Enlarge image

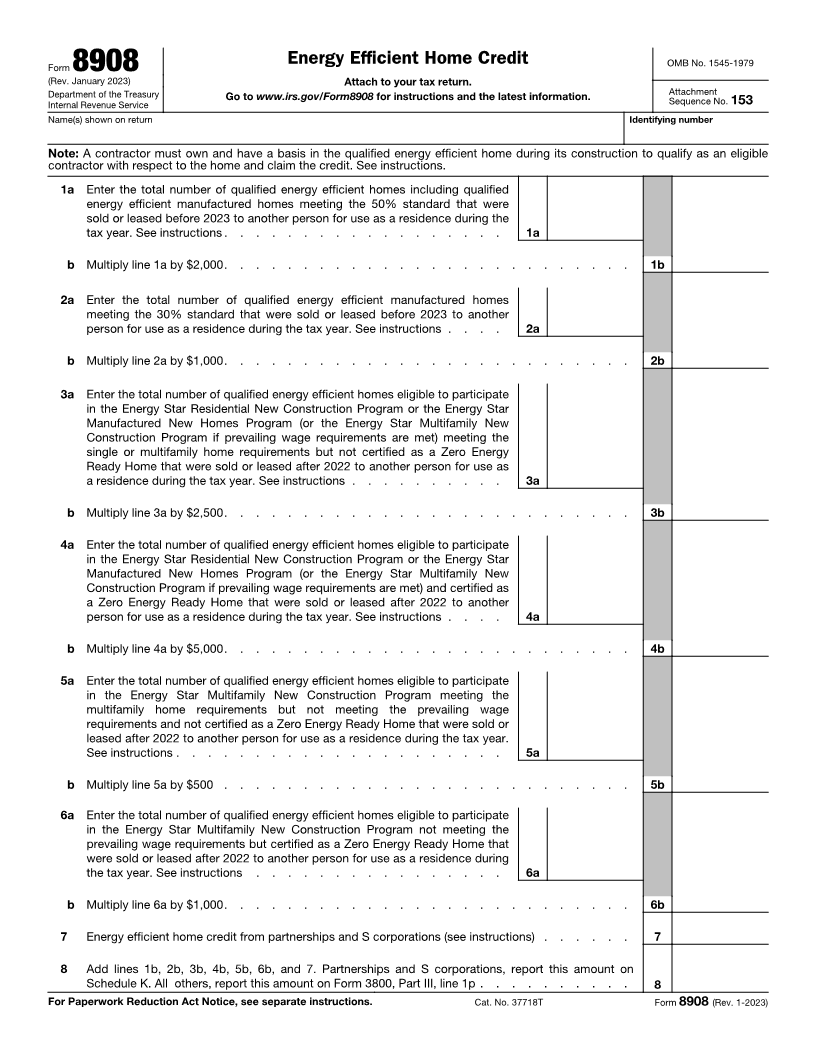

Energy Efficient Home Credit OMB No. 1545-1979

Form 8908

(Rev. January 2023) Attach to your tax return.

Department of the Treasury Go to www.irs.gov/Form8908 for instructions and the latest information. Attachment

Internal Revenue Service Sequence No. 153

Name(s) shown on return Identifying number

Note: A contractor must own and have a basis in the qualified energy efficient home during its construction to qualify as an eligible

contractor with respect to the home and claim the credit. See instructions.

1 a Enter the total number of qualified energy efficient homes including qualified

energy efficient manufactured homes meeting the 50% standard that were

sold or leased before 2023 to another person for use as a residence during the

tax year. See instructions . . . . . . . . . . . . . . . . . . 1a

b Multiply line 1a by $2,000. . . . . . . . . . . . . . . . . . . . . . . . . . 1b

2 a Enter the total number of qualified energy efficient manufactured homes

meeting the 30% standard that were sold or leased before 2023 to another

person for use as a residence during the tax year. See instructions . . . . 2a

b Multiply line 2a by $1,000. . . . . . . . . . . . . . . . . . . . . . . . . . 2b

3 a Enter the total number of qualified energy efficient homes eligible to participate

in the Energy Star Residential New Construction Program or the Energy Star

Manufactured New Homes Program (or the Energy Star Multifamily New

Construction Program if prevailing wage requirements are met) meeting the

single or multifamily home requirements but not certified as a Zero Energy

Ready Home that were sold or leased after 2022 to another person for use as

a residence during the tax year. See instructions . . . . . . . . . . 3a

b Multiply line 3a by $2,500. . . . . . . . . . . . . . . . . . . . . . . . . . 3b

4 a Enter the total number of qualified energy efficient homes eligible to participate

in the Energy Star Residential New Construction Program or the Energy Star

Manufactured New Homes Program (or the Energy Star Multifamily New

Construction Program if prevailing wage requirements are met) and certified as

a Zero Energy Ready Home that were sold or leased after 2022 to another

person for use as a residence during the tax year. See instructions . . . . 4a

b Multiply line 4a by $5,000. . . . . . . . . . . . . . . . . . . . . . . . . . 4b

5 a Enter the total number of qualified energy efficient homes eligible to participate

in the Energy Star Multifamily New Construction Program meeting the

multifamily home requirements but not meeting the prevailing wage

requirements and not certified as a Zero Energy Ready Home that were sold or

leased after 2022 to another person for use as a residence during the tax year.

See instructions . . . . . . . . . . . . . . . . . . . . . 5a

b Multiply line 5a by $500 . . . . . . . . . . . . . . . . . . . . . . . . . . 5b

6 a Enter the total number of qualified energy efficient homes eligible to participate

in the Energy Star Multifamily New Construction Program not meeting the

prevailing wage requirements but certified as a Zero Energy Ready Home that

were sold or leased after 2022 to another person for use as a residence during

the tax year. See instructions . . . . . . . . . . . . . . . . 6a

b Multiply line 6a by $1,000. . . . . . . . . . . . . . . . . . . . . . . . . . 6b

7 Energy efficient home credit from partnerships and S corporations (see instructions) . . . . . . 7

8 Add lines 1b, 2b, 3b, 4b, 5b, 6b, and 7. Partnerships and S corporations, report this amount on

Schedule K. All others, report this amount on Form 3800, Part III, line 1p . . . . . . . . . . 8

For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 37718T Form 8908 (Rev. 1-2023)