Enlarge image

Electronic Deposit of Tax Refund of $1 Million or More

Form (Rev. November 2018)8302 ▶ Attach to your income tax return (other than Forms 1040, OMB No. 1545-1763

Department of the Treasury 1120, or 1120S), Form 1045, or Form 1139.

Internal Revenue Service ▶ Go to www.irs.gov/Form8302 for the latest information.

Name(s) shown on income tax return Identifying number

Name and location (city, state) of bank Taxpayer’s phone number

1 Method of deposit (one box must be checked) Direct deposit Fedwire

2 Routing number (must be nine digits). The first two digits must be between 01 and 12 or 21 through 32.

3 Account number (include hyphens but omit spaces and special symbols): 4 Type of account (one box

must be checked):

Checking Savings

General Instructions Conditions Resulting in a processed, see Assembling the Return in

the instructions for the form with which

Section references are to the Internal Refund by Check the Form 8302 is filed. For Forms 1045

Revenue Code unless otherwise noted. If the IRS is unable to process this or 1139, attach a separate Form 8302 for

request for an electronic deposit, a refund each carryback year.

Purpose of Form by check will be generated. Reasons for

File Form 8302 to request that the IRS not processing a request include: Specific Instructions

electronically deposit a tax refund of $1 • The name on the tax return does not Identifying number. Enter the employer

million or more directly into an account match the name on the account. identification number or social security

at any U.S. bank or other financial number shown on the tax return to which

institution (such as a mutual fund, credit • You fail to indicate the method of deposit

union, or brokerage firm) that accepts to be used (direct deposit or Fedwire). Form 8302 is attached.

electronic deposits. • The financial institution rejects the Line 1. Direct deposit is an electronic

The benefits of an electronic deposit electronic deposit because of an payment alternative that uses the

include a faster refund, the added incorrect routing or account number. Automated Clearing House (ACH)

system. Fedwire is atransaction-by-

security of a paperless payment, and the • You fail to indicate the type of account transaction processingsystem designed

savings of tax dollars associated with the the deposit is to be made to (checking or for items that must bereceived by

reduced processing costs. savings). payees the same day asoriginated by

Who May File • There is an outstanding liability the the IRS.

offset of which reduces the refund to When there is a verified potential that

Form 8302 may be filed with any tax less than $1 million. the tax refund will be applied to a debt

return other than Form 1040, 1120, or • You are subject to the Treasury Offset owed to a particular agency, a Fedwire

1120S to request an electronic deposit Program (TOP) and fail to indicate direct deposit will be rejected due to the offset.

of a refund of $1 million or more. You are deposit as the method of deposit to be To receive an electronic deposit, elect to

not eligible to request an electronic used. use the direct deposit method of deposit

deposit if: instead of Fedwire.

• The receiving financial institution is a How To File

Line 2. Enter the financial institution’s

foreign bank or a foreign branch of a Attach Form 8302 to the applicable routing number and verify that the

U.S. bank, or return or application for refund. To institution will accept the type of

• You have applied for an employer ensure that your tax return is correctly electronic deposit requested. See the

identification number but are filing your

tax return before receiving one.

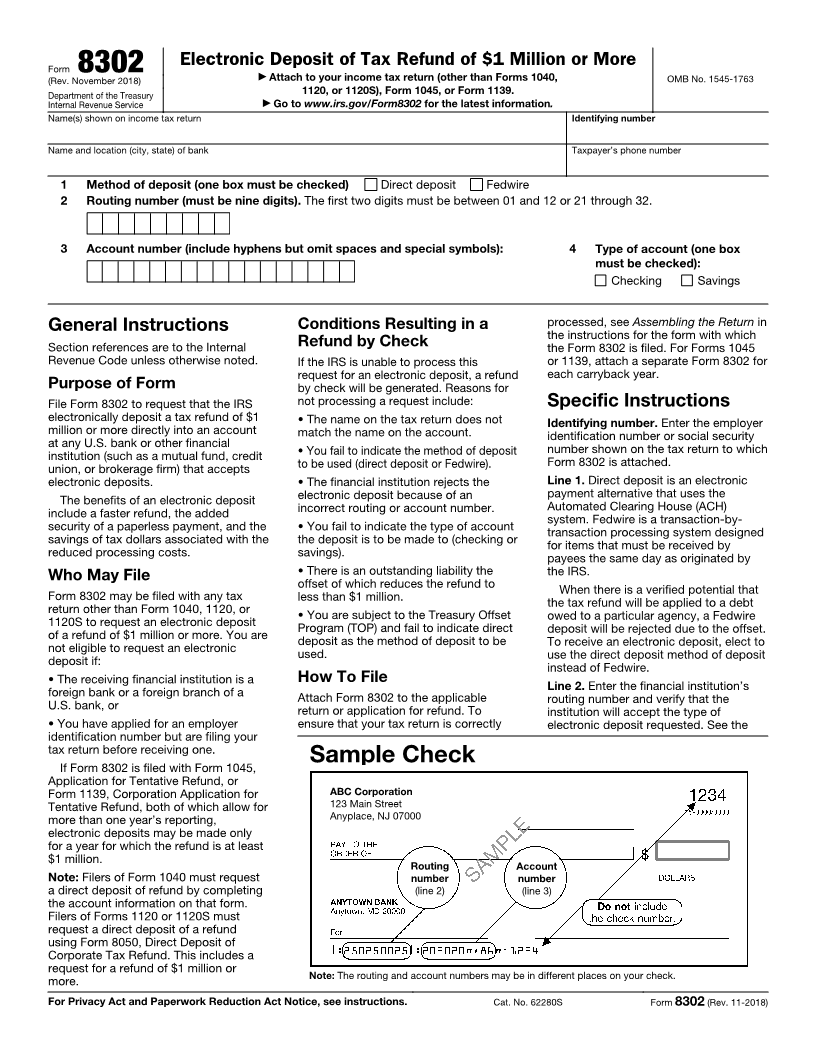

Sample Check

If Form 8302 is filed with Form 1045,

Application for Tentative Refund, or

Form 1139, Corporation Application for ABC Corporation

Tentative Refund, both of which allow for 123 Main Street

more than one year’s reporting, Anyplace, NJ 07000

electronic deposits may be made only

for a year for which the refund is at least

$1 million. Routing Account

Note: Filers of Form 1040 must request number number

a direct deposit of refund by completing (line 2) (line 3)

the account information on that form.

Filers of Forms 1120 or 1120Smust

request a direct deposit of a refund

using Form 8050, Direct Deposit of

Corporate Tax Refund. This includes a

request for a refund of $1 million or Note: The routing and account numbers may be in different places on your check.

more.

For Privacy Act and Paperwork Reduction Act Notice, see instructions. Cat. No. 62280S Form 8302 (Rev. 11-2018)