Enlarge image

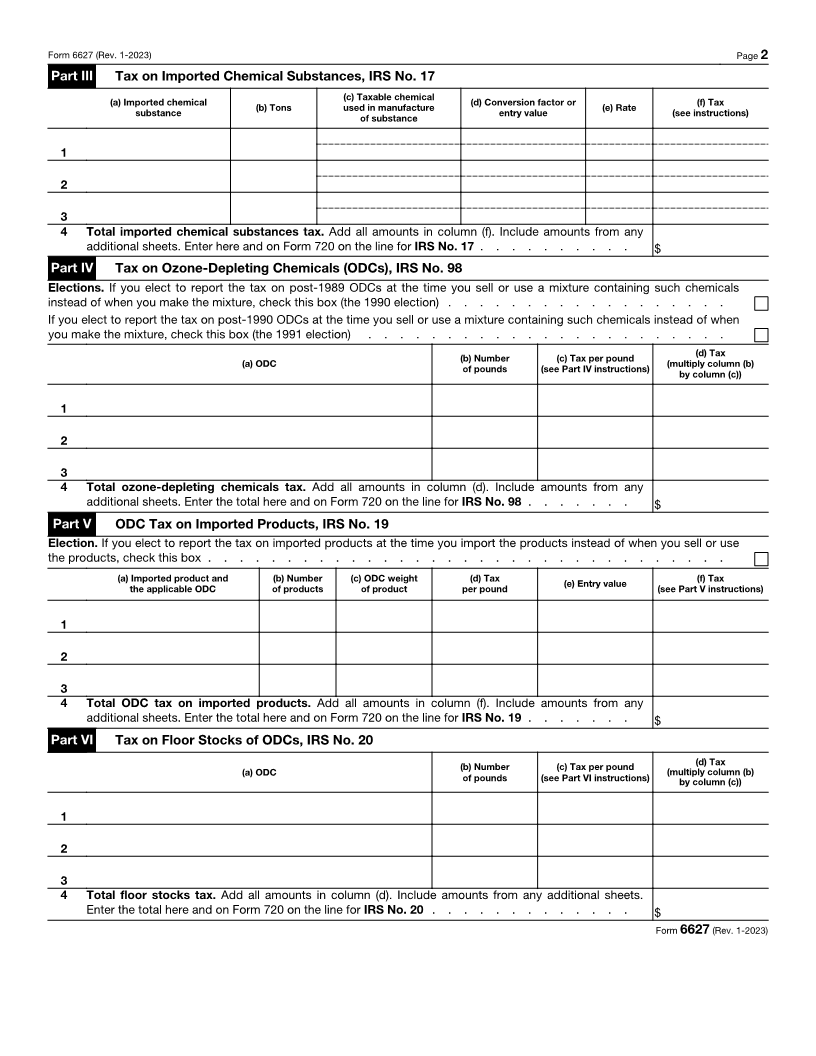

Form 6627 Environmental Taxes

OMB No. 1545-0023

(Rev. January 2023) Attach to Form 720.

Department of the Treasury

Internal Revenue Service Go to www.irs.gov/Form6627 for instructions and the latest information.

Name (as shown on Form 720) Quarter ending Employer identification number (EIN)

(a) (b) (c)

Part I Tax on Petroleum Barrels Rate Tax

1 Crude oil received at a U.S. refinery . . . . . . . . . . . .

2 Crude oil taxed before receipt at refinery . . . . . . . . . .

3 Taxable crude oil. Subtract line 2 from line 1. Enter the result on both

lines 3(a) and 3(b), column (a). Enter in column (c) the amount of tax by

multiplying column (a) by column (b) for both lines. (a) $ .164 bbl $

(b) $ .09 bbl $

4 Crude oil used in or exported from the U.S. before the tax was imposed.

Multiply column (a) by column (b) and enter the amount of tax in column

(c). Enter on both lines 4(a) and 4(b), column (a). Enter in column (c) the

amount of tax by multiplying column (a) by column (b) for both lines. (a) $ .164 bbl $

(b) $ .09 bbl $

5 Total domestic petroleum superfund tax (add lines 3(a) and 4(a), column

(c)). Enter here and on Form 720 on the line for IRS No. 53 . . . . $

6 Total domestic petroleum oil spill tax. Add lines 3(b) and 4(b), column (c).

Enter the total here and on Form 720 on the line for IRS No. 18 . . . $

7 Imported petroleum products superfund tax. Enter the number of barrels

imported in column (a). (Must agree with line 8, column (a).) Enter in

column (c) the amount of tax by multiplying column (a) by column (b), and

also enter it on Form 720 on the line for IRS No. 16 . . . . . . . $ .164 bbl $

8 Imported petroleum products oil spill tax. Enter the number of barrels

imported in column (a). (Must agree with line 7, column (a).) Multiply

column (a) by column (b) and enter the amount of tax in column (c). Also

enter the amount on Form 720 on the line for IRS No. 21 . . . . . $ .09 bbl $

Part II Tax on Chemicals (Other Than Ozone-Depleting Chemicals (ODCs)), IRS No. 54

Chemical (c) Tax Chemical (c) Tax

(general formula (a) Tons (b) Rate (multiply column (a) (general formula (a) Tons (b) Rate (multiply column (a)

or symbol) by column (b)) or symbol) by column (b))

1 Acetylene (C2H2) $9.74 24 Lead oxide (PbO) $8.28

2 Ammonia (NH3) . 5.28 25 Mercury (Hg) . . 8.90

3 Antimony (Sb) . 8.90 26 Methane (CH4) . 6.88

4 Antimony trioxide 27 Naphthalene (C10H8) 9.74

(Sb2O3) . . . 7.50 28 Nickel (Ni) . . . 8.90

5 Arsenic (As) . . 8.90 29 Nitric acid (HNO3) 0.48

6 Arsenic trioxide 30 Phosphorus (P) . 8.90

(As2O3) . . . . 6.82 31 Potassium

7 Barium sulfide (BaS) 4.60 dichromate (K2 Cr2 7O ) 3.38

8 Benzene (C6H6) . 9.74 32 Potassium

9 Bromine (Br) . . 8.90 hydroxide (KOH) . 0.44

10 Butadiene (C4H6) 9.74 33 Propylene (C3H6) . 9.74

11 Butane (C4H10) . 9.74 34 Sodium dichromate

12 Butylene (C4H8) . 9.74 (NaCr2O7) . . . 3.74

13 Cadmium (Cd) . 8.90 35 Sodium hydroxide

14 Chlorine (Cl) . . 5.40 (NaOH) . . . . 0.56

15 Chromite (FeCr2O4) 3.04 36 Stannic chloride

16 Chromium (Cr) . 8.90 (SnCl4) . . . . 4.24

17 Cobalt (Co) . . 8.90 37 Stannous chloride

18 Cupric oxide (CuO) 7.18 (SnCl2) . . . . 5.70

19 Cupric sulfate (CuSO4 ) 3.74 38 Sulfuric acid (H2 SO4 ) 0.52

20 Cuprous oxide (Cu2 O) 7.94 39 Toluene (C7H8) . 9.74

21 Ethylene (C2H4) . 9.74 40 Xylene (C8H10) . 9.74

22 Hydrochloric acid (HCI) 0.58 41 Zinc chloride (ZnCl2 ) 4.44

23 Hydrogen fluoride (HF) 8.46 42 Zinc sulfate (ZnSO4 ) 3.80

43 Total Chemical Tax (add lines 1–42, column (c)). Enter here and on Form 720 on the line for IRS No. 54 $

For Privacy Act and Paperwork Reduction Act Notice, see the Instructions for Form 720. Cat. No. 43490I Form 6627 (Rev. 1-2023)