Enlarge image

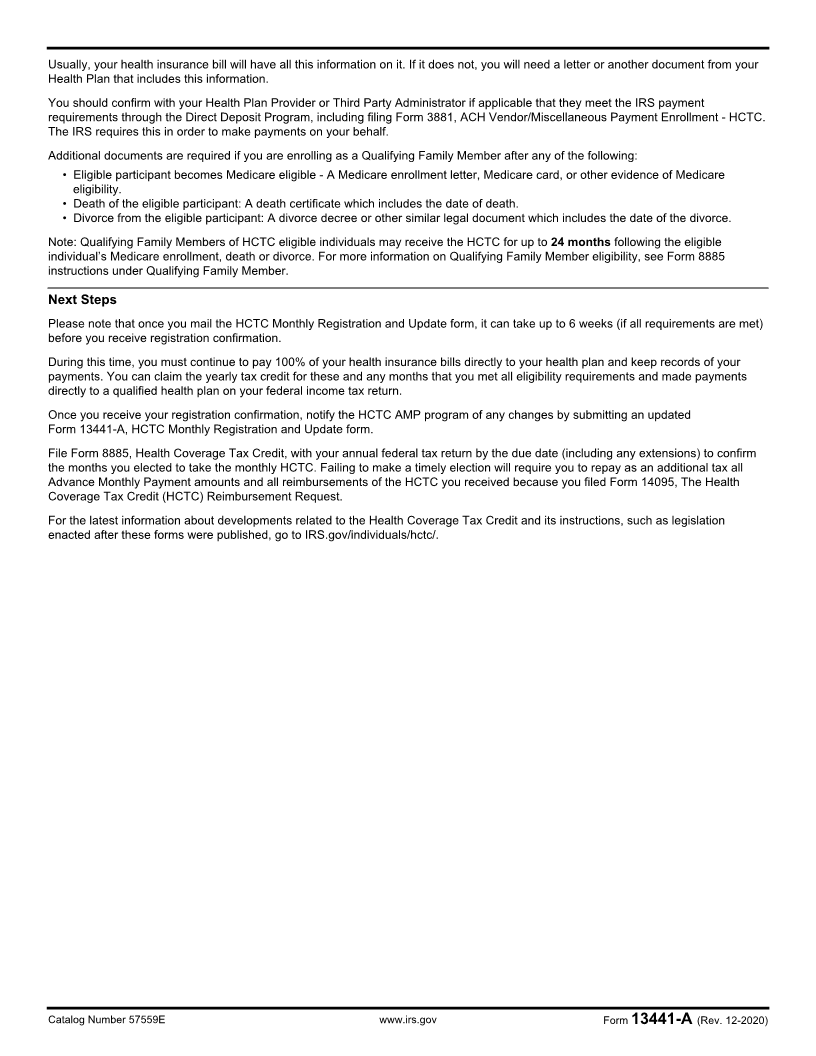

Instructions for Form 13441-A, Health Coverage Tax Credit (HCTC)

Monthly Registration and Update

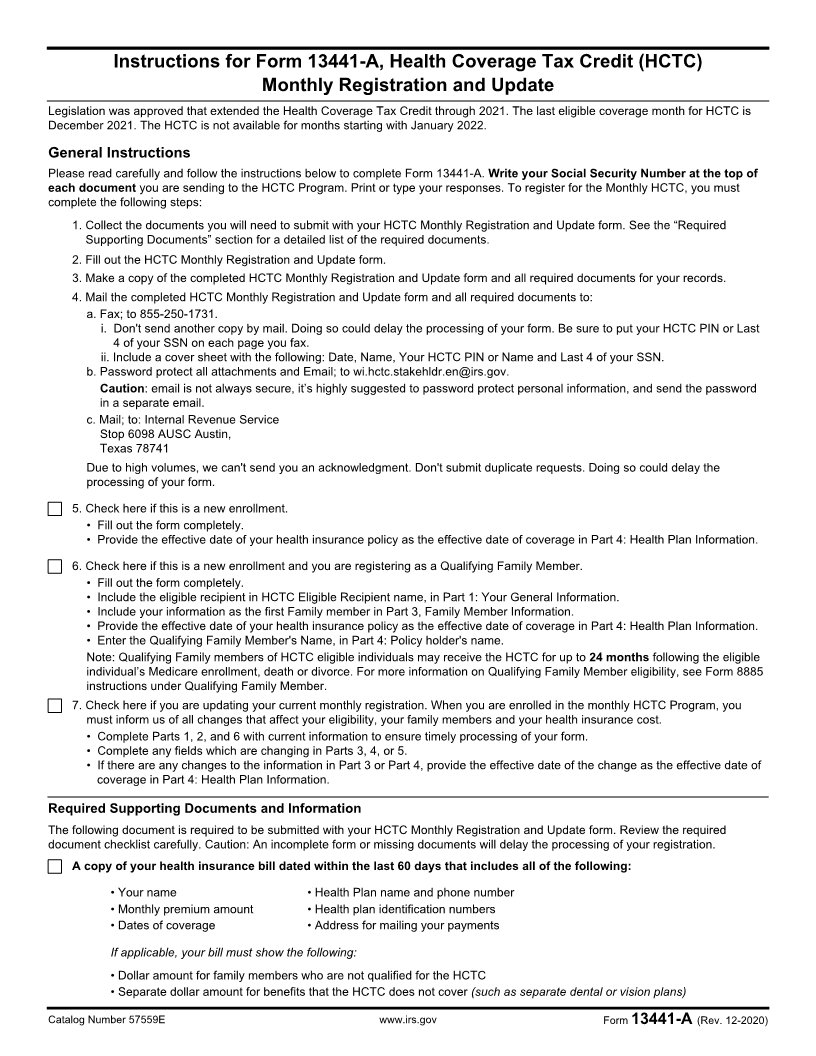

Legislation was approved that extended the Health Coverage Tax Credit through 2021. The last eligible coverage month for HCTC is

December 2021. The HCTC is not available for months starting with January 2022.

General Instructions

Please read carefully and follow the instructions below to complete Form 13441-A. Write your Social Security Number at the top of

each document you are sending to the HCTC Program. Print or type your responses. To register for the Monthly HCTC, you must

complete the following steps:

1. Collect the documents you will need to submit with your HCTC Monthly Registration and Update form. See the “Required

Supporting Documents” section for a detailed list of the required documents.

2. Fill out the HCTC Monthly Registration and Update form.

3. Make a copy of the completed HCTC Monthly Registration and Update form and all required documents for your records.

4. Mail the completed HCTC Monthly Registration and Update form and all required documents to:

a. Fax; to 855-250-1731.

i. Don't send another copy by mail. Doing so could delay the processing of your form. Be sure to put your HCTC PIN or Last

4 of your SSN on each page you fax.

ii. Include a cover sheet with the following: Date, Name, Your HCTC PIN or Name and Last 4 of your SSN.

b. Password protect all attachments and Email; to wi.hctc.stakehldr.en@irs.gov.

Caution: email is not always secure, it’s highly suggested to password protect personal information, and send the password

in a separate email.

c. Mail; to: Internal Revenue Service

Stop 6098 AUSC Austin,

Texas 78741

Due to high volumes, we can't send you an acknowledgment. Don't submit duplicate requests. Doing so could delay the

processing of your form.

5. Check here if this is a new enrollment.

• Fill out the form completely.

• Provide the effective date of your health insurance policy as the effective date of coverage in Part 4: Health Plan Information.

6. Check here if this is a new enrollment and you are registering as a Qualifying Family Member.

• Fill out the form completely.

• Include the eligible recipient in HCTC Eligible Recipient name, in Part 1: Your General Information.

• Include your information as the first Family member in Part 3, Family Member Information.

• Provide the effective date of your health insurance policy as the effective date of coverage in Part 4: Health Plan Information.

• Enter the Qualifying Family Member's Name, in Part 4: Policy holder's name.

Note: Qualifying Family members of HCTC eligible individuals may receive the HCTC for up to 24 months following the eligible

individual’s Medicare enrollment, death or divorce. For more information on Qualifying Family Member eligibility, see Form 8885

instructions under Qualifying Family Member.

7. Check here if you are updating your current monthly registration. When you are enrolled in the monthly HCTC Program, you

must inform us of all changes that affect your eligibility, your family members and your health insurance cost.

• Complete Parts 1, 2, and 6 with current information to ensure timely processing of your form.

• Complete any fields which are changing in Parts 3, 4, or 5.

• If there are any changes to the information in Part 3 or Part 4, provide the effective date of the change as the effective date of

coverage in Part 4: Health Plan Information.

Required Supporting Documents and Information

The following document is required to be submitted with your HCTC Monthly Registration and Update form. Review the required

document checklist carefully. Caution: An incomplete form or missing documents will delay the processing of your registration.

A copy of your health insurance bill dated within the last 60 days that includes all of the following:

• Your name • Health Plan name and phone number

• Monthly premium amount • Health plan identification numbers

• Dates of coverage • Address for mailing your payments

If applicable, your bill must show the following:

• Dollar amount for family members who are not qualified for the HCTC

• Separate dollar amount for benefits that the HCTC does not cover (such as separate dental or vision plans)

Catalog Number 57559E www.irs.gov Form 13441-A (Rev. 12-2020)