Enlarge image

OMB No. 1545-2025

Form 8912 Credit to Holders of Tax Credit Bonds

Department of the Treasury Attach to your tax return. 2020

▶

Attachment

Internal Revenue Service ▶ Go to www.irs.gov/Form8912 for instructions and the latest information. Sequence No. 154

Name(s) shown on return Identifying number

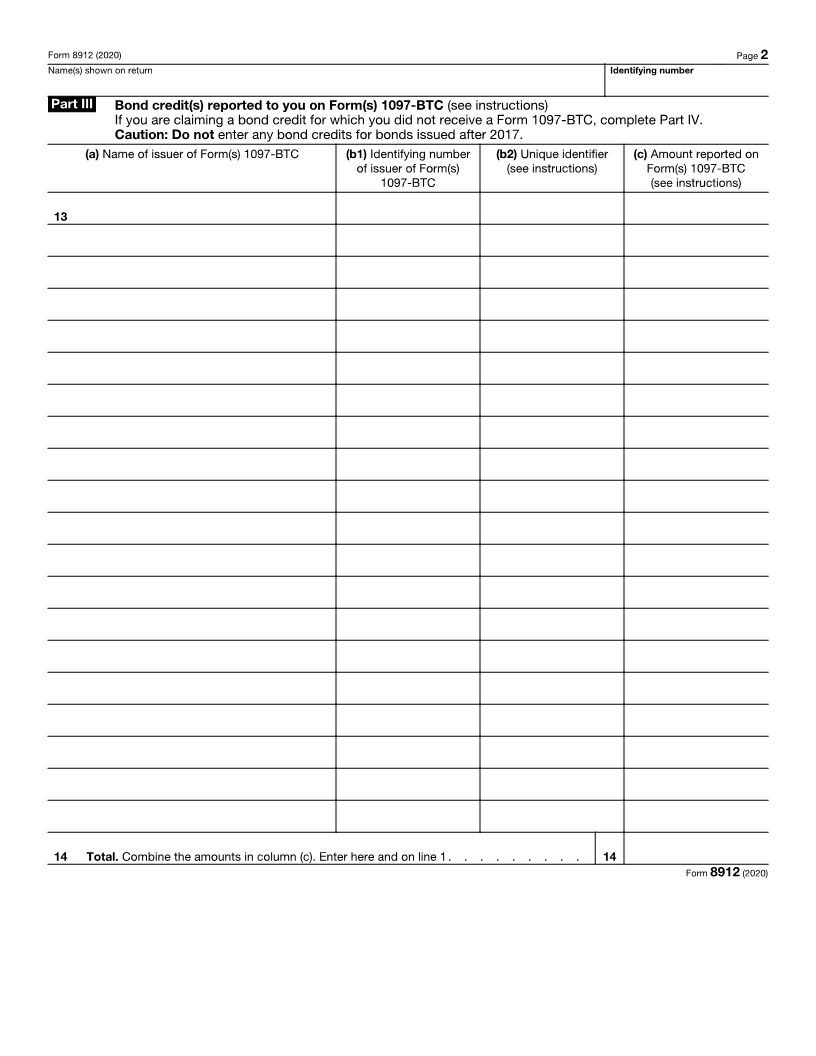

Part I Current Year Credit

1 Bond credit(s) from Part III. Enter the amount from line 14. See instructions . . . . . . . . 1

2 Bond credit(s) from Part IV. Enter the amount from line 20. See instructions . . . . . . . . 2

3 Carryforward of credits for qualified tax credit bonds and build America bonds to 2020 (see

instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Total credit. Add lines 1 through 3. Estates and trusts figuring the credit for a clean renewable

energy bond, go to line 5; partnerships and S corporations, report this amount on Schedule K. (You

must also issue Form(s) 1097-BTC. See Form 1097-BTC and its instructions.) All others, go to Part II 4

5 Amount allocated to the beneficiaries of the estate or trust. (You must also issue Form(s) 1097-BTC.

See Form 1097-BTC and its instructions.) See instructions . . . . . . . . . . . . . 5

6 Estates and trusts. Subtract line 5 from line 4. Use this amount to complete Part II . . . . . 6

Part II Allowable Credit

7 Regular tax before credits:

• Individuals. Enter the sum of the amounts from Form 1040, 1040-SR, or 1040-NR, line 16 and

Schedule 2 (Form 1040), line 2 . . . . . . . . . . . . . . . . . . . . . .

• Corporations. Enter the amount from Form 1120, Schedule J, line 2; or the amount from the 7

applicable line of your return. . . . . . . . . . . . . . . . . . . . . . .

• Estates and trusts. Enter the sum of the amounts from Form 1041, Schedule G, lines 1a and

1b; or the amount from the applicable line of your return . . . . . . . . . . . . . }

8 Alternative minimum tax:

• Individuals. Enter the amount from Form 6251, line 11. . . . . . . . . . . . . .

• Estates and trusts. Enter the amount from Schedule I (Form 1041), line 54 . . . . . . . 8

}

9 Add line 7 and line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10a Foreign tax credit . . . . . . . . . . . . . . . . . . . 10a

b Certain allowable credits (see instructions) . . . . . . . . . . . 10b

c General business credit (see instructions) . . . . . . . . . . . 10c

d Credit for prior year minimum tax (Form 8801 or Form 8827) . . . . . 10d

e Add lines 10a through 10d . . . . . . . . . . . . . . . . . . . . . . . . 10e

11 Net income tax. Subtract line 10e from line 9 . . . . . . . . . . . . . . . . . . 11

12 Credit to holders of tax credit bonds allowed for the current year. Enter the smallest of line 4,

line 11, or the amount as limited by the formula in the instructions for line 12. (If line 12 is smaller

than line 4, see instructions.) Estates and trusts, enter the smallest of line 6, line 11, or the amount

as limited by the formula in the instructions for line 12. (If line 12 is smaller than line 6, see

instructions.) Report this amount on Schedule 3 (Form 1040), line 6; Form 1120, Schedule J, line 5e;

Form 1041, Schedule G, line 2d; or the amount from the applicable line of your return . . . . 12

For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 37722B Form 8912 (2020)