Enlarge image

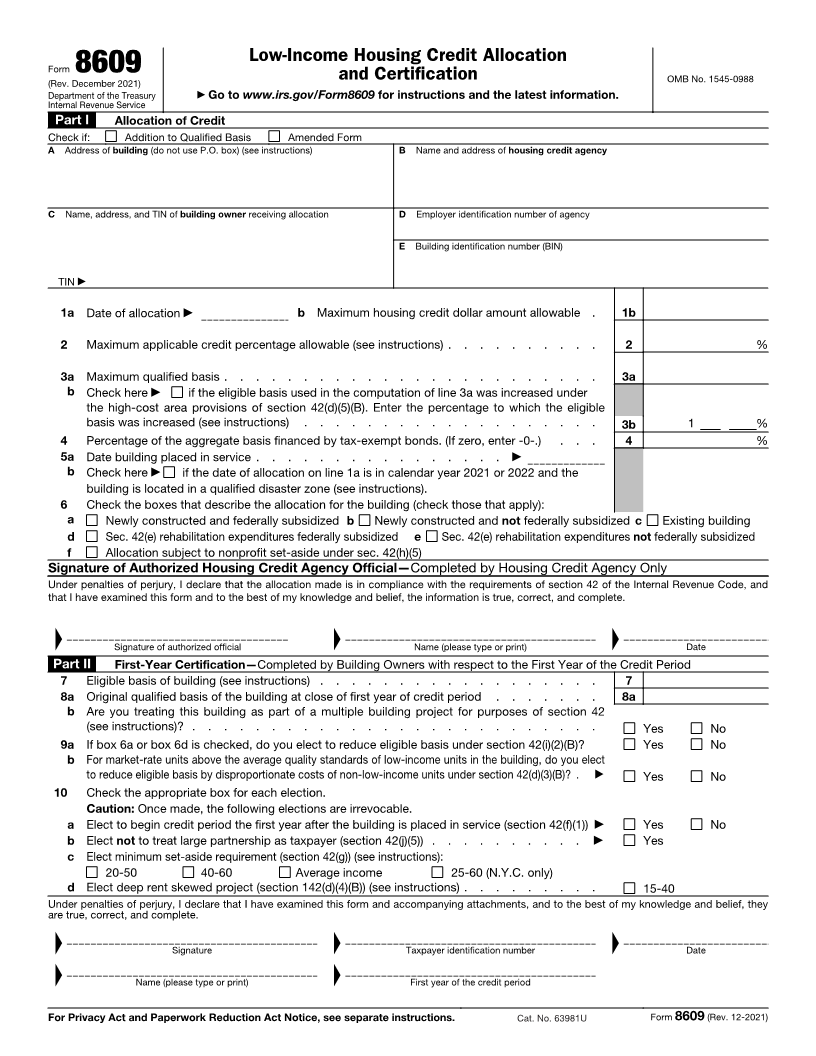

Low-Income Housing Credit Allocation

Form 8609 and Certification OMB No. 1545-0988

(Rev. December 2021)

Department of the Treasury ▶ Go to www.irs.gov/Form8609 for instructions and the latest information.

Internal Revenue Service

Part I Allocation of Credit

Check if: Addition to Qualified Basis Amended Form

A Address of building (do not use P.O. box) (see instructions) B Name and address of housing credit agency

C Name, address, and TIN of building owner receiving allocation D Employer identification number of agency

E Building identification number (BIN)

TIN ▶

1 a Date of allocation ▶ b Maximum housing credit dollar amount allowable . 1b

2 Maximum applicable credit percentage allowable (see instructions) . . . . . . . . . . 2 %

3a Maximum qualified basis . . . . . . . . . . . . . . . . . . . . . . . . 3a

b Check here ▶ if the eligible basis used in the computation of line 3a was increased under

the high-cost area provisions of section 42(d)(5)(B). Enter the percentage to which the eligible

basis was increased (see instructions) . . . . . . . . . . . . . . . . . . . 3b 1 %

4 Percentage of the aggregate basis financed by tax-exempt bonds. (If zero, enter -0-.) . . . 4 %

5a Date building placed in service . . . . . . . . . . . . . . . . ▶

b Check here ▶ if the date of allocation on line 1a is in calendar year 2021 or 2022 and the

building is located in a qualified disaster zone (see instructions).

6 Check the boxes that describe the allocation for the building (check those that apply):

a Newly constructed and federally subsidized b Newly constructed and not federally subsidized c Existing building

d Sec. 42(e) rehabilitation expenditures federally subsidized e Sec. 42(e) rehabilitation expenditures not federally subsidized

f Allocation subject to nonprofit set-aside under sec. 42(h)(5)

Signature of Authorized Housing Credit Agency Official—Completed by Housing Credit Agency Only

Under penalties of perjury, I declare that the allocation made is in compliance with the requirements of section 42 of the Internal Revenue Code, and

that I have examined this form and to the best of my knowledge and belief, the information is true, correct, and complete.

▲ ▲ ▲

Signature of authorized official Name (please type or print) Date

Part II First-Year Certification—Completed by Building Owners with respect to the First Year of the Credit Period

7 Eligible basis of building (see instructions) . . . . . . . . . . . . . . . . . . 7

8a Original qualified basis of the building at close of first year of credit period . . . . . . . 8a

b Are you treating this building as part of a multiple building project for purposes of section 42

(see instructions)? . . . . . . . . . . . . . . . . . . . . . . . . . . Yes No

9a If box 6a or box 6d is checked, do you elect to reduce eligible basis under section 42(i)(2)(B)? Yes No

b For market-rate units above the average quality standards of low-income units in the building, do you elect

to reduce eligible basis by disproportionate costs of non-low-income units under section 42(d)(3)(B)? . ▶ Yes No

10 Check the appropriate box for each election.

Caution: Once made, the following elections are irrevocable.

a Elect to begin credit period the first year after the building is placed in service (section 42(f)(1)) ▶ Yes No

b Elect not to treat large partnership as taxpayer (section 42(j)(5)) . . . . . . . . . . ▶ Yes

c Elect minimum set-aside requirement (section 42(g)) (see instructions):

20-50 40-60 Average income 25-60 (N.Y.C. only)

d Elect deep rent skewed project (section 142(d)(4)(B)) (see instructions) . . . . . . . . . 15-40

Under penalties of perjury, I declare that I have examined this form and accompanying attachments, and to the best of my knowledge and belief, they

are true, correct, and complete.

▲ ▲ ▲

Signature Taxpayer identification number Date

▲ ▲

Name (please type or print) First year of the credit period

For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 63981U Form 8609 (Rev. 12-2021)