, and less than 2/ 3of gross Estimated Tax Worksheet

amounts up to $3,000. The 15% rate income for 2022 and 2023 is from

applies to amounts between the two farming or fishing). Line 4. Exemption

thresholds. However, if a return wasn’t filed for Decedents’ estates. A decedent’s

2022 or that return didn’t cover a full 12 estate is allowed a $600 exemption.

Purpose of Form months, item (2) above doesn’t apply. Trusts required to distribute all

Use this package to figure and pay For this purpose, include household income currently. A trust whose

estimated tax for an estate or trust. employment taxes when figuring the tax governing instrument requires that all

Estimated tax is the amount of tax an shown on the tax return, but only if: income be distributed currently

estate or trust expects to owe for the is allowed a $300 exemption, even if it

year after subtracting the amount of any • The estate or trust will have federal distributed amounts other than income

tax withheld and the amount of any income tax withheld from any income, or during the tax year.

credits. • The estate or trust would be required Qualified disability trusts. A qualified

This package is primarily for first-time to make estimated tax payments (to disability trust is allowed a $4,700

filers. After the IRS receives the first avoid a penalty) even if it didn’t include exemption. This amount is not subject to

payment voucher, the estate or trust will household employment taxes when phaseout.

receive a 1041-ES package with the figuring its estimated tax.

A qualified disability trust is any trust:

name, address, and employer Exceptions. Estimated tax payments

identification number (EIN) preprinted on aren’t required from: 1. Described in 42 U.S.C. 1396p(c)(2)

(B)(iv) and established solely for the

the vouchers for the next tax year. Use 1. An estate of a domestic decedent or benefit of an individual under 65 years of

the preprinted vouchers unless the a domestic trust that had a full 12-month age who is disabled, and

Electronic Federal Tax Payment System 2022 tax year and had no tax liability for

(EFTPS) is used. If you, as fiduciary, that year; 2. All of the beneficiaries of which are

didn’t receive any 2023 preprinted determined by the Commissioner of

vouchers, use the vouchers in this 2. A decedent’s estate for any tax year Social Security to have been disabled for

package. However, don’t use the ending before the date that is 2 years some part of the tax year within the

vouchers to notify the IRS of a change of after the decedent’s death; or meaning of 42 U.S.C. 1382c(a)(3).

address. If the fiduciary has moved, 3. A trust that was treated as owned A trust won’t fail to meet (2) above just

complete Form 8822-B, Change of by the decedent if the trust will receive because the trust’s corpus may revert to

Address or Responsible Party — the residue of the decedent’s estate a person who isn't disabled after the

Business. under the will (or, if no will is admitted to trust ceases to have any disabled

probate, is the trust primarily responsible beneficiaries.

for paying debts, taxes, and expenses of

administration) for any tax year ending

before the date that is 2 years after the

decedent’s death.

Cat. No. 63550R