Enlarge image

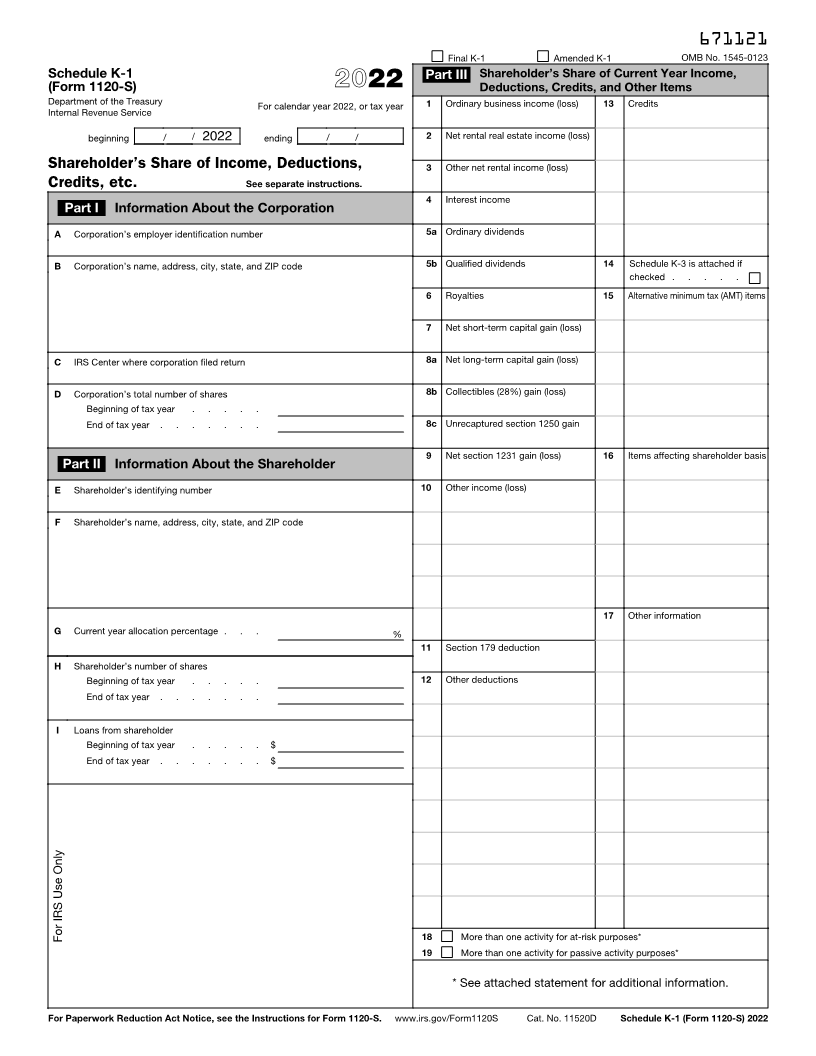

671121

Final K-1 Amended K-1 OMB No. 1545-0123

Schedule K-1 Part III Shareholder’s Share of Current Year Income,

(Form 1120-S) 2022 Deductions, Credits, and Other Items

Department of the Treasury For calendar year 2022, or tax year 1 Ordinary business income (loss) 13 Credits

Internal Revenue Service

beginning / / 2022 ending / / 2 Net rental real estate income (loss)

Shareholder’s Share of Income, Deductions, 3 Other net rental income (loss)

Credits, etc. See separate instructions.

4 Interest income

Part I Information About the Corporation

A Corporation’s employer identification number 5a Ordinary dividends

B Corporation’s name, address, city, state, and ZIP code 5b Qualified dividends 14 Schedule K-3 is attached if

checked . . . . .

6 Royalties 15 Alternative minimum tax (AMT) items

7 Net short-term capital gain (loss)

C IRS Center where corporation filed return 8a Net long-term capital gain (loss)

D Corporation’s total number of shares 8b Collectibles (28%) gain (loss)

Beginning of tax year . . . . .

End of tax year . . . . . . . 8c Unrecaptured section 1250 gain

9 Net section 1231 gain (loss) 16 Items affecting shareholder basis

Part II Information About the Shareholder

E Shareholder’s identifying number 10 Other income (loss)

F Shareholder’s name, address, city, state, and ZIP code

17 Other information

G Current year allocation percentage . . . %

11 Section 179 deduction

H Shareholder’s number of shares

Beginning of tax year . . . . . 12 Other deductions

End of tax year . . . . . . .

I Loans from shareholder

Beginning of tax year . . . . . $

End of tax year . . . . . . . $

For IRS Use Only 18 More than one activity for at-risk purposes*

19 More than one activity for passive activity purposes*

* See attached statement for additional information.

For Paperwork Reduction Act Notice, see the Instructions for Form 1120-S. www.irs.gov/Form1120S Cat. No. 11520D Schedule K-1 (Form 1120-S) 2022